Tag: Jim Skelton

-

Education gap on Wichita City Council

Currently there is discussion in Wichita on whether higher education is valued by residents. Following, from April 2011, a look at the educational achievement of the Wichita City Council.

-

Wichita being sued, alleging improper handling of bond repayment savings

A lawsuit claims that when the City of Wichita refinanced its special assessment bonds, it should have passed on the savings to the affected taxpayers, and it did not do that.

-

A Wichita Shocker, redux

Based on events in Wichita, the Wall Street Journal wrote “What Americans seem to want most from government these days is equal treatment. They increasingly realize that powerful government nearly always helps the powerful …” But Wichita’s elites don’t seem to understand this.

-

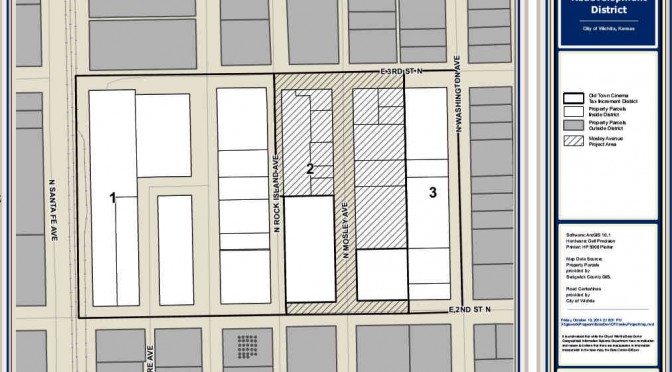

Wichita drops taxpayer protection clause

To protect itself against self-defeating appeals of property valuation in tax increment financing districts, the City of Wichita once included a protective clause in developer agreements. But this consideration is not present in two proposed agreements.

-

Sedgwick County elections: Commissioners

In Sedgwick County, two fiscally conservative commission candidates prevailed.

-

Wichita’s evaluation of development team should be reconsidered

The evaluation matrix released for a project to be considered next week by the Wichita City Council ought to be recalculated.

-

Sedgwick County Commission: Let’s not vote today

At the October 31 meeting of the Sedgwick County Commission, Karl Peterjohn introduced a measure that would let the Kansas Legislature know that the commission supports improving the tax climate in Kansas, and specifically would limit property tax growth. But electoral politics forced a delay in a vote.

-

Sedgwick County tower sale was not in citizens’ best interest

The sale of a radio tower owned by Sedgwick County reveals another case of local government not looking out for the interests of citizens and taxpayers, with the realization that the stain of cronyism is alive and well.

-

Special interests will capture south-central Kansas planning

Special interest groups are likely to co-opt the government planning process started in south-central Kansas as these groups see ways to benefit from the plan. The public choice school of economics and political science has taught us how special interest groups seek favors from government at enormous costs to society, and we will see this…

-

Open records again an issue in Kansas

Responses to records requests made by Kansas Policy Institute are bringing attention to shortcomings in the Kansas Open Records Act.

-

Wichita voters reject cronyism — again

Voters in Wichita and the surrounding area have rejected, for the second time this year, the culture of political cronyism that passes for economic development in Wichita.

-

Skelton, Sedgwick County Commissioner, censured by party

Jim Skelton, a Sedgwick County Commissioner, has been censured by his party.