Tag: Sedgwick county government

-

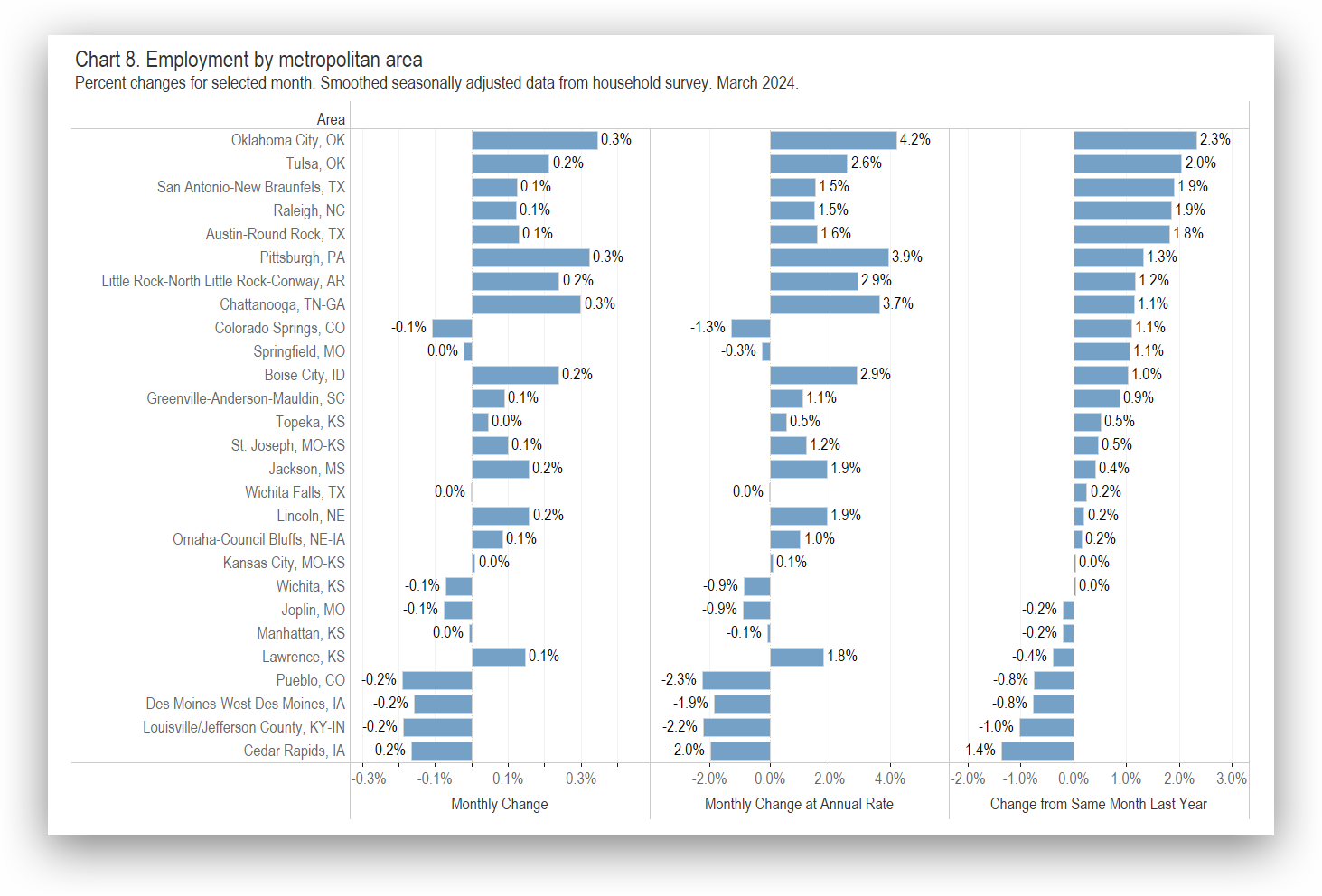

Wichita Employment Situation, March 2024

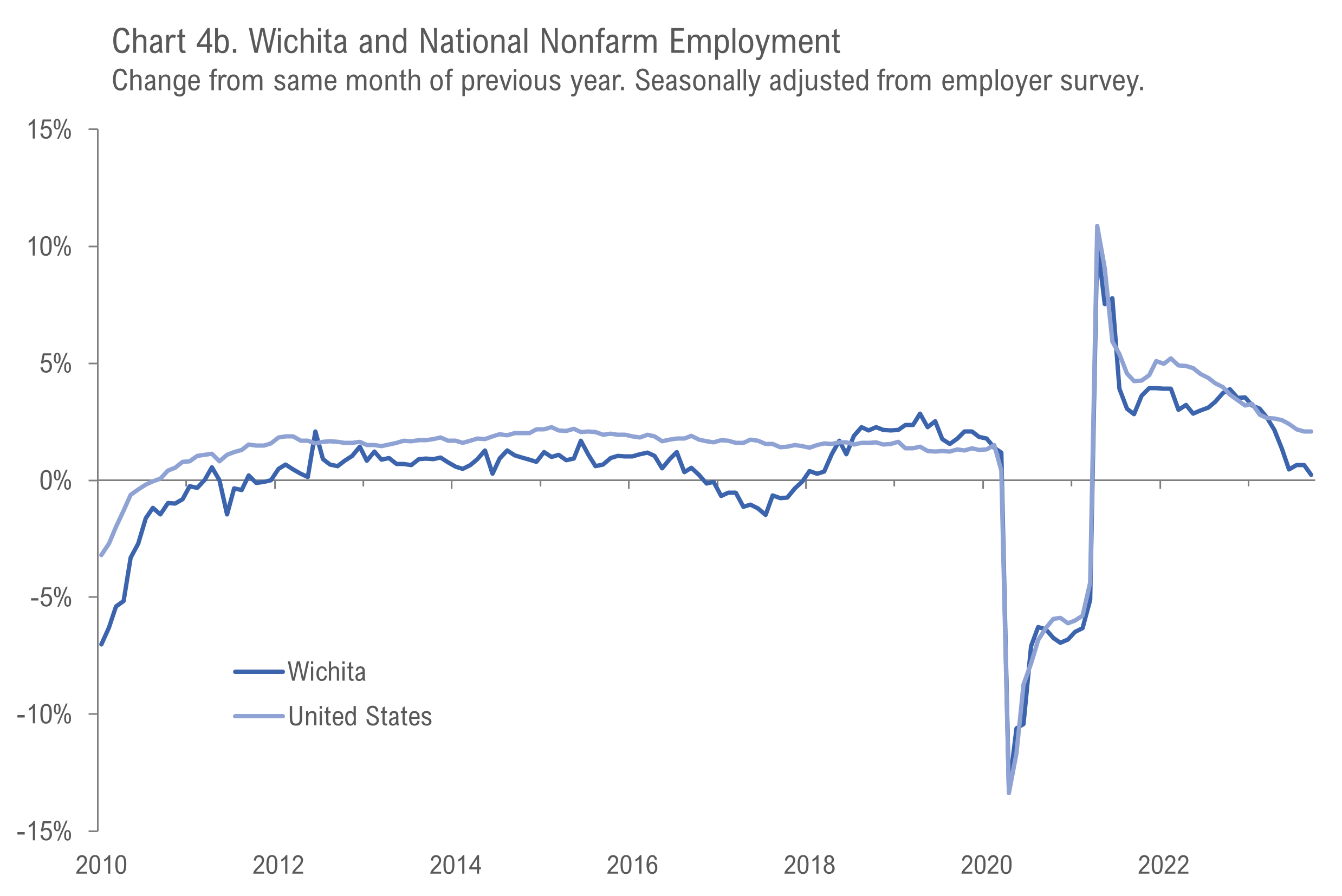

For the Wichita metropolitan area in March 2024, most employment indicators changed only slightly from the prior month. Wichita continues to perform poorly compared to its peers.

-

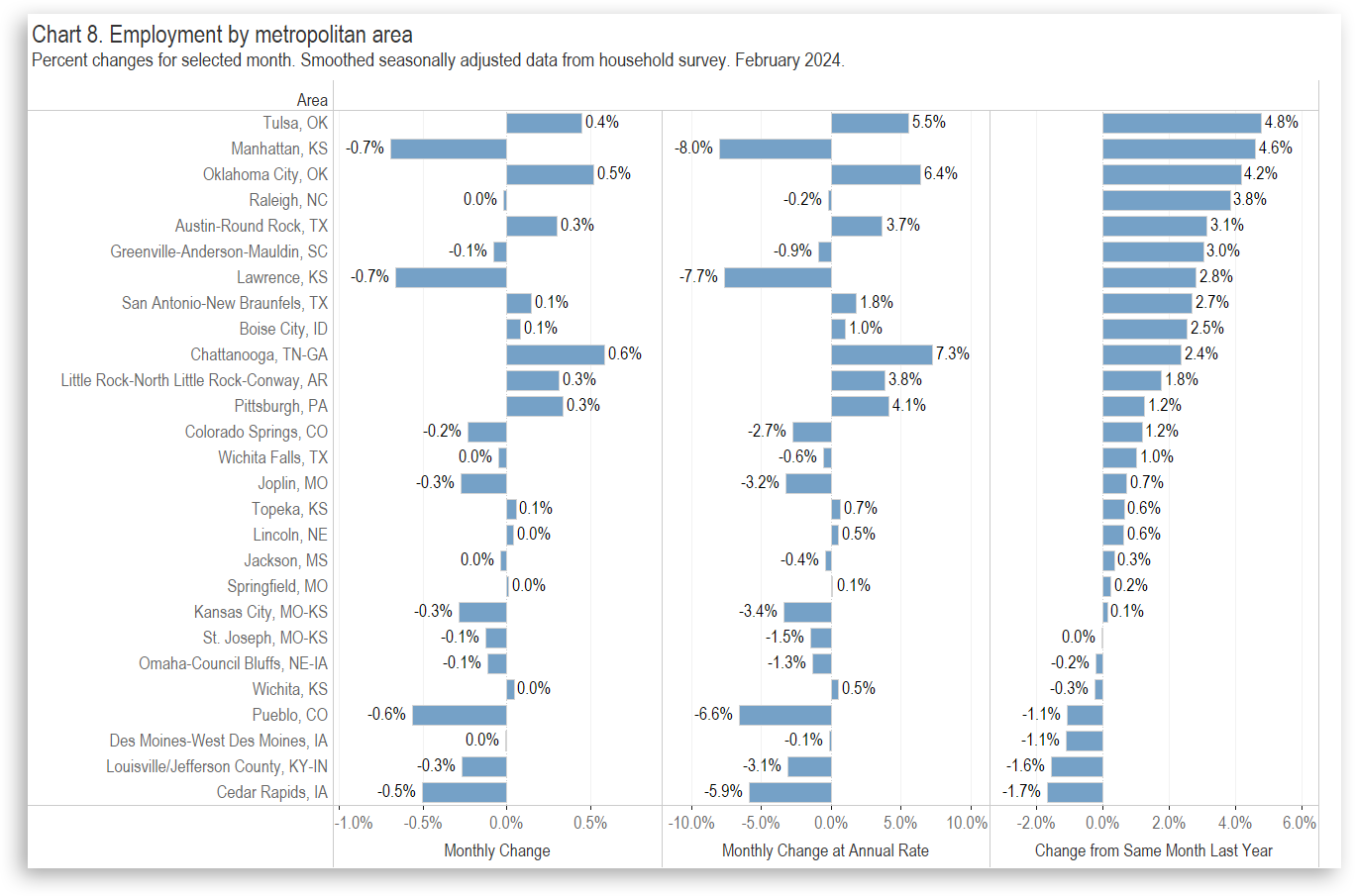

Wichita Employment Situation, February 2024

For the Wichita metropolitan area in February 2024, most employment indicators changed only slightly from the prior month, and the unemployment rate did not change. Wichita continues to perform poorly compared to its peers.

-

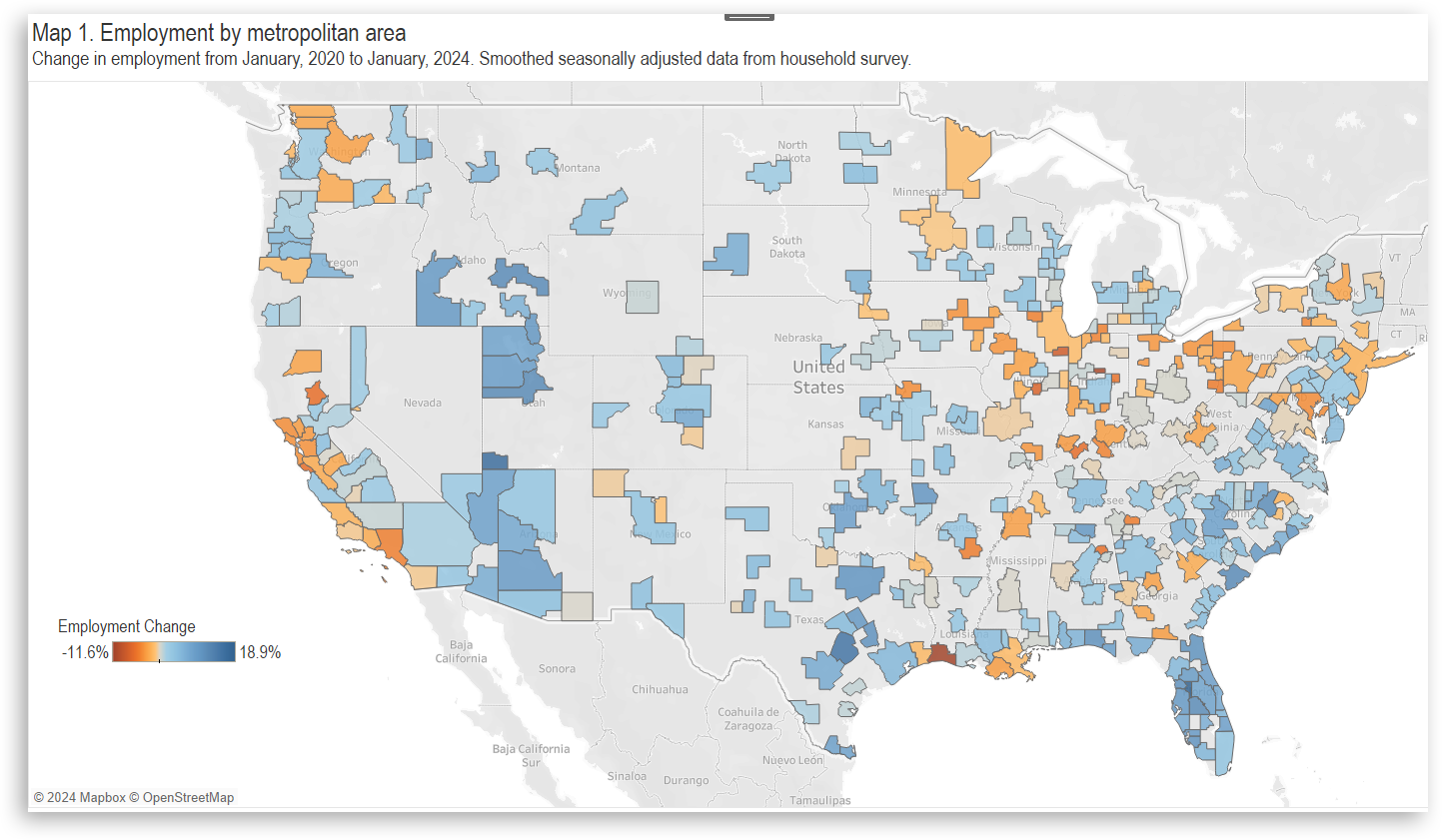

Wichita Employment Situation, January 2024

For the Wichita metropolitan area in January 2024, most employment indicators declined slightly from the prior month, and the unemployment rate did not change. Wichita continues to perform poorly compared to its peers.

-

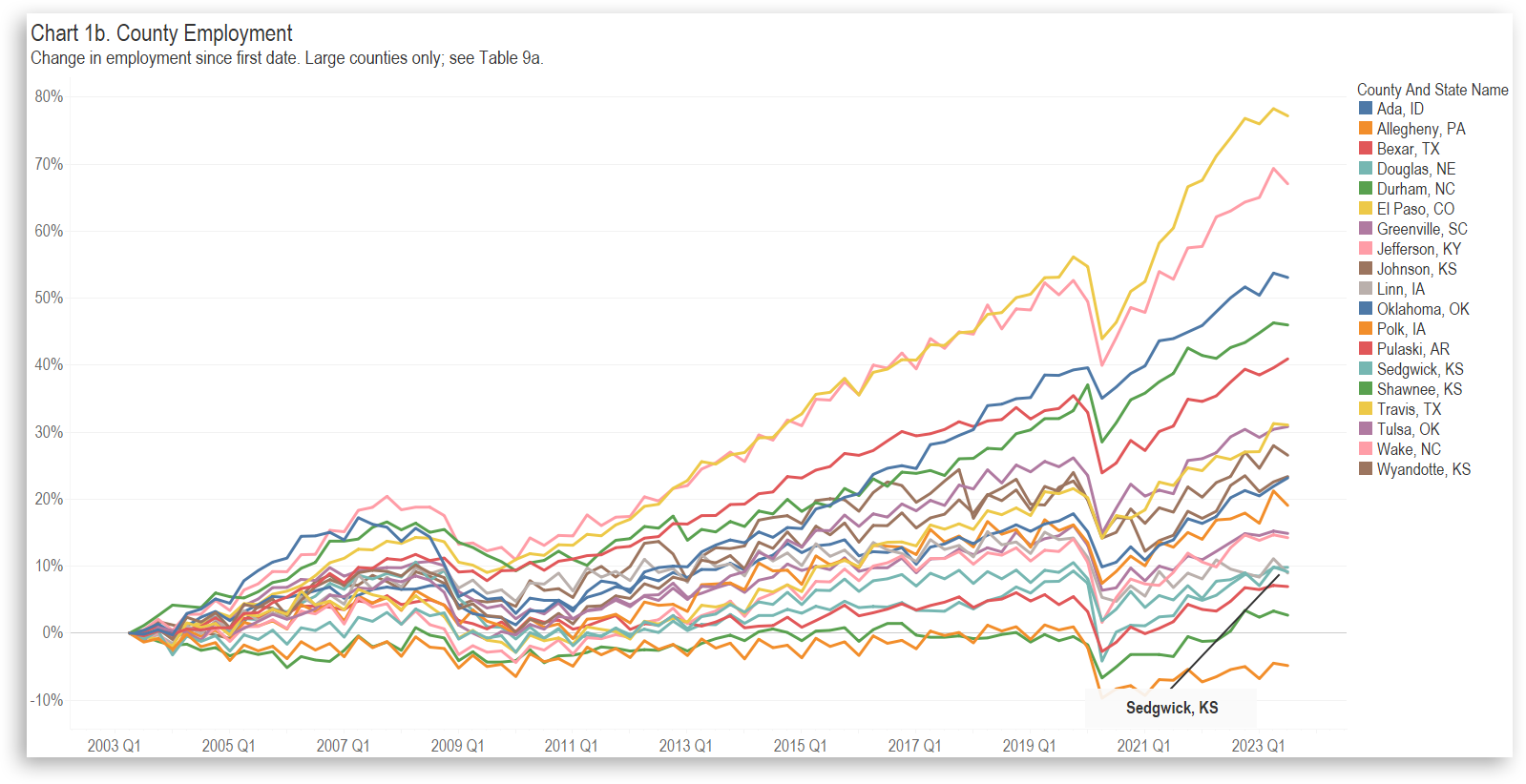

Large County Employment, Third Quarter 2023

Employment in large counties, including Sedgwick County and others of interest.

-

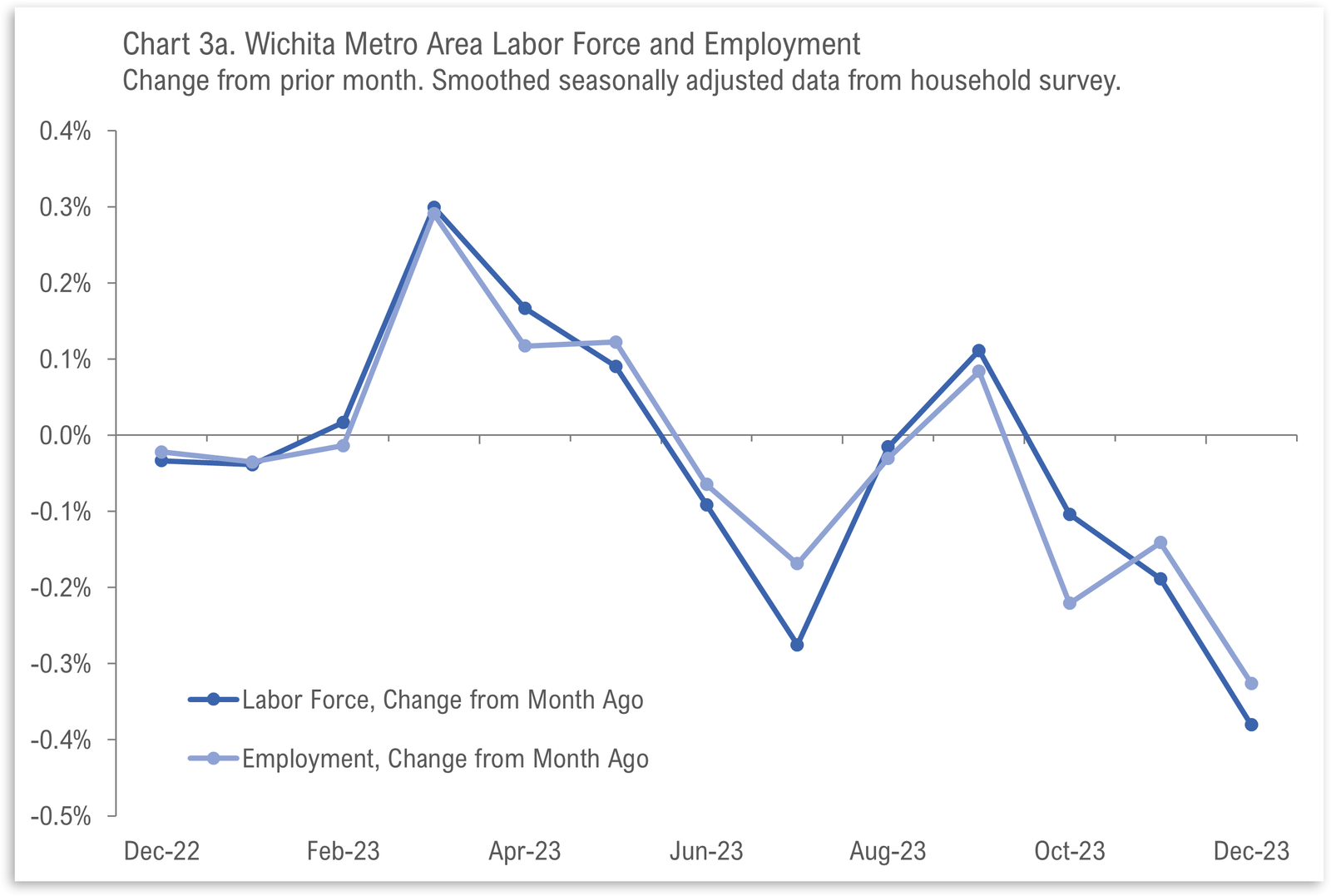

Wichita Employment Situation, December 2023

For the Wichita metropolitan area in December 2023, major employment indicators declined from the prior month, and the unemployment rate also fell. Wichita continues to perform poorly compared to its peers.

-

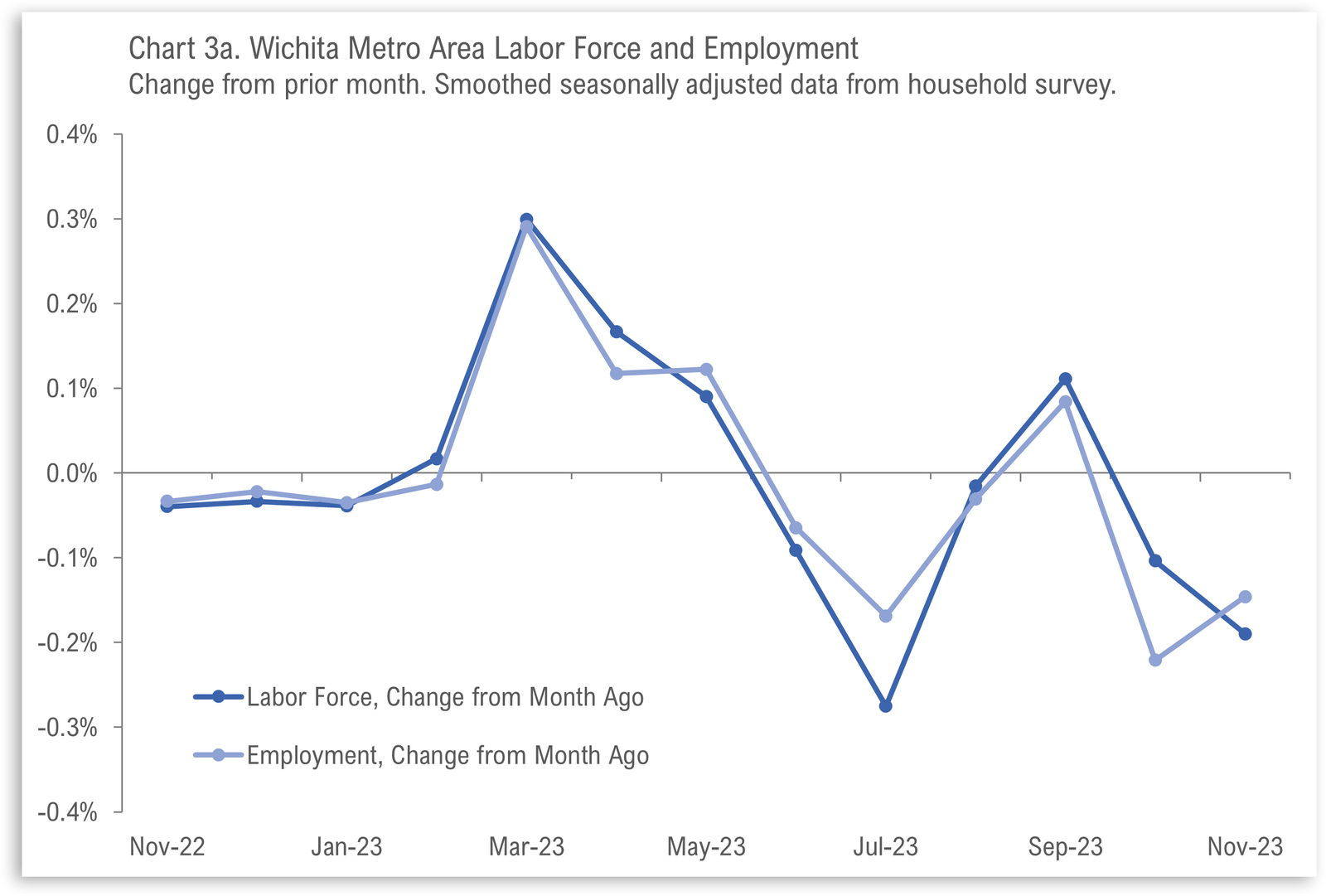

Wichita Employment Situation, November 2023

For the Wichita metropolitan area in November 2023, major employment indicators declined from the prior month. Wichita continues to perform poorly compared to its peers.

-

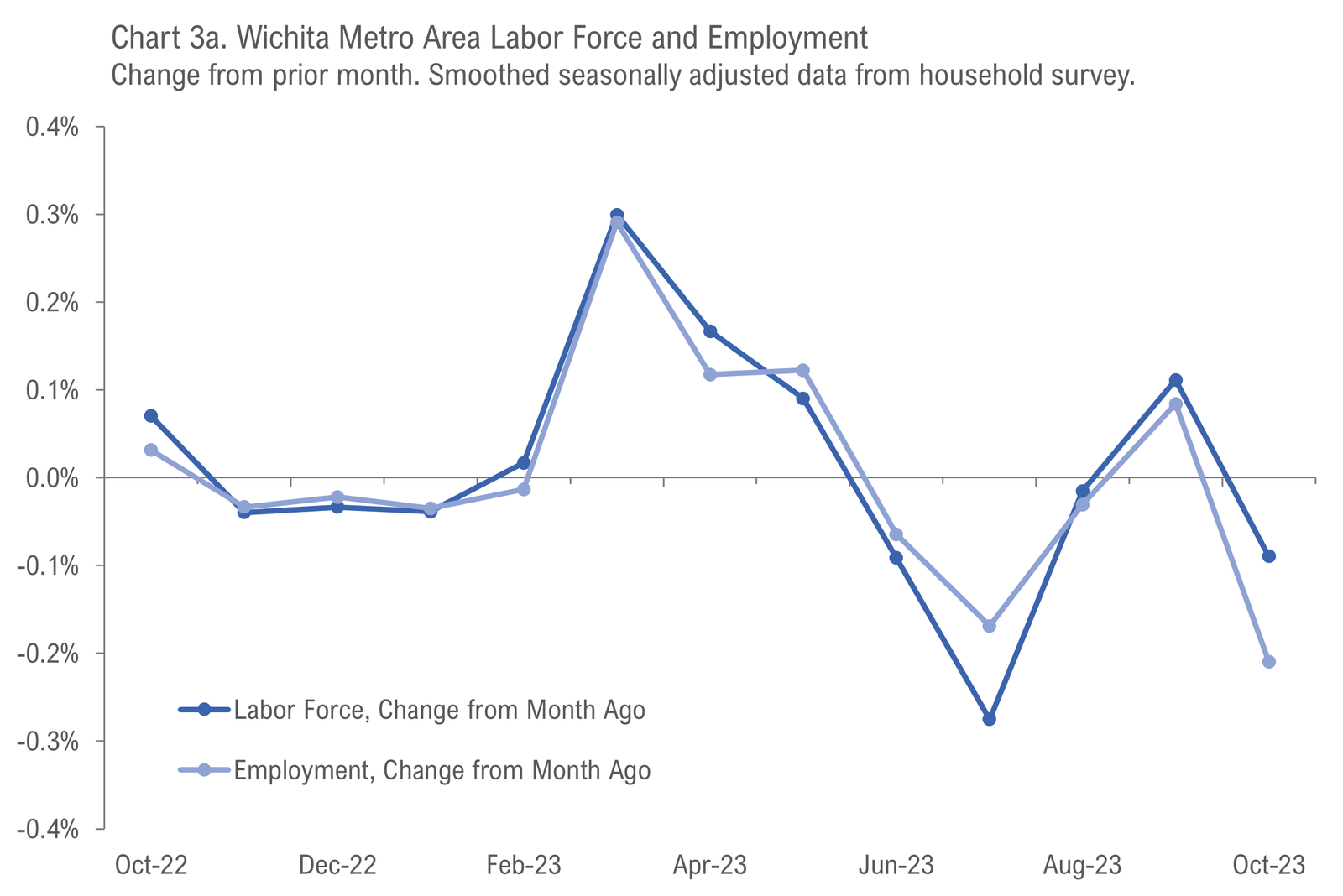

Wichita Employment Situation, October 2023

For the Wichita metropolitan area in October 2023, major employment indicators declined from the prior month. Wichita performs poorly compared to its peers.

-

Large County Employment, Second Quarter 2023

Employment in large counties, including Sedgwick County and others of interest.

-

Wichita Employment Situation, September 2023

For the Wichita metropolitan area in September 2023, major employment indicators were little changed from the prior month.