Tag: Economic freedom

-

Kansas Center for Economic Growth

Kansas Center for Economic Growth, often cited as an authority by Kansas news media and politicians, is not the independent and unbiased source it claims to be.

-

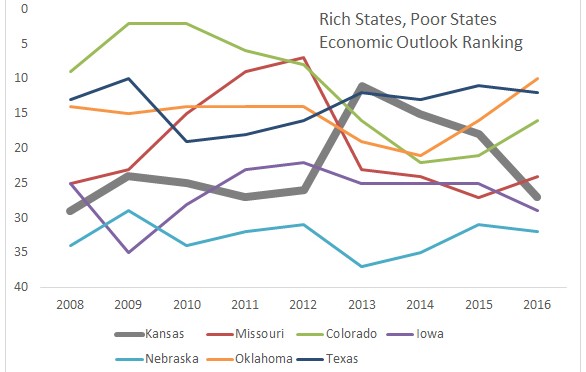

Rich States, Poor States, 2106 edition

In Rich States, Poor States, Kansas continues with middle-of-the-pack performance, and fell sharply in the forward-looking forecast.

-

Wichita on verge of new regulatory regime

The Wichita City Council is likely to create a new regulatory regime for massage businesses in response to a problem that is already addressed by strict laws.

-

Wichita to impose burdensome occupational requirements

The proposed massage therapist regulations in Wichita are likely to be ineffective, but will limit economic opportunity and harm consumers.

-

WichitaLiberty.TV: Heritage Foundation’s Bryan Riley on free trade

Foreign trade is an important issue in this year’s presidential campaign. Heritage Foundation economist and Senior Policy Analyst Bryan Riley explains concepts that voters can use in making an informed decision.

-

Massage business regulations likely to be ineffective, but will be onerous

The Wichita City Council is likely to create a new regulatory regime for massage businesses in response to a problem that is already addressed by strict laws.

-

Wichita Chamber calls for more cronyism

By advocating for revival of the Export-Import Bank of the United States, the Wichita Metro Chamber of Commerce continues its advocacy for more business welfare, more taxes, more wasteful government spending, and more cronyism

-

WichitaLiberty.TV: Wichita’s regulations and economic development

Do Wichita’s many laws and regulations accomplish their goals? Then, are Wichita’s economic development policies likely to work?

-

Entrepreneurship in Wichita

As Wichita seeks to reboot its spirit of entrepreneurship, we should make sure we do things that have a chance of working.

-

WichitaLiberty.TV: Jeffrey Tucker and ‘Bit by Bit: How P2P Is Freeing the World’

Jeffrey Tucker talks about his most recent book “Bit by Bit: How P2P Is Freeing the World” and how Bitcoin and other distributed technologies are affecting the world.

-

Intellectuals vs. the rest of us

Why are so many opposed to private property and free exchange — capitalism, in other words — in favor of large-scale government interventionism? Lack of knowledge, or ignorance, is one answer, but there is another.

-

WichitaLiberty.TV: Rodger Woods of Americans for Prosperity-Kansas

Americans for Prosperity is one of the largest grassroots political action groups. Its motto is “Economic Freedom in Action.” Rodger Woods, deputy state director for AFP-Kansas, joins me to explain AFP’s mission and goals, and some specific issues.