Everyone who cares about Wichita — the entire city, not just special interests — ought to be opposed to the continued use of tax increment financing (TIF) districts and other forms of subsidy that direct benefits to a small group at the expense of everyone else.

Proponents of these programs such as Wichita Eagle editorial writer Rhonda Holman, most elected officials, and nearly all bureaucrats, need to justify these incentives. They make their case, of course, but the case is shallow. We need to look at research that studies these programs. We need to consider the effect of these programs on the city as a whole, and on the civic attitudes of Wichitans. When we do, we find that these programs just don’t deliver what they promise, unless you focus only on the special interest groups that feed off these programs. We also see that these programs contribute to the cynicism that is destructive to a civil society where people exist and trade harmoniously.

What is the purpose? Development? Jobs?

Some people want TIF because it promises development that otherwise would not happen. Others want the jobs that they see TIF create.

The problem is that both promises are false — if you are able to look beyond stage one. There’s no doubt that things happen in TIF districts, usually. Buildings are built or renovated. Businesses open. People go to work.

This simple analysis appeals to elected officials and newspaper editorial writers. But if we are concerned about the overall prosperity of our city, we need to look beyond the borders of the TIF district. When we do that, we come to a different assessment.

Regarding the effect of TIF on overall development, economists Richard F. Dye and David F. Merriman have studied tax increment financing extensively. Their article Tax Increment Financing: A Tool for Local Economic Development states in its conclusion:

TIF districts grow much faster than other areas in their host municipalities. TIF boosters or naive analysts might point to this as evidence of the success of tax increment financing, but they would be wrong. Observing high growth in an area targeted for development is unremarkable.

So TIFs are good for the favored development that receives the subsidy — not a surprising finding. It’s what self-serving elected officials, bureaucrats, and newspaper editorial writers can see and focus on. But what about the rest of the city? Continuing from the same study:

If the use of tax increment financing stimulates economic development, there should be a positive relationship between TIF adoption and overall growth in municipalities. This did not occur. If, on the other hand, TIF merely moves capital around within a municipality, there should be no relationship between TIF adoption and growth. What we find, however, is a negative relationship. Municipalities that use TIF do worse.

We find evidence that the non-TIF areas of municipalities that use TIF grow no more rapidly, and perhaps more slowly, than similar municipalities that do not use TIF. (emphasis added)

So if we are concerned about overall growth in Wichita, we need to realize that TIF simply shifts development from one place to another. The overall impact, according to uncontroverted research, is negative: less growth, not more.

What about jobs? Paul F. Byrne of Washburn University authored a recent report titled Does Tax Increment Financing Deliver on Its Promise of Jobs? The Impact of Tax Increment Financing on Municipal Employment Growth. In its abstract we find this conclusion regarding the impact of TIF on jobs:

Increasingly, municipal leaders justify their use of tax increment financing (TIF) by touting its role in improving municipal employment. However, empirical studies on TIF have primarily examined TIF’s impact on property values, ignoring the claim that serves as the primary justification for its use. This article addresses the claim by examining the impact of TIF adoption on municipal employment growth in Illinois, looking for both general impact and impact specific to the type of development supported. Results find no general impact of TIF use on employment. However, findings suggest that TIF districts supporting industrial development may have a positive effect on municipal employment, whereas TIF districts supporting retail development have a negative effect on municipal employment. These results are consistent with industrial TIF districts capturing employment that would have otherwise occurred outside of the adopting municipality and retail TIF districts shifting employment within the municipality to more labor-efficient retailers within the TIF district. (emphasis added)

While this research might be used to support a TIF district for industrial development, TIF in Wichita is primarily used for retail development. And, when looking at the entire picture, the effect on employment is negative.

Verge of corruption

The ability and willingness of local elected officials to dish out TIF and other forms of subsidy places them, as Randal O’Toole has written, “on the verge of corruption.” In Wichita, David Burk and the principals of Key Construction make extensive use of political campaign contributions, and have benefited handsomely from TIF and other forms of subsidy. A recent analysis of campaign contributions by these parties to Wichita City Council members showed just how prevalent are these contributions.

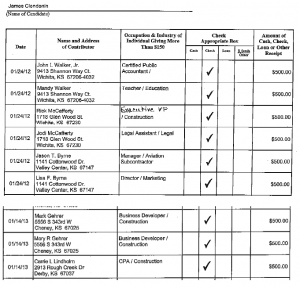

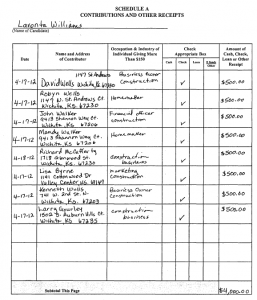

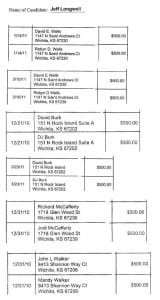

In Wichita city elections, individuals may contribute up to $500 to candidates, once during the primary election and again during the general election. As you can see in this table complied from Wichita City Council campaign finance reports, spouses often contribute as well. So it’s not uncommon to see the David and DJ Burk family contribute $2,000 to a candidate for their primary and general election campaigns. That’s a significant sum for a city council district election campaign cycle. Click here for a compilation of campaign contributions made by those associated with the Douglas Place project, a recent collaboration between Burk, Key Construction, and others.

Council Member Jeff Longwell (district 5, west and northwest Wichita), in his second term as council member and with his heart set on becoming the next mayor, leads the pack in accepting campaign contributions from parties associated with the Douglas Place project. For his most recent election, he received $4,000 from parties associated with Key Construction, and $2,000 from David Burk and his wife. Total from parties associated with the Douglas Place project: $6,000.

Lavonta Williams, (district 1, northeast Wichita), who is also vice mayor, received $5,000 from parties associated with Douglas Place: $4,000 from parties associated with Key Construction, and $2,000 from David Burk and his wife.

Mayor Carl Brewer received $4,000 from parties associated with Douglas Place: $3,500 from parties associated with Key Construction, and $500 DJ Burk, David Burk’s wife.

Council Member Janet Miller (district 6, north central Wichita) received $3,500 during her 2009 election campaign from parties associated with Douglas Place: $1,500 from parties associated with Key Construction, and $2,000 from David Burk and his wife.

For his 2011 election campaign, newly-elected Council Member Pete Meitzner (district 2, east Wichita) received $2,500 from parties associated with Douglas Place: $1,500 from parties associated with Key Construction, and $1,000 from David Burk and his wife.

The people who make these contributions and the officeholders who receive them deny that they make any difference. That’s hard to believe. These donors don’t often contribute to candidates for the Kansas Legislature or U.S. Congress. That’s because these bodies don’t have the power to dish out the subsidies that the Wichita City Council does. I’d say these donors are acting rationally, in their self-interest.

If you’re still not convinced, consider the case of Reverend Kevass Harding, who wanted to redevelop the Ken-Mar shopping center, and Wichita City Council member Lavonta Williams, (district 1, northeast Wichita), who is presently serving as vice mayor.

As reported in 2009, Harding and his wife made campaign contributions to Williams. These campaign contributions, made in the maximum amount allowable, were out of character for the Hardings. They had made very few contributions to political candidates, and they appear not to have made many since then.

But in June 2008, just before the Ken-Mar TIF district was to be considered for approval, the Hardings made contributions in the maximum allowable amount to Williams, who represents Ken-Mar’s district. Harding would not explain why he made the contributions. Williams offered a vague and general explanation that had no substantive meaning.

The close linkage between these political contributions the awarding of money illustrates the need for pay-to-play laws in Wichita and Kansas. These laws impose various restrictions on the activities of elected officials and the awarding of contracts or other largesse to those who have made political contributions.

Citizens become cynical when they feel there is a group of insiders — commonly called the “good ol’ boy network” — who get whatever they want from city hall at the expense of taxpayers. It’s surprising that the Wichita Eagle editorial board is either not aware of this, or doesn’t see it as a problem. In the meantime, our newspaper, along with those in the network of city hall insiders, continue to contribute to the destruction of civil society in Wichita.

Additional Reading:

- Wichita property taxes are high, leading to other problems: “An ongoing study by the Minnesota Taxpayers Association tells us that Wichita has high business property taxes. This may be a reason why the Wichita City Council feels it is necessary to offer relief from these taxes, but it is not an effective economic development strategy.”

- Tax increment financing: The right tool for Wichita jobs?: “Tax Increment Financing (TIF) is an economic development tool that uses the expected growth (or increment) in property tax revenues from a designated geographic area of a municipality to finance bonds used to pay for goods and services calculated to spur growth in the TIF district. The analysis performed for this study found TIF does not tend to produce a net increase in economic activity; favors large businesses over small businesses; often excludes local businesses and residents from the planning process; and operates in a manner that contradicts conventional notions of justice and fairness. We recommend seeking alternatives to TIF and reforms to TIF that make the process more democratic and the distribution of benefits more fair to residents of TIF districts.”

- Giving away the store to get a store: “Largely because it promises something for nothing — an economic stimulus in exchange for tax revenue that otherwise would not materialize — this tool is becoming increasingly popular across the country. Originally used to help revive blighted or depressed areas, TIFs now appear in affluent neighborhoods, subsidizing high-end housing developments, big-box retailers, and shopping malls. And since most cities are using TIFs, businesses such as Cabela’s can play them off against each other to boost the handouts they receive simply to operate profit-making enterprises.”

- Wichita’s economic development strategy: rent seeking: “It is wealth, after all, that defines prosperity. Our goal ought to be to create an environment where everyone lives in an environment conducive to creating prosperity and wealth. But in a misguided effort, our city leaders, week after week, take actions that produce just the opposite.”

- Wichita economic development: And then what will happen?: “Critics of the economic development policies in use by the City of Wichita are often portrayed as not being able to see and appreciate the good things these policies are producing, even though they are unfolding right before our very eyes. The difference is that some look beyond the immediate — what is seen — and ask “And then what will happen?” — looking for the unseen.

- Wichita and its political class: “Discussion at a Wichita City Council meeting provided an opportunity for citizens to discover the difference in the thinking of the political class and those who value limited government and capitalism.”

- Wichita on corporate welfare, again: “An award of $2.5 million by the City of Wichita to aircraft manufacturer Hawker Beechcraft to ward off a threatened move to Louisiana stands out as an example of corporate welfare given for its own sake, and not in response to any real threat.”

- Wichitans mislead on Warren IMAX incentives: “With the possibility of another IMAX theater being built not too far from Wichita, we now know that Wichitans were mislead in awarding economic development incentives.”

- Wichita again to bet on corporate welfare as economic development: “The Wichita City Council may take action that promotes corporate welfare and the city’s economic development policy.”

- In Wichita and Kansas, economic development is not working: “The effort of Wichita and Kansas to retain Hawker Beechcraft, one of our leading employers and a Wichita institution, provides a lesson in the futility of corporate welfare as an economic development policy: Someone is usually willing to pay more. We would be much better off if we start transforming Kansas to a state where all companies are nurtured, not by bureaucratic and political oversight and handouts, but by a low taxing and spending environment, and a reasonable regulatory regime.”

- Tax increment financing is not free money: “Cato Institute Senior Fellow Randal O’Toole has written extensively on the subject of urban planning, development, and tax increment financing (TIF) districts. The following article contains many points that the Wichita City Council may wish to consider as it considers expansion of a downtown Wichita TIF district at tomorrow’s council meeting.”

Wichita mayor Carl Brewer with major campaign donor Dave Wells of Key Construction. Brewer will vote tomorrow whether to grant a company Wells is part owner of sales tax forgiveness worth $703,017.

Wichita mayor Carl Brewer with major campaign donor Dave Wells of Key Construction. Brewer will vote tomorrow whether to grant a company Wells is part owner of sales tax forgiveness worth $703,017.