Tag: KansasOpenGov

-

Discussion of open government in Wichita and Kansas

Perspectives may differ, but the point is the same — more government transparency leads to more citizen engagement and better outcomes in communities, states, and nations.

-

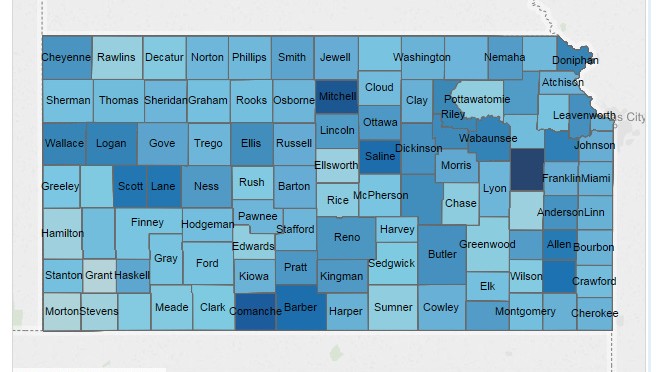

Kansas property tax data, the interactive visualization

Here is an interactive visualization that holds property tax data for Kansas counties from 1997 to 2013.

-

Bill would end taxpayer-funded lobbying in Kansas

A bill has been introduced in the Kansas Senate that would end or limit taxpayer-funded lobbying.

-

More Kansas spending data online

Kansas Policy Institute has added more data to KansasOpenGov, its government transparency portal.

-

Kansas schools’ unspent funds on the rise — again

New data from the Kansas Department of Education show that Kansas public schools increased their operating carryover cash reserves by $93.7 million in the fiscal year ended June 30, 2011.

-

Kansas and Wichita quick takes: Friday May 6, 2011

Today: Wichita downtown sites draw little interest; KPERS; more flexibility for school funds; despite “cuts,” spending grows; Sandy Springs a model; states’ war for jobs; shale gas to be topic in Wichita; Economics in one lesson this Monday; voters favor cuts, not tax increases to balance budget; here’s the Kansas data.

-

Kansas and Wichita quick takes: Wednesday February 9, 2011

Today: ACLU leader to speak in Wichita; information added to KansasOpenGov.org; “The Citizen” launches; economic development in Wichita explained; limits on state agency advertising proposed; Wichita lame ducks to take junket.

-

Kansas and Wichita quick takes: Thursday January 6, 2011

Today: State GOP chief to speak in Wichita; Kansas budget under more stress; Education and Medicaid spending protected; Kansas websites to be presented; Kansas school spending, constitutional issues discussed; low interest rates and saving.

-

Kansas school funds on the rise

Kansas schools, while presenting a gloomy financial outlook, have failed to spend all the funds they’ve been given.

-

KansasOpenGov.org provides state data to citizens

KansasOpenGov.org provides an easy-to-access repository of data about Kansas state and local governments, giving citizens the data they need to hold officials accountable.

-

Kansas schools cut, yet fail to spend

Kansas schools have cut staff and teachers at the same time carryover fund balances have increased.