Tag: Wichita and Kansas schools

-

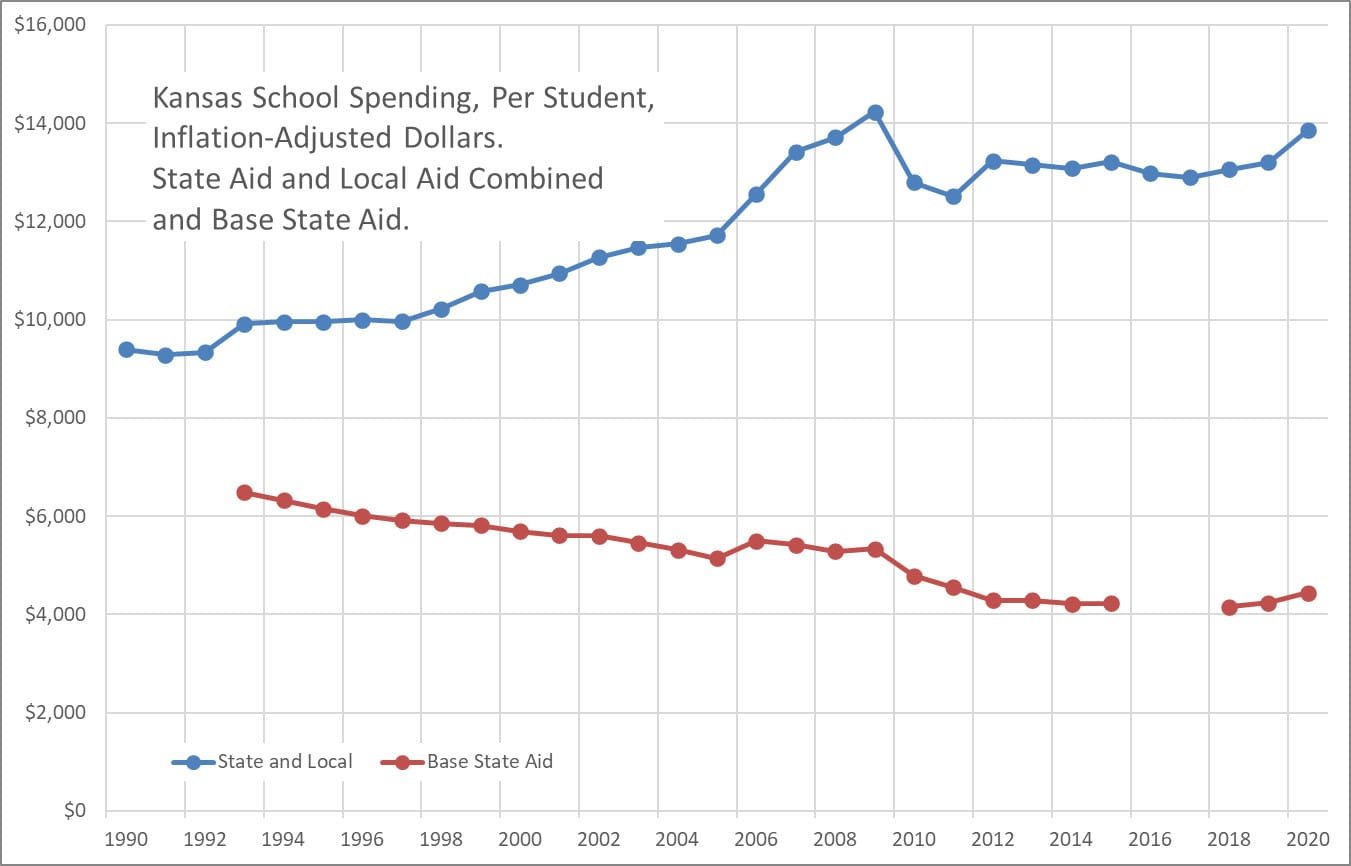

Kansas school spending

Kansas school district spending, updated through 2020 and adjusted for inflation.

-

Kansas school spending, through 2020

Charts of Kansas school spending presented in different forms.

-

Wichita property tax on commercial property: High

An ongoing study reports that property taxes on commercial and industrial property in Wichita are high. In particular, taxes on commercial property in Wichita are among the highest in the nation.

-

Kansas school employment

Kansas school employment rose for the current school year.

-

Performance levels in Wichita schools

There is some good news in the performance level reports for Wichita public schools.

-

Kansas school salaries

Kansas school salaries, visualized.

-

Wichita public schools, by the charts

Data from the annual report for the 2018-2019 school year for USD 259, the Wichita, Kansas public school district.

-

Kansas sees large drop in test scores

Using demographically-adjusted scores, Kansas falls in state rankings of National Assessment of Educational Progress (NAEP).

-

From Pachyderm: Wichita school board candidates

From the Wichita Pachyderm Club this week: Candidates for the board of USD 259, the Wichita public school district. This was recorded October 4, 2019.