-

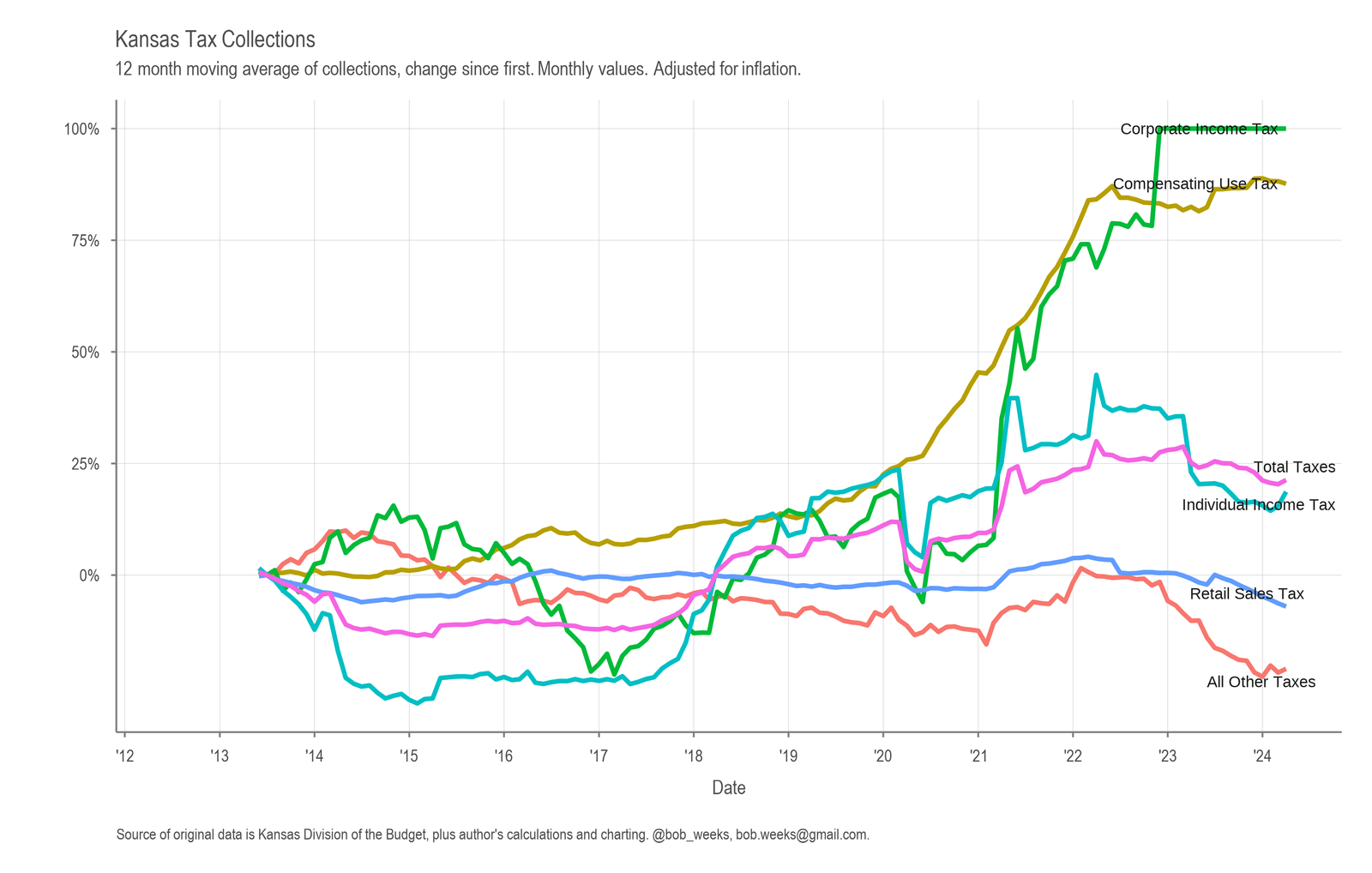

Kansas Tax Revenue, April 2024

Read more: Kansas Tax Revenue, April 2024For April 2024, Kansas tax revenue was 9.6 percent higher than April 2023, and 7.7 percent higher than estimated.

-

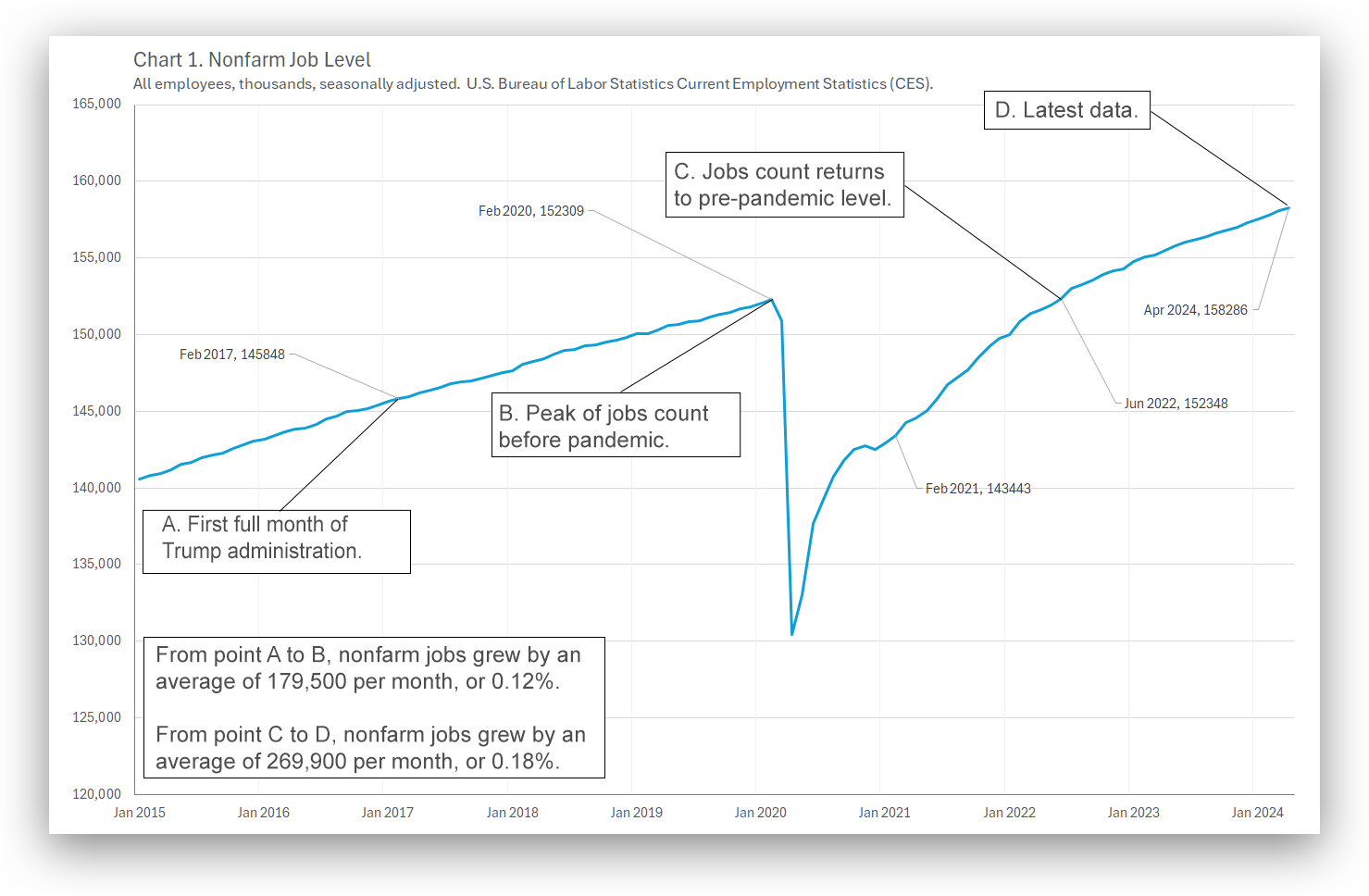

Employment, pre- and post-Covid

Read more: Employment, pre- and post-CovidComparing job growth before and after the Covid pandemic, attempting to remove the effect of the pandemic.

-

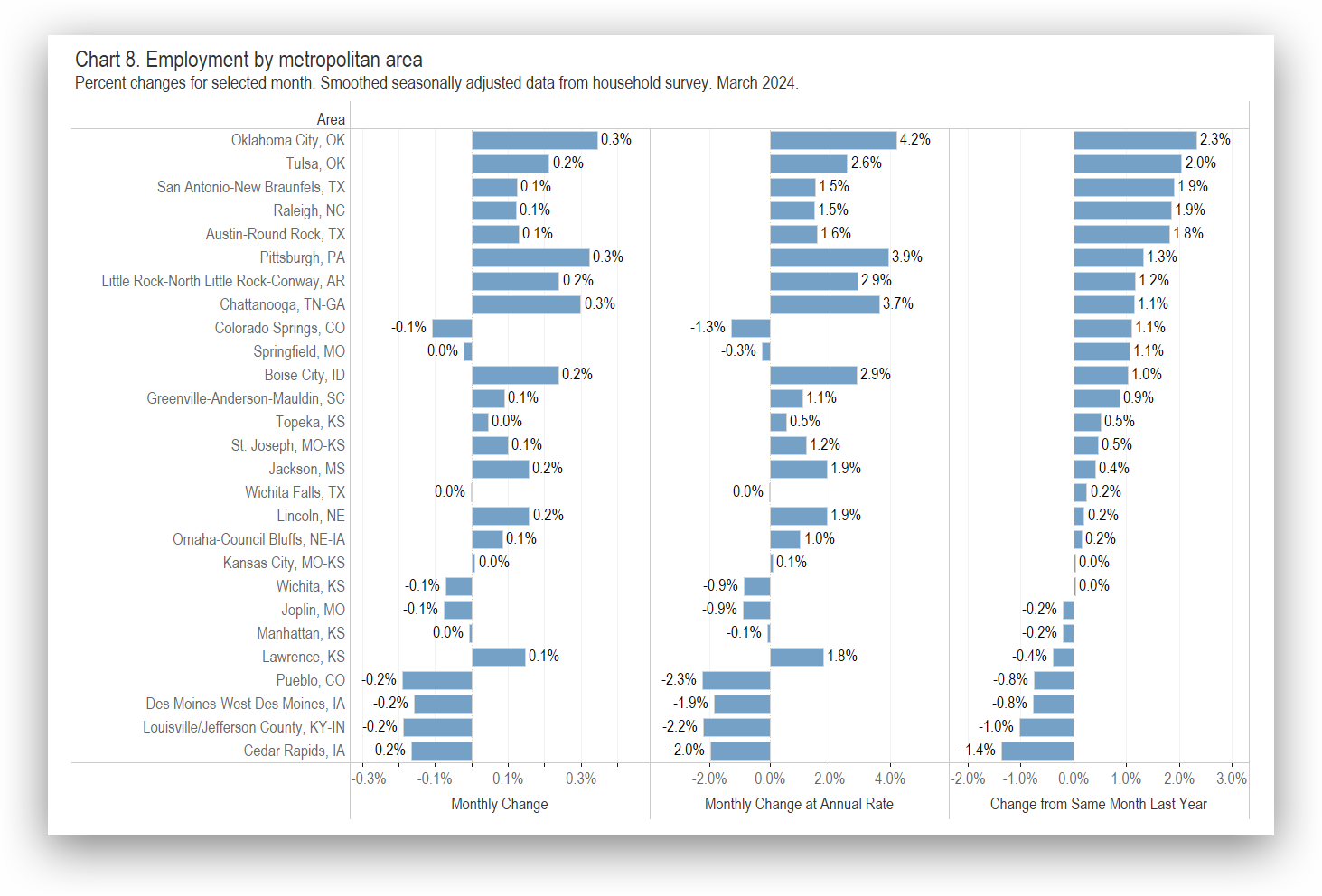

Wichita Employment Situation, March 2024

Read more: Wichita Employment Situation, March 2024For the Wichita metropolitan area in March 2024, most employment indicators changed only slightly from the prior month. Wichita continues to perform poorly compared to its peers.

-

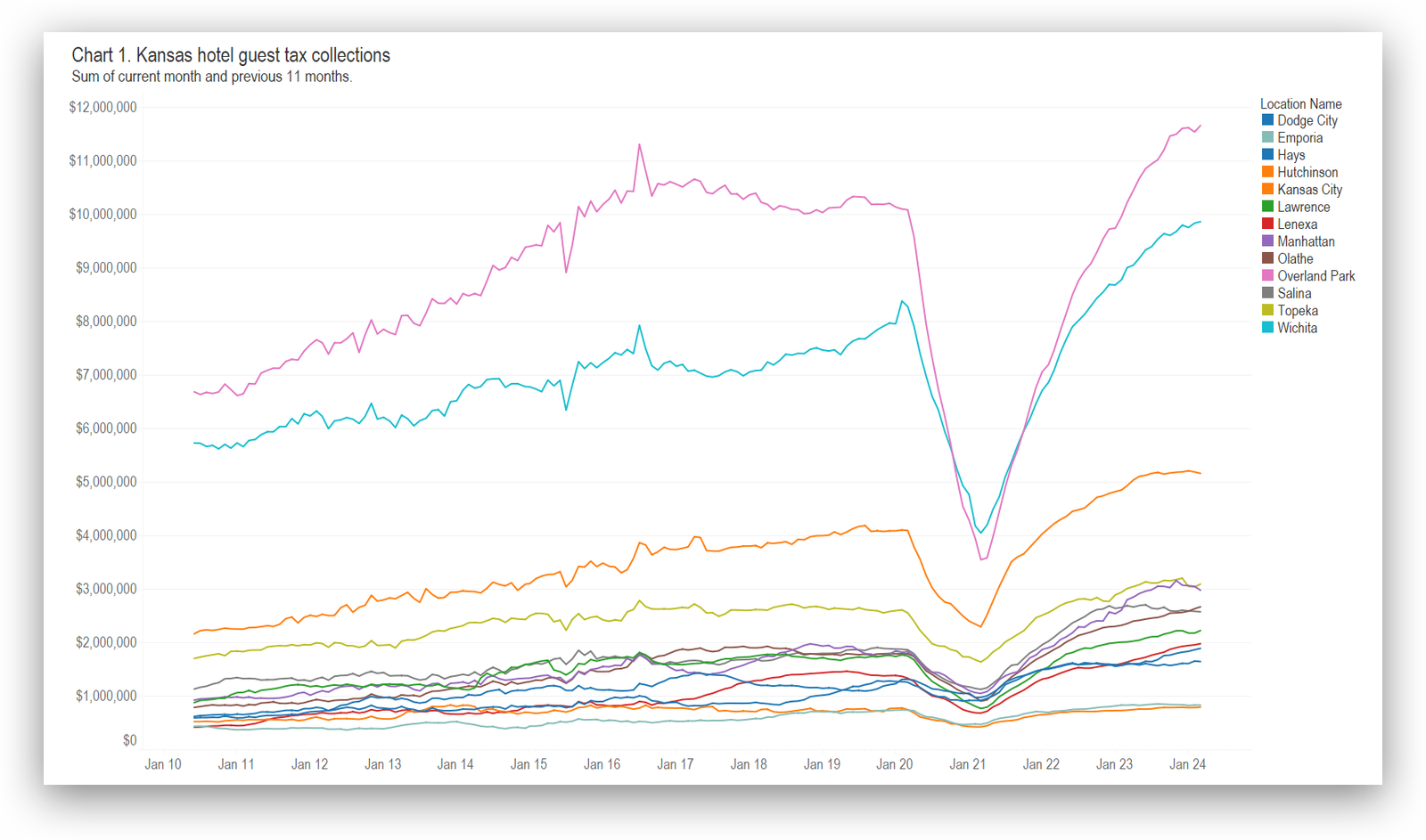

Updated: Kansas hotel guest tax collections

Read more: Updated: Kansas hotel guest tax collectionsKansas hotel guest tax collections presented in an interactive visualization. Updated with data through March 2024.

-

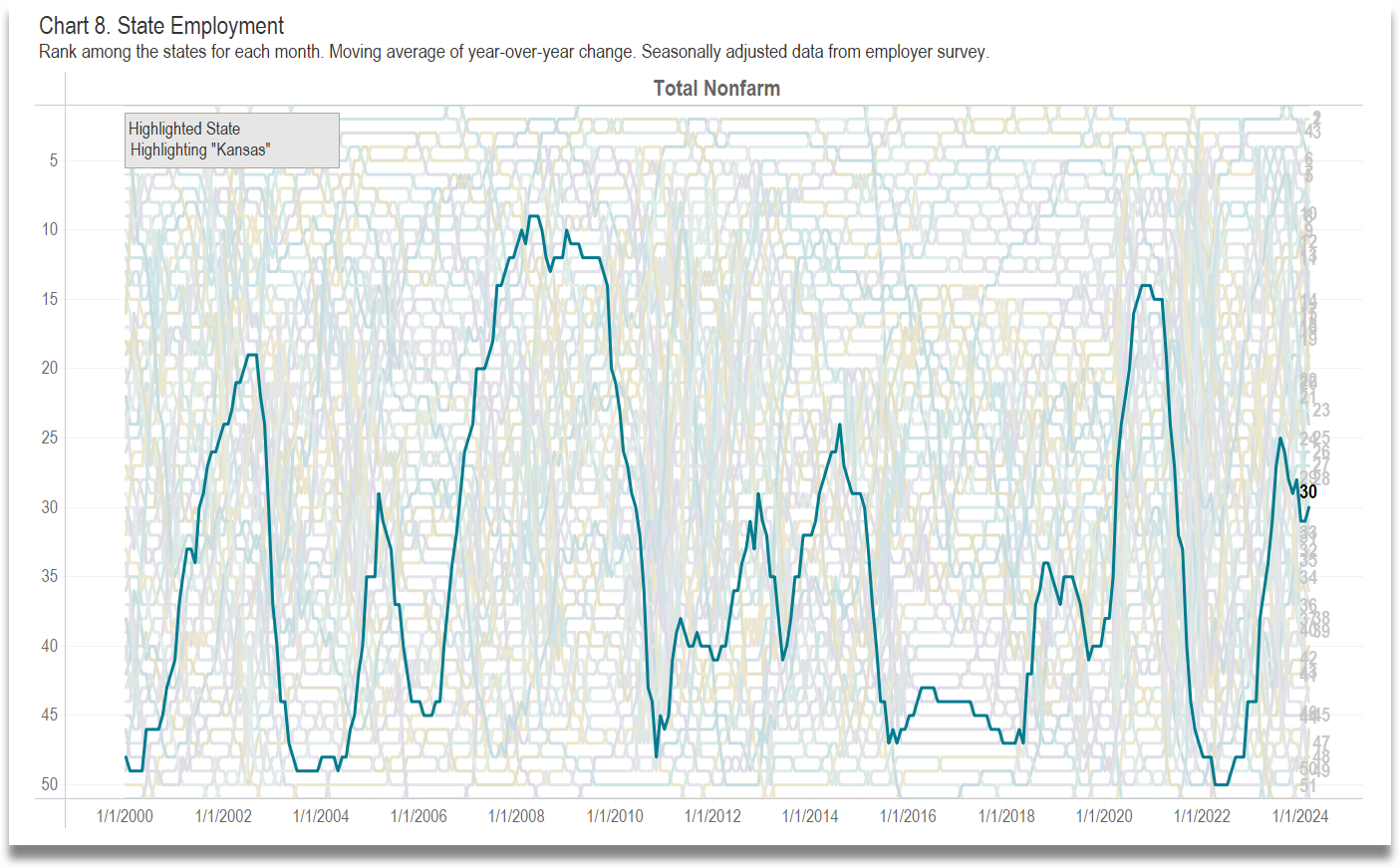

Kansas Employment Situation, March 2024

Read more: Kansas Employment Situation, March 2024In Kansas in March 2024, the labor force fell slightly, the number of jobs rose, and the unemployment was unchanged compared to the previous month. Over the year, Kansas is at the midpoint of states in job growth.

-

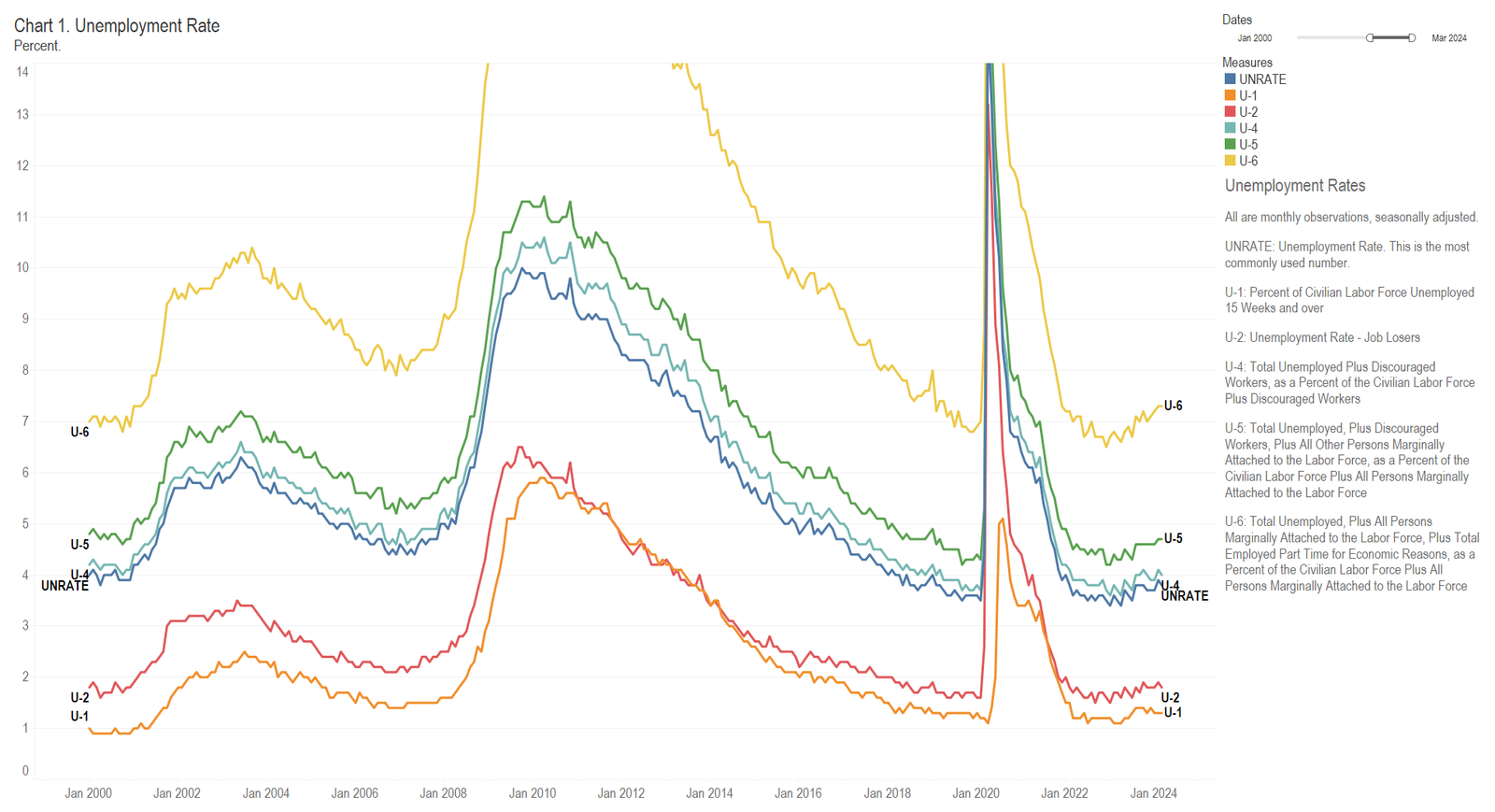

Unemployment Rates

Read more: Unemployment RatesAll the unemployment rates published by Bureau of Labor Statistics in an interactive visualization.

-

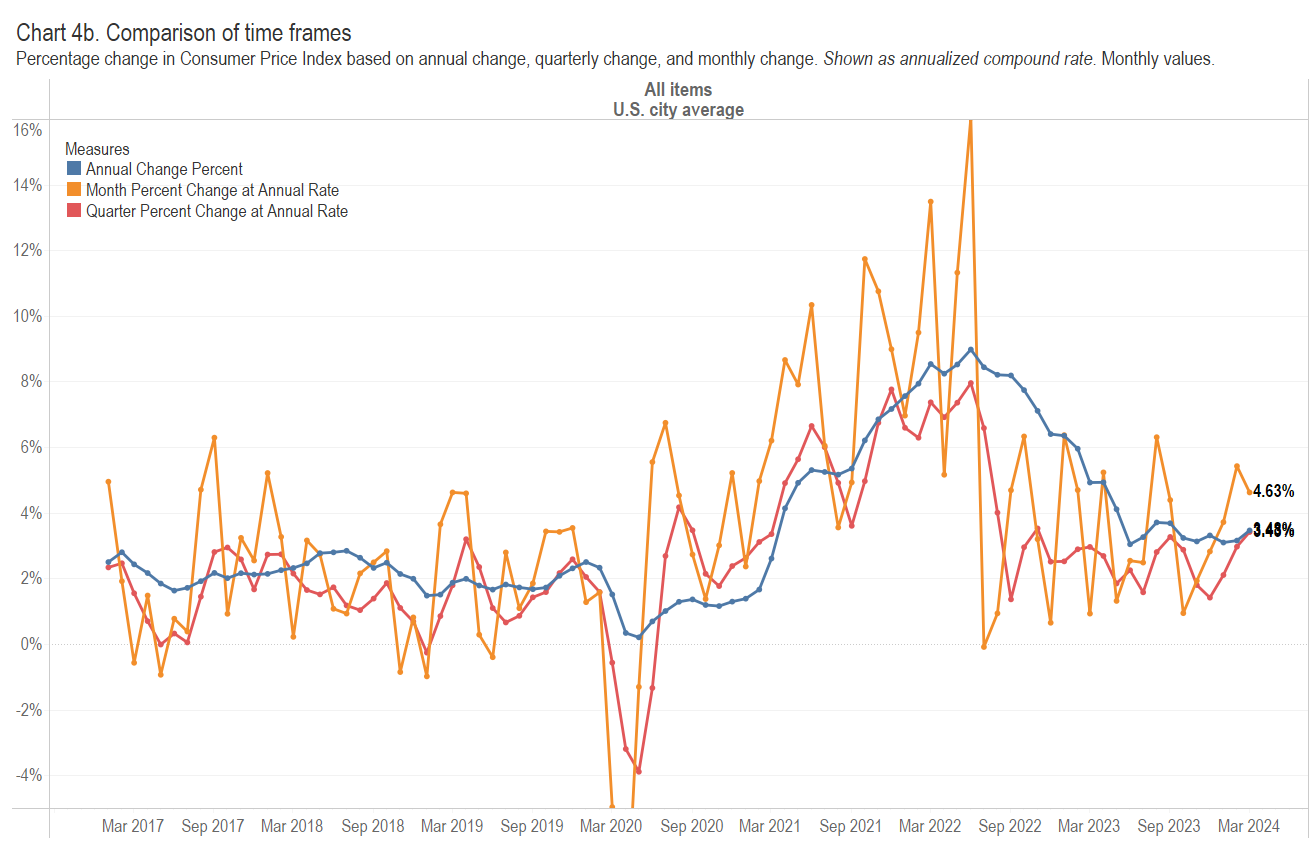

Consumer Price Index, March 2024

Read more: Consumer Price Index, March 2024Looking at inflation calculations in a different way.

-

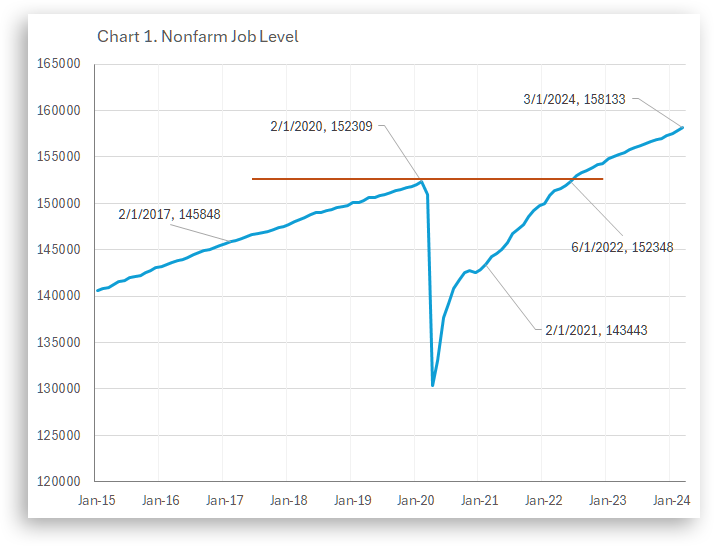

Employment, pre- and post-Covid

Read more: Employment, pre- and post-CovidComparing job growth before and after the Covid pandemic, attempting to remove the effect of the pandemic.

-

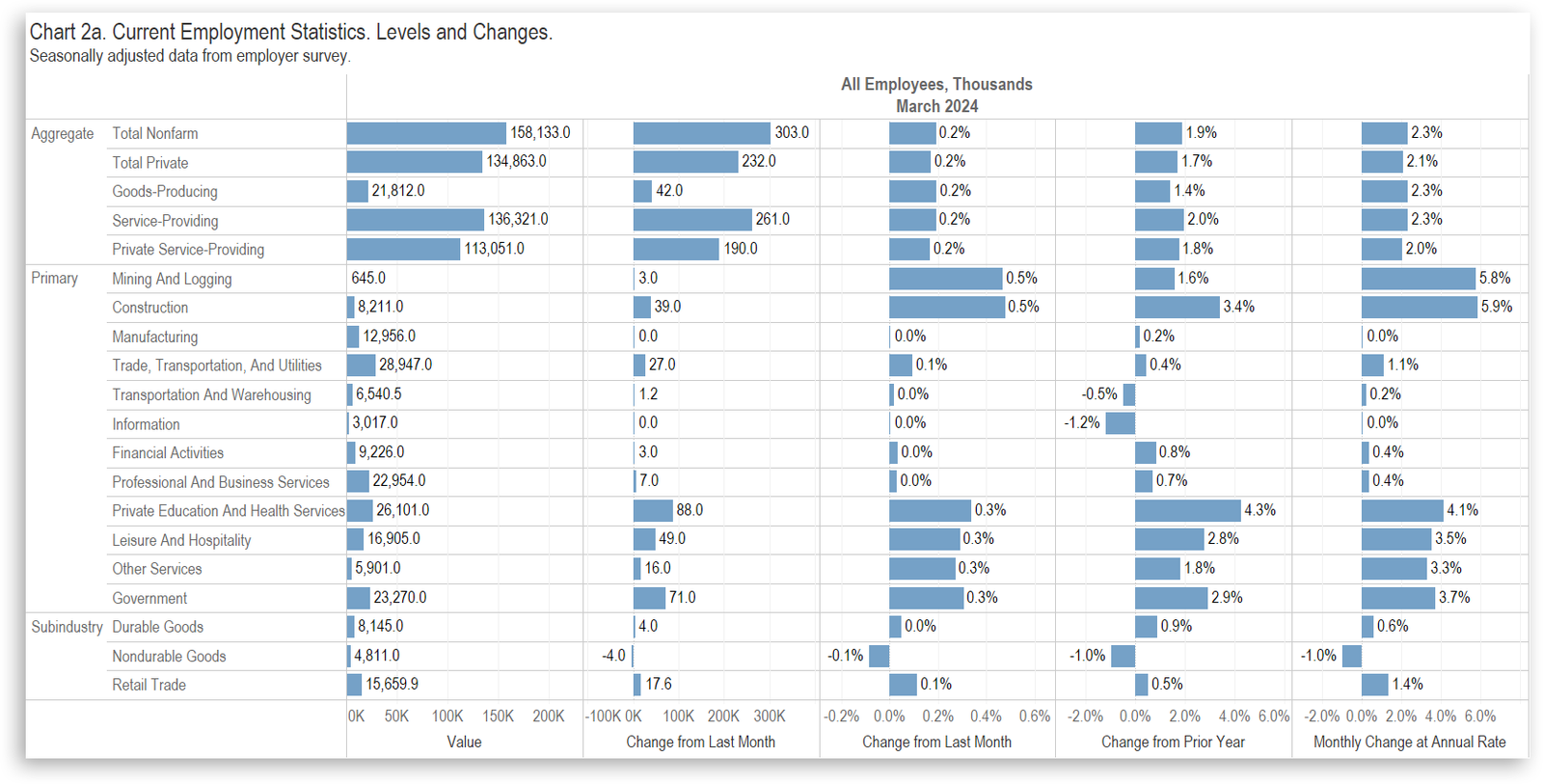

National Employment Situation, March 2024

Read more: National Employment Situation, March 2024Total nonfarm payroll employment increased by 333,000 in March 2024 from February 2024. The unemployment rate fell from 3.9 percent to 3.8 percent.