Here are highlights from the Voice for Liberty for 2015. Also be sure to view the programs on WichitaLiberty.TV for guests like debate expert Rodney Wren, radio talk show Joseph Ashby, Congressman Mike Pompeo, Dave Trabert and James Franko of Kansas Policy Institute, author Shari Howard McMinn, Sedgwick County Commissioners Karl Peterjohn and Richard Ranzau, Michael Tanner of the Cato Institute, Rodger Woods of Americans for Prosperity, Jeffrey Tucker of Foundation for Economic Education, Radio talk show host Andy Hooser, and Jonathan Williams of American Legislative Exchange Council.

January

A chance for Wichita to embrace transparency

Promises of transparency were made during the recent Wichita sales tax campaign. If the city cares about government transparency, the city should implement its campaign promises, even though the tax did not pass. Click here.

Wichita loan agreement subject to interpretation

In 2009 the City of Wichita entered into an ambiguous agreement to grant a forgivable loan, and then failed to follow its own agreement. Worse yet, there has been no improvement to similar contracts. Such agreements empower the city to grant favor at its discretion. Click here.

Wichita TIF projects: some background

Tax increment financing disrupts the usual flow of tax dollars, routing funds away from cash-strapped cities, counties, and schools back to the TIF-financed development. TIF creates distortions in the way cities develop, and researchers find that the use of TIF means lower economic growth. Click here.

Government intervention may produce unwanted incentives

A Kansas economic development incentive program has the potential to alter hiring practices for reasons not related to applicants’ job qualifications. Click here.

Wichita city hall falls short in taxpayer protection

An incentives agreement the Wichita city council passed on first reading is missing several items that city policy requires. How the council and city staff handle the second reading of this ordinance will let us know for whose interests city hall works: citizens, or cronies. Click here.

In Kansas, PEAK has a leak

A Kansas economic development incentive program is pitched as being self-funded, but is probably a drain on the state treasure nonetheless. Click here.

Kansas Democratic Party income tax reckoning

A story told to generate sympathy for working mothers at the expense of Kansas Governor Sam Brownback is based on arithmetic that is not plausible. Click here.

A Kansas calamity, at $15,399 per pupil

If things are so bad in Kansas schools at this level of spending, will any amount of spending satisfy school districts? Click here.

Sin-tax or vice-tax?

As Kansas considers raising additional revenue by raising the tax on tobacco and alcohol, let’s declare the end to governmental labeling of vice as sin, and people as sinners. Click here.

Ray Merrick on the gotcha factor

The Kansas House of Representatives, led by its Speaker, decides to retain the ability to cast votes in secret. Click here.

February

Availability of testimony in the Kansas Legislature

Despite having a website with the capability, only about one-third of standing committees in the Kansas Legislature are providing written testimony online. Click here.

Kansas spring elections should be moved

Moving spring elections to fall of even-numbered years would produce more votes on local offices like city council and school board. Click here.

Making Wichita an inclusive and attractive community

There are things both easy and difficult Wichita could do to make the city inclusive and welcoming of all, especially the young and diverse. Click here.

How do school choice programs affect budgets and performance of school districts?

Opponents of school choice programs argue the programs harm school districts, both financially and in their ability to serve their remaining students. Evidence does not support this position. Click here.

What we can learn from the piano

The purchase of a piano by a Kansas school district teaches us a lesson. Instead of a system in which schools raise money voluntarily — a system in which customers are happy to buy, donors are happy to give, and schools are grateful to receive — we have strife. Click here.

Community improvement districts in Kansas

Community Improvement Districts are a relatively recent creation of the Kansas Legislature. In a CID, merchants charge additional sales tax, up to an extra two cents per dollar. Click here.

Industrial revenue bonds in Kansas

Industrial Revenue Bonds are a confusing economic development program. Click here.

STAR bonds in Kansas

The Kansas STAR bonds program provides a mechanism for spending by autopilot, without specific appropriation by the legislature. Click here.

Sam Williams, CPA?

Sam Williams, a candidate for Wichita mayor, is not entitled to use the title “CPA,” according to Kansas law. Click here.

Rally for school choice in Kansas

This month, parents and children from around Kansas rallied in the Kansas Capitol for school choice. Click here.

March

School choice and state spending on schools

States like Kansas that are struggling to balance budgets could use school choice programs as a way to save money. Click here.

Energy subsidies for electricity production, in proportion

To compare federal subsidies for the production of electricity, we must consider subsidy values in proportion to the amount of electricity generated, because the magnitude is vastly different.

Click here.

Block grants a chance for more school choice in Kansas

The block grant school funding bill under consideration in the Kansas Legislature would hold districts harmless for enrollment declines due to school choice. Click here.

Downtown Wichita deal shows some of the problems with the Wichita economy

A look at the Wichita city council’s action regarding a downtown Wichita development project and how it is harmful to Wichita taxpayers and the economy. Click here.

April

Study on state and local regulation released

Kansas Policy Institute released a study of regulation and its impact at the state and local level. This is different from most investigations of regulation, as most focus on federal regulations. Click here.

Wichita city council member Jeff Longwell should not have voted

A sequence of events involving Jeff Longwell should concern citizens as they select the next Wichita mayor. Based on Wichita law, Longwell should not have voted on a matter involving the Ambassador Hotel, either for or against it. Click here.

Rich States, Poor States, 2105 edition

In Rich States, Poor States, Kansas continues with middle-of-the-pack performance, and fell in the forward-looking forecast for the second year in a row. Click here.

Sedgwick County elections have an anomaly

A Wichita statistician is thwarted in efforts to obtain data that might explain a strange observation. Click here.

Wichita Eagle fails readers, again

In its coverage of the 2015 election, the Wichita Eagle prints several stories that ought to cause readers to question the reliability of its newsroom.

Click here.

Economic indicators for Kansas

During this century the Kansas economy has not kept up with the national economy and most neighboring states. Click here.

Did Jeff Longwell dodge a tough city council vote?

On election day, Wichita city council member and mayoral candidate Jeff Longwell appears to have ducked an inconvenient vote and would not say why. Click here.

Intrust Bank Arena loss for 2014 is $5 million

The depreciation expense of Intrust Bank Arena in downtown Wichita recognizes and accounts for the sacrifices of the people of Sedgwick County and its visitors to pay for the arena. But no one wants to talk about this. Click here.

Wichita has examples of initiative and referendum

Citizens in Wichita have been busy exercising their rights of initiative and referendum at the municipal level. The Kansas Legislature should grant the same rights to citizens at the state level. Click here.

May

Wichita economic development, the need for reform

An incentives deal for a Wichita company illustrates a capacity problem and the need for reform. Click here.

Wichita property tax rates up again

The City of Wichita says that it hasn’t raised its mill levy in many years. Data shows the mill levy has risen, and its use has shifted from debt service to current consumption. Click here.

Brownback derangement syndrome on display

A newspaper op-ed illustrates some of the muddled thinking of Kansas newspaper editorialists, not to mention Brownback derangement syndrome. Click here.

In Wichita, bad governmental behavior excused

A Wichita newspaper op-ed is either ignorant of, or decides to forgive and excuse, bad behavior in Wichita government, particularly by then-mayoral candidate Jeff Longwell. Click here.

Soviet-style society seen as Wichita’s future

If local governments don’t fund arts, we risk a Soviet-style existence. This line of thought is precisely backwards. Click here.

Wichita water statistics update

Updated statistics show that the Wichita ASR water project has not been producing water at the projected rate, even after projections were halved. (This article was updated each month as new statistics became available.) Click here.

Kansas public school establishment ought to thank Sam Brownback

Kansas public schools ought to thank the governor and legislature for failing to give parents the power of school choice. Click here.

June

In Wichita, campaigning for a tax, then asking for exemption from paying

Having contributed $5,000 to persuade Wichita voters to raise the sales tax, a company now seeks exemption from paying any sales tax. Click here.

Taxation in the states

Examining tax collections by the states shows that Kansas collects more tax than many of our neighbors, and should put to rest some common myths. Click here.

With tax exemptions, what message does Wichita send to existing landlords?

As the City of Wichita prepares to grant special tax status to another new industrial building, existing landlords must be wondering why they struggle to stay in business when city hall sets up subsidized competitors with new buildings and a large cost advantage. Click here.

How to turn $399,000 into $65,000 in downtown Wichita

Once embraced by Wichita officials as heroes, real estate listings for two floors of a downtown Wichita office building illustrate the carnage left behind by two developers. Click here.

Kansas sales tax has disproportionate harmful effects

Kansas legislative and executive leaders must realize that a shift to consumption taxes must be accompanied by relief from its disproportionate harm to low-income households. Click here.

July

The candlemakers’ petition

The arguments presented in the following essay by Frederic Bastiat, written in 1845, are still in use in city halls, county courthouses, school district boardrooms, state capitals, and probably most prominently and with the greatest harm, Washington. Click here.

Wichita property taxes still high, but comparatively better

An ongoing study reveals that generally, property taxes on commercial and industrial property in Wichita are high. In particular, taxes on commercial property in Wichita are among the highest in the nation, although Wichita has improved comparatively. Click here.

In Wichita, wasting electricity a chronic problem

The chronic waste of electricity in downtown Wichita is a problem that probably won’t be solved soon, given the city’s attitude. Click here.

Kansas school standards evaluated

A new edition of an ongoing study shows that Kansas school standards are weak, compared to other states. This is a continuation of a trend. Click here.

Wichita schools could increase engagement at no cost

The Wichita public school district could boost its engagement with citizens with a simple step that would add no cost. Click here.

For Sedgwick County Zoo, a moratorium on its commitment

As the Sedgwick County Zoo and its supporters criticize commissioners for failing to honor commitments, the Zoo is enjoying a deferral of loan payments and a break from accumulating interest charges. Click here.

August

Sedgwick County spending beneficiaries overwhelm others

That so many speakers at a public hearing were in favor of government spending is not surprising. Click here.

In Wichita, benefitting from your sales taxes, but not paying their own

A Wichita real estate development benefits from the sales taxes you pay, but doesn’t want to pay themselves. Click here.

Federal rules serve as ‘worms’ buried in promises of ‘free money’

An often unappreciated mechanism throughout the Kansas budget severely limits the ability of legislators and governors to adapt to changing state priorities. A new paper from Kansas Policy Institute explains. Click here.

In Sedgwick County, expectation of government entitlements

In Sedgwick County, we see that once companies are accustomed to government entitlements, any reduction is met with resistance. Click here.

In Wichita, an incomplete economic development analysis

The Wichita City Council will consider an economic development incentive based on an analysis that is nowhere near complete. Click here.

In Sedgwick County, a moral crusade

In Sedgwick County the debate over the budget has the dimension of a moral crusade, except for one thing. Click here.

Cost of restoring quality of life spending cuts in Sedgwick County: 43 deaths

An analysis of public health spending in Sedgwick County illuminates the consequences of public spending decisions. In particular, those calling for more spending on zoos and arts must consider the lives that could be saved by diverting this spending to public health, according to analysis from Kansas Health Institute. Click here.

Wichita Chamber speaks on county spending and taxes

The Wichita Metro Chamber of Commerce urges spending over fiscally sound policies and tax restraint in Sedgwick County. Click here.

Wichita property tax delinquency problem not solved

Despite a government tax giveaway program, problems with delinquent special assessment taxes in Wichita have become worse. Click here.

Kansas school standards found lower than in most states

A second study finds that Kansas uses low standards for evaluating the performance of students in its public schools. Click here.

Wichita Business Journal reporting misses the point

Reporting by the Wichita Business Journal regarding economic development incentives in Wichita makes a big mistake in overlooking where the real money is. Click here.

The Kansas economy and agriculture

There’s no need for Kansas state government to exaggerate the value of agriculture to the Kansas economy. Click here.

Wichita CID illustrates pitfalls of government intervention

A proposed special tax district in Wichita holds the potential to harm consumers, the city’s reputation, and the business prospects of competitors. Besides, we shouldn’t let private parties use a government function for their exclusive benefit. Click here.

September

Another week in Wichita, more CID sprawl

Shoppers in west Wichita should prepare to pay higher taxes, if the city approves a Community Improvement District at Kellogg and West Streets. Click here.

Wichita’s demolition policy

Wichita homeowners must pay for demolition of their deteriorating homes, but the owners of a long-festering and highly visible commercial property get to use tax funds for their demolition expense. Click here.

Sales tax exemptions in Kansas

Can eliminating sales tax exemptions in Kansas generate a pot of gold? Click here.

Kansas Center for Economic Growth and the truth

Why can’t Kansas public school spending advocates — especially a former Kansas state budget director — tell the truth about schools and spending, wonders Dave Trabert of Kansas Policy Institute. Click here.

Criminal justice reform: Why it matters

Mark Holden, Senior Vice President and General Counsel at Koch Industries, Inc., speaks about criminal justice reform initiatives Koch is encouraging in and why they’re important from moral, constitutional and fiscal perspectives. Click here.

Where are our documents?

Government promotes and promises transparency, but finds it difficult to actually provide. Click here.

State taxes and charitable giving

States with higher rates of economic growth grow total charitable giving at a faster rate than states with low rates of economic growth, finds a new report by American Legislative Exchange Council. Click here.

October

Wichita perpetuates wasteful system of grants; feels good about it

While praising the U.S. Economic Development Administration for a grant to Wichita State university, Wichita city planners boost the growth of wasteful government spending. Click here.

Wichita cheers its planned economy

While success in growing a company is welcome in Wichita, there are broader issues that affect the rest of the metropolitan area. Click here.

Despite growth of sharing economy, Wichita relies on centralization

The sharing economy provides for the decentralization and privatization of regulation, but the City of Wichita clings to the old ways. Click here.

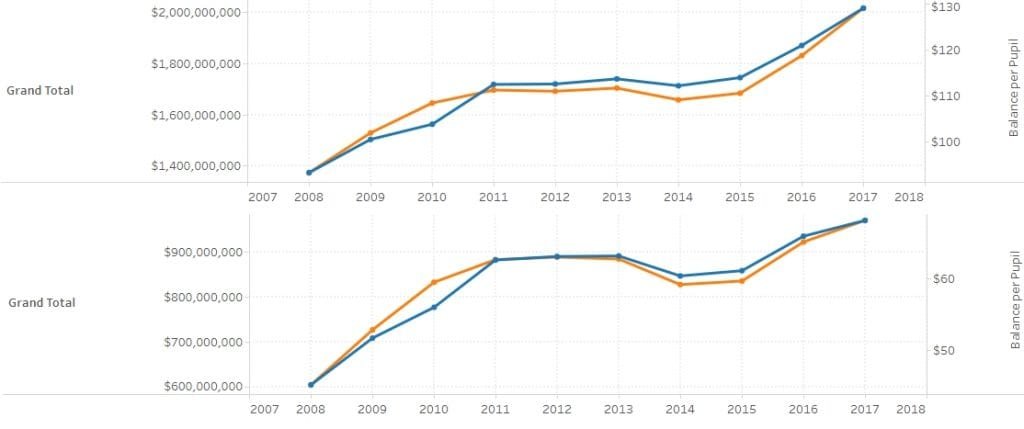

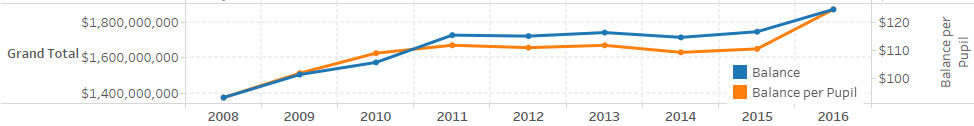

Kansas school fund balances

Kansas school fund balances rose slightly this year, both in absolute dollars and dollars per pupil. Click here.

Merit pay fairness is not about teachers

Opposing teacher merit pay based on fairness issues isn’t being fair to students. Instead, it’s cruel to students. Click here.

Wichita’s growth in gross domestic product

An interactive visualization of gross domestic product for metropolitan areas. Click here.

Wichita Chamber calls for more cronyism

By advocating for revival of the Export-Import Bank of the United States, the Wichita Metro Chamber of Commerce continues its advocacy for more business welfare, more taxes, more wasteful government spending, and more cronyism. Click here.

Kansas school support

An interactive visualization of data provided to members of the Kansas 2015 Special Committee on K-12 Student Success. Click here.

Bombardier can be a learning experience

The unfortunate news of the cancellation of a new aircraft program can be a learning opportunity for Wichita. Click here.

Wichita officials, newspaper, just don’t get it on Ex-Im Bank

Wichita’s establishment prefers cronyism over capitalism. Click here.

November

Kansas NAEP scores for 2015

Reactions to the release of National Assessment of Educational Progress scores for Kansas and the nation. Also, an interactive visualization. Click here.

Wichita Eagle: Reporting, then research

Wichita Eagle reporting on a controversy involving religion might leave discerning readers wondering just what is the correct story. Click here.

Kansas fiscal experiment

Those evaluating the Kansas fiscal “experiment” should consider what is the relevant input variable. Click here.

Campaign contribution changes in Wichita

A change to Wichita city election law is likely to have little practical effect. Click here.

Wichita to consider three tax abatements

When considering whether to grant three property tax abatements, the Wichita city council is unlikely to ask this question: Why can’t these companies expand if they have to pay the same taxes everyone else pays? Click here.

For Wichita’s mayor, too many public hearings

Is the Wichita city council burdened with too many public hearings? Wichita’s mayor seems to think so. Click here.

Historic preservation tax credits, or developer welfare?

A Wichita developer seeks to have taxpayers fund a large portion of his development costs, using a wasteful government program of dubious value. Click here.

Kansas cities force tax breaks on others

When Kansas cities grant economic development incentives, they may also unilaterally take action that affects overlapping jurisdictions such as counties, school districts, and the state itself. The legislature should end this. Click here.

December

Wichita checkbook register

A records request to the City of Wichita results in data as well as insight into the city’s attitude towards empowering citizens with data. Click here.

Kansas school reform

A Wichita economist and attorney offers advice to a committee of the Kansas Legislature on reforming Kansas schools for student achievement. Click here.

Employment by metropolitan area

An interactive visualization of employment in metropolitan areas. Click here.

Survey finds Kansans with little knowledge of school spending

As in years past, a survey finds that when Kansans are asked questions about the level of school spending, few have the correct information. Click here.

A simple step for transparency in Kansas government

There exists a simple and inexpensive way for the Kansas Legislature to make its proceedings more readily available. Click here.

Wichita Pachyderm Club: 2015 speakers and programs

Here is a list of all the Wichita Pachyderm Club programs in 2015. For many of the programs a video or audio presentation is available. Click here.