Leaders in Wichita often liken government decision making to running a business, but there are important differences.

![]() As Wichita considers the future of its economy, a larger role for government is contemplated. The views of the people leading the effort to expand government management of the local economy are important to explore. Consider Greater Wichita Economic Development Coalition Chairman Gary Schmitt, who is also an executive at Intrust Bank. Following is an excerpt from the minutes of the May 22, 2013 meeting of the Board of Sedgwick County Commissioners. The topic was a forgivable loan to Starwood Hotels and Resorts Worldwide Inc. These loans are equivalent to a cash grant, as long as conditions are met. At the time of this meeting Schmitt was vice chair of GWEDC.

As Wichita considers the future of its economy, a larger role for government is contemplated. The views of the people leading the effort to expand government management of the local economy are important to explore. Consider Greater Wichita Economic Development Coalition Chairman Gary Schmitt, who is also an executive at Intrust Bank. Following is an excerpt from the minutes of the May 22, 2013 meeting of the Board of Sedgwick County Commissioners. The topic was a forgivable loan to Starwood Hotels and Resorts Worldwide Inc. These loans are equivalent to a cash grant, as long as conditions are met. At the time of this meeting Schmitt was vice chair of GWEDC.

This discourse shows the value of elected officials like Karl Peterjohn, and also Richard Ranzau, as he too contributed to the understanding of this matter. When Michael O’Donnell served on the Wichita City Council, he also contributed in this way.

Here’s what Schmitt told the commissioners, based on the meeting minutes: “I know at the bank where I work, if we had a $1 invested and get a return of over $2.40, we would consider that a very good investment in the future.”

Shortly after that he said “Very similar what we do at the bank when we negotiate loan amounts or rates. So it is very much a business decision to try to figure out how to bring 900 jobs to our community without overspending or over committing.”

The problem is that when the bank Schmitt works for makes a loan, there are several forces in play that are not present in government. Perhaps the most obvious is that a bank loans money and expects to be repaid. In the case of the forgivable loan the commission was considering, the goal is that the loan is not repaid. These loans, remember, are a grant of cash, subject to a few conditions. If the recipient company is required to repay the loan, it is because it did not meet conditions such as job count or capital investment. In these circumstances, the company is probably not performing well economically, and therefore may not be able to repay the loan.

The problem is that when the bank Schmitt works for makes a loan, there are several forces in play that are not present in government. Perhaps the most obvious is that a bank loans money and expects to be repaid. In the case of the forgivable loan the commission was considering, the goal is that the loan is not repaid. These loans, remember, are a grant of cash, subject to a few conditions. If the recipient company is required to repay the loan, it is because it did not meet conditions such as job count or capital investment. In these circumstances, the company is probably not performing well economically, and therefore may not be able to repay the loan.

Another example of how a bank is different from government is that at a bank, both parties enter the loan transaction voluntarily. The bank’s shareholders and depositors are voluntary participants. Perhaps not explicitly for each loan, but if I do not like the policies or loans my bank has made, I can easily move my shares and deposits to another bank. But for these government loans, I personally have appeared several times before governmental bodies asking that the loan not be made. I did not consent. And changing government is much more difficult than changing banks.

Another difference between Schmitt’s bank and government is that bank’s goal is to earn a profit. Government doesn’t calculate profit. It is not able to, and when it tries, it efforts fall short. For one thing, government conscripts its capital. It faces no market test as to whether it is making good investments. It doesn’t have to compete with other institutions for capital, as a private bank does. Ludwig von Mises taught us that government can’t calculate profit and loss, the essential measure that lets us know if a business is making efficient use of resources. Thomas DiLorenzo elaborated, writing: “There is no such thing as real accounting in government, of course, since there are no profit-and-loss statements, only budgets. Consequently, there is no way of ever knowing, in an accounting sense, whether government is adding value or destroying it.”

An example of this lack of accounting for capital comes from the same governmental body making this forgivable loan. In Intrust Bank Arena depreciation expense is important, even today, I explain that proper attention given to the depreciation expense of Intrust Bank Arena in downtown Wichita would recognize and account for the sacrifices of the people of Sedgwick County and its visitors to pay for the arena. But the county doesn’t do that, at least not in its most visible annual reporting of the arena’s financial results.

Governments locally do have a measure of what they consider to be “profit.” It’s the benefit-cost ratio calculated by the Center for Economic Development and Business Research (CEDBR) at Wichita State University. This is the source of the “$1 invested and get a return of over $2.40” that Schmitt referenced. But the “benefits” that go into this calculation are quite different from the profits that business firms attempt to earn. Most importantly, the benefits that government claims are not really benefits. Instead, they’re in the form of additional tax revenue paid to government. This is very different from the profits companies earn in voluntary market transactions.

Government usually claims that in order to get these “benefits,” the incentives must be paid. But often the new economic activity (expansion, etc.) would have happened anyway without the incentives. There is much evidence that economic development incentives rank low on the list of factors businesses consider when making investments. A related observation is that if the relatively small investment government makes in incentives is solely or even partially responsible for such wonderful outcomes in terms of jobs, why doesn’t government do this more often? If the Sedgwick County Board of Commissioners has such power to create economic growth, why is anyone unemployed?

Those, like Gary Schmitt, who are preparing to lead Wichita’s efforts in stimulating its economy believe that government should take on a larger role. We need to make sure that these leaders understand the fundamental differences between government and business, and how government can — and can’t — help business grow.

Following is an excerpt from the meeting minutes:

Chairman Skelton said, “Okay, thank you. Anybody else who wishes to speak today? Please state your name and address for the record.”

Mr. Gary Schmitt, (address redacted to respect privacy) greeted the Commissioners and said, “I work at Intrust Bank and I am the Vice-Chair of GWEDC. Thank you for the opportunity to speak to you today. I want to thank all of you also for just saving the county $700,000 by refinancing the bond issue. I think that was a great move. I think that’s exactly what we need to do to help support our county.

Mr. Schmitt said, “Also want to say I think Starwood coming to Wichita with 900 jobs in the very near future is a big win for Wichita, for Sedgwick County and our community. And I just want to encourage you to support the $200,000 investment. I know at the bank where I work, if we had a $1 invested and get a return of over $2.40, we would consider that a very good investment in the future. And I think having 900 people employed in basically starter jobs, or jobs to fill the gap in their financial needs for their families is very important also. So thank you very much for the opportunity to speak. I encourage you to support positive vote on this.”

Chairman Skelton said, “Commissioner Peterjohn.”

Commissioner Peterjohn said, “Mr. Schmidt, I thank you for coming down and speaking today and your efforts on behalf of GWEDC. One of the things I struggle with these issues when they come before the Commission is what is the, how do we come up with an optimum number? I mean, why is $200,000 the right figure for the county’s contribution. And also, I mean, other than the fact that the city approved a similar amount yesterday, and when this comes to us and the calculations are coming from a, I think, a basic input and output model that fluctuates, depending on what assumptions you feed into it, I struggle with, you know, how do we determine, when you get a proposal at the bank, somebody comes in and says, hey, I would like to borrow x number of dollars for this project, we expect a net present value or rate of return of so much, and based on a loan cost of a certain interest rate, we get those very specific calculations. Can you provide any insight, in terms of why $200,000 is the optimal number for this forgivable loan over 5 years, and help me out on that point?”

Mr. Schmitt said, “I’ll try. GWEDC basically is a cooperation between businesses, business community leaders and also the city and the county government. We sort of have all the players at the table. And it’s very similar to what we do at the bank, when somebody comes in and asks for a proposal, we have to understand what our capacity is, what our expectations are, and we analyze all that. By using WSU calculate return on investment, that’s similar to what we do at the bank to calculate our return on investment. Now, I’m sure Starwood would be very excited if we said we will give you $2 million instead of $200,000, but we negotiated a number that we thought was acceptable to Starwood and also us.

“Very similar what we do at the bank when we negotiate loan amounts or rates. So it is very much a business decision to try to figure out how to bring 900 jobs to our community without overspending or over committing. So, Mr. Peterjohn, I think we’ve tried to do everything we can to bring the best deal to the community we possibly can.”

Commissioner Peterjohn said, “Well then help me out, in terms of the point that was raised over, we’ve got a forgivable loan for five years, but the calculation, in terms of return and so on are over 10 years. So basically our clawback provisions don’t exist from year 6 through 10.”

Mr. Schmitt said, “Well…”

Commissioner Peterjohn said, “And then you’ve got that disparity.”

Mr. Schmitt said, “You know, the other interesting thing is they have a 15 year lease out there on the building. So our expectation is they will be a minimum of 15 years. So do we do it on 5, 10, or 15 years. So, I understand your question. I don’t know the answer to that.”

Commissioner Peterjohn said, “Okay. Thank you for coming down and providing…” Mr. Schmitt said, “You are welcome. Thank you.”

A letter to NetApp from the Kansas Department of Commerce laid out the potential benefits from the state. As detailed in the letter, the programs with potential dollar amounts are: Promoting Employment Across Kansas (PEAK), up to $7,705,535; Kansas Industrial Training with PEAK, up to $160,800; sales tax savings of $6,880,000; personal property tax exemption, $11,913,682; and High Performance Incentive Program (HPIP), $8,500,000. The total of these is $35,160,017. Some of these benefits are paid over a period of years. The PEAK benefits are payable over seven years, according to the letter, so that’s about $1.1 million per year. These are potential benefits; the company may not actually qualify for and receive this entire amount. But it’s what the state offered.

A letter to NetApp from the Kansas Department of Commerce laid out the potential benefits from the state. As detailed in the letter, the programs with potential dollar amounts are: Promoting Employment Across Kansas (PEAK), up to $7,705,535; Kansas Industrial Training with PEAK, up to $160,800; sales tax savings of $6,880,000; personal property tax exemption, $11,913,682; and High Performance Incentive Program (HPIP), $8,500,000. The total of these is $35,160,017. Some of these benefits are paid over a period of years. The PEAK benefits are payable over seven years, according to the letter, so that’s about $1.1 million per year. These are potential benefits; the company may not actually qualify for and receive this entire amount. But it’s what the state offered. purchasing the Broadview Hotel, the city allowed the hotel to escape paying much of the taxes that the rest of us have to pay. According to city information, Drury planned to spend $22,797,750 on the hotel. If we use this as the appraised value for the property when it is complete, the annual property taxes due for this property would be $22,797,750 times .25 times 126.323 divided by 1000, or $719,970. This calculation may be rough, but it gives us an idea of the annual operating subsidy being given to this hotel for the next ten years. Remember, city officials complain of an incentives budget of only $1.65 million per year.

purchasing the Broadview Hotel, the city allowed the hotel to escape paying much of the taxes that the rest of us have to pay. According to city information, Drury planned to spend $22,797,750 on the hotel. If we use this as the appraised value for the property when it is complete, the annual property taxes due for this property would be $22,797,750 times .25 times 126.323 divided by 1000, or $719,970. This calculation may be rough, but it gives us an idea of the annual operating subsidy being given to this hotel for the next ten years. Remember, city officials complain of an incentives budget of only $1.65 million per year. When Boeing announced in 2012 that it was closing its Wichita operations, city leaders complained that Boeing was leaving Wichita even though it had received many incentives. From 1979 to 2007, Boeing received tax abatements through the industrial revenue bond process worth $658 million, according to a compilation provided by the City of Wichita. At the time, city officials said the average amount of bonds was $120 million per year. With Wichita commercial property tax rates at 3.008 percent ($30.08 per $1,000 of appraised value),

When Boeing announced in 2012 that it was closing its Wichita operations, city leaders complained that Boeing was leaving Wichita even though it had received many incentives. From 1979 to 2007, Boeing received tax abatements through the industrial revenue bond process worth $658 million, according to a compilation provided by the City of Wichita. At the time, city officials said the average amount of bonds was $120 million per year. With Wichita commercial property tax rates at 3.008 percent ($30.08 per $1,000 of appraised value),  Note that the sources of financing for the Exchange Place project includes “Tax Credit Equity.” Here’s an example of another downtown project, the Ambassador Hotel, and the incentive package the city prepared:

Note that the sources of financing for the Exchange Place project includes “Tax Credit Equity.” Here’s an example of another downtown project, the Ambassador Hotel, and the incentive package the city prepared:

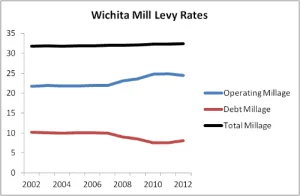

In 2002 the City of Wichita mill levy rate was 31.845. In 2012 it was 32.471, based on the city’s Comprehensive Annual Financial Report. That’s an increase of 0.626 mills, or 1.97 percent. The

In 2002 the City of Wichita mill levy rate was 31.845. In 2012 it was 32.471, based on the city’s Comprehensive Annual Financial Report. That’s an increase of 0.626 mills, or 1.97 percent. The

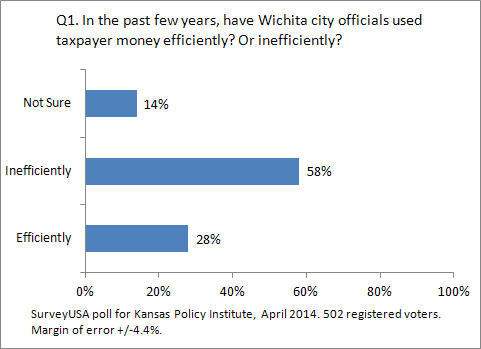

In Wichita, about one-third of voters polled support local governments using taxpayer money to provide subsidies to certain businesses for economic development.

In Wichita, about one-third of voters polled support local governments using taxpayer money to provide subsidies to certain businesses for economic development.

The City of Wichita insists on a certain level of return on investment for its economic development incentives, but doesn’t apply that criteria to overlapping jurisdictions.

The City of Wichita insists on a certain level of return on investment for its economic development incentives, but doesn’t apply that criteria to overlapping jurisdictions.