From January 2012, how tax increment financing routes benefits to politically-connected firms.

It is now confirmed: In Wichita, tax increment financing (TIF) leads to taxpayer-funded waste that benefits those with political connections at city hall.

The latest evidence we have is the construction of a downtown parking garage that benefits Douglas Place, especially the Ambassador Hotel, a renovation of a historic building now underway.

The flow of tax dollars Wichita city leaders had planned for Douglas Place called for taxpayer funds to be routed to a politically-connected construction firm. And unlike the real world, where developers have an incentive to build economically, the city created incentives for Douglas Place developers to spend lavishly in a parking garage, at no cost to themselves. In fact, the wasteful spending would result in profit for them.

The original plan for Douglas Place as specified in a letter of intent that the city council voted to support, called for a parking garage and urban park to cost $6,800,000. Details provided at the August 9th meeting of the Wichita City Council gave the cost for the garage alone as $6,000,000. The garage would be paid for by capital improvement program (CIP) funds and tax increment financing (TIF). The CIP is Wichita’s long-term plan for building public infrastructure. TIF is different, as we’ll see in a moment.

At the August 9th meeting it was also revealed that Key Construction of Wichita would be the contractor for the garage. The city’s plan was that Key Construction would not have to bid for the contract, even though the garage is being paid for with taxpayer funds. Council Member Michael O’Donnell (district 4, south and southwest Wichita) expressed concern about the no-bid contract. As a result, the contract was put out for competitive bid.

Now a winning bid has been determined, according to sources in city hall, and the amount is nearly $1.3 million less than the council was willing to spend on the garage. This is money that otherwise would have gone into the pockets of Key Construction. Because of the way the garage is being paid for, that money would not have been a cost to Douglas Place’s developers. Instead, it would have been a giant ripoff of Wichita taxpayers. This scheme was approved by Mayor Carl Brewer and all city council members except O’Donnell.

Even worse, the Douglas Place developers have no incentive to economize on the cost of the garage. In fact, they have incentives to make it cost even more.

Two paths for developer taxes

Recall that the garage is being paid for through two means. One is CIP, which is a cost to Wichita taxpayers. It doesn’t cost the Douglas Place developers anything except for their small quotal share of Wichita’s overall tax burden. In exchange for that, they get part of a parking garage paid for.

Under TIF, the more the parking garage costs, the more Douglas Place property taxes are funneled back to it — taxes, remember, it has to pay anyway. (Since Douglas Place won’t own the garage, it doesn’t have to pay taxes on the value of the garage, so it’s not concerned about the taxable value of the garage increasing its tax bill.)

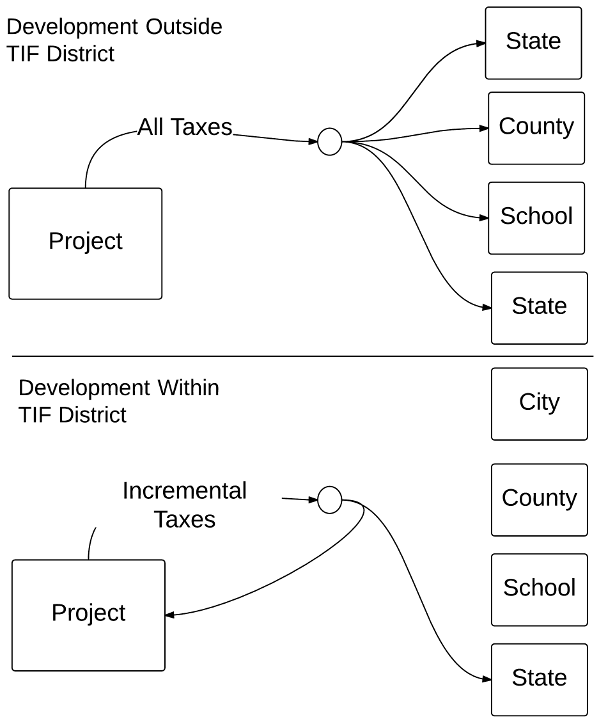

Most people and businesses have their property taxes go towards paying for public services like police protection, firemen, and schools. But TIF allows these property taxes to be used for a developer’s exclusive benefit. That leads to distortions.

Why would Douglas Place be interested in an expensive parking garage? Here are two reasons:

First, the more the garage costs, the more the hotel benefits from a fancier and nicer garage for its guests to park in. Remember, since the garage is paid for by property taxes on the hotel — taxes Douglas Place must pay in any case — there’s an incentive for the hotel to see these taxes used for its own benefit rather than used to pay for firemen, police officers, and schools.

Second, consider Key Construction, the planned builder of the garage under a no-bid contract. The more expensive the garage, the higher the profit for Key.

Now add in the fact that one of the partners in the Douglas Place project is a business entity known as Summit Holdings LLC, which is composed of David Wells, Kenneth Wells, Richard McCafferty, John Walker Jr., and Larry Gourley. All of these people are either owners of Key Construction or its executives. The more the garage costs, the higher the profit for these people. Remember, they’re not paying for the garage. City taxpayers are.

The sum of all this is a mechanism to funnel taxpayer funds, via tax increment financing, to Key Construction. The more the garage costs, the better for Douglas Place and Key Construction — and the worse for Wichita taxpayers.

Fueled by campaign contributions?

It’s no wonder Key Construction principals contributed $16,500 to Wichita Mayor Carl Brewer and five city council members during their most recent campaigns. Council Member Jeff Longwell (district 5, west and northwest Wichita) alone received $4,000 of that sum, and he also accepted another $2,000 from managing member David Burk and his wife.

This scheme — of which few people must be aware as it has not been reported anywhere but here — is a reason why Wichita and Kansas need pay-to-play laws. These laws impose restrictions on the activities of elected officials and the awarding of contracts.

An example is a charter provision of the city of Santa Ana, in Orange County, California, which states: “A councilmember shall not participate in, nor use his or her official position to influence, a decision of the City Council if it is reasonably foreseeable that the decision will have a material financial effect, apart from its effect on the public generally or a significant portion thereof, on a recent major campaign contributor.”

This project also shows why complicated financing schemes like tax increment financing need to be eliminated. Government intervention schemes like this turn the usual economic incentives upside down, and at taxpayer expense.

Leave a Reply