Tag: Wichita Eagle opinion watch

-

Intrust Bank Arena loss for 2019 nears $5 million

A truthful accounting of the finances of Intrust Bank Arena in downtown Wichita shows a large loss.

-

The finances of Intrust Bank Arena in Wichita

A truthful accounting of the finances of Intrust Bank Arena in downtown Wichita shows a large loss. Despite hosting the NCAA basketball tournament, the arena’s “net income” fell.

-

Wichita Eagle calls for a responsible plan for higher taxes

A Wichita Eagle editorial argues for higher property taxes to help the city grow.

-

Wichita Eagle argues for higher taxes

The Wichita Eagle editorial board wants higher taxes. Relying on its data and arguments will lead citizens to misinformed and uninformed opinions.

-

Wichita school spending, according to the Wichita Eagle

A recent editorial by the largest newspaper in Kansas misinforms its readers.

-

What is the real problem at Wichita Southeast?

There is likely a different explanation for problems at a Wichita high schools from what we’ve been told by the school district and our newspaper.

-

Intrust Bank Arena loss for 2017 is $4,222,182

As in years past, a truthful accounting of the finances of Intrust Bank Arena in downtown Wichita shows a large loss.

-

Project Wichita right to look ahead at city’s future

We can understand self-serving politicians and bureaucrats. It’s what they do. But a city’s newspaper editorial board ought to be concerned with the truth.

-

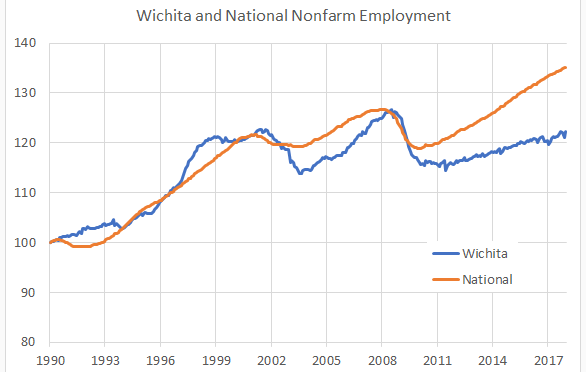

Mayor Longwell’s pep talk

A column written by Wichita Mayor Jeff Longwell ignores the reality of Wichita’s economy.

-

Wichita, youthful and growing from the core

A letter writer tells Wichitans that “We have an opportunity to show the country the future of Wichita is youthful and bright, and its growing from the core out.”

-

Intrust Bank Arena loss for 2016 is $4,293,901

As in years past, a truthful accounting of the finances of Intrust Bank Arena in downtown Wichita shows a large loss.

-

Fake government spawns fake news

Discussions of public policy need to start from a common base of facts and information. An episode shows that both our state government and news media are not helping