Tag: Tax increment financing

-

Economic development in Wichita: Looking beyond the immediate

Decisions on economic development initiatives in Wichita are made based on “stage one” thinking, failing to look beyond what is immediate and obvious.

-

Wichita economic development items

The Wichita city council has been busy with economic development items, and more are upcoming.

-

City of Wichita State Legislative Agenda: Economic Development

The City of Wichita wishes to preserve the many economic development incentives it has at its disposal.

-

Kansas cities should not unilaterally grant tax breaks

When Kansas cities grant economic development incentives, they may also unilaterally take action that affects overlapping jurisdictions such as counties, school districts, and the state itself. The legislature should end this.

-

Tax not me, but food for the poor

This is Union Station in downtown Wichita. Its owner has secured a deal whereby future property taxes will be diverted to him rather than funding the costs of government like fixing streets, running the buses, and paying schoolteachers. This project may also receive a sales tax exemption. But as you can see, the owner wants…

-

Old Town Cinema TIF update

The City of Wichita Department of Fiance has prepared an update on the financial performance of the Old Town Cinema Tax Increment Financing (TIF) District. There’s not much good news in this document.

-

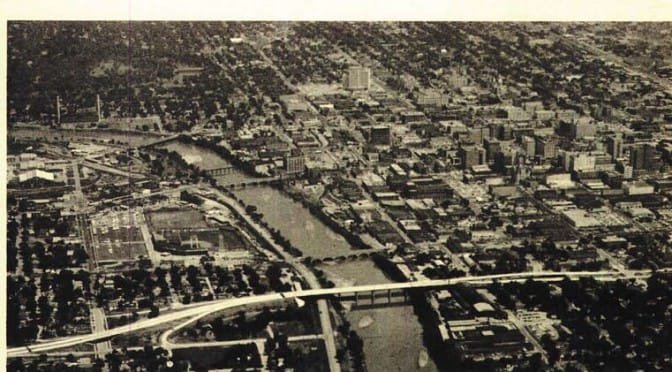

Union Station development drains taxes from important needs

The diversion of future property tax revenues away from local governmental treasuries should concern every taxpaying citizen when one considers the many needs for these funds, says John Todd.

-

Errors in Wichita Union Station development proposal

Documents the Wichita City Council will use to evaluate a development proposal contain material errors. Despite the city being aware of the errors for more than one month, they have not been corrected.

-

Union Station TIF provides lessons for Wichita voters

A proposed downtown Wichita development deserves more scrutiny than it has received, as it provides a window into the city’s economic development practice that voters should peek through as they consider voting for the Wichita sales tax.

-

What incentives can Wichita offer?

Wichita government leaders complain that Wichita can’t compete in economic development with other cities and states because the budget for incentives is too small. But when making this argument, these officials don’t include all incentives that are available.

-

Kansas budgeting “off the tops” is bad policy

Direct transfers of taxpayer money sent to a specific business or industry is always a tough sell to politicians, let alone the voting public. But, that is why some corporations pay lots of money to lobbyists, writes Steve Anderson for Kansas Policy Institute.

-

Sedgwick County elections: Commissioners

In Sedgwick County, two fiscally conservative commission candidates prevailed.