An op-ed in the Wichita Eagle regarding school choice prompts uninformed and misinformed comments.

An op-ed written by James Franko appearing in the Wichita Eagle explains the importance of the Kansas Tax Credit for Low Income Students Scholarship Program. This is a program that awards scholarships to students to attend schools of choice. It is a small program. For the school year ending in 2018, 292 students received scholarships totaling $675,892.63. This represents one of every 9,606 dollars spent on Kansas schools. For each group of 1,632 Kansas students, one received a tax credit scholarship. Yet, this program is seen as a threat to existing public schools.

Following is Franko’s editorial, followed by some comments left by Wichita Eagle readers.

Tax credit programs give parents power over their children’s education

James Franko

December 22, 2018

James Franko is vice president and policy director at Kansas Policy Institute.

Education in Kansas has evolved dramatically since settlers plowed out a life on the Plains. The one-room schoolhouse is gone and the local community coming together to hire a young woman to teach are left to the Little House stories that I read with my kids. Education is now a political debate where decisions are increasingly made far away from families, teachers and local communities.

While certainly well-intended, people in Topeka and Washington, D.C., are making decisions, demanding paperwork and setting standards that remove parents and teachers from the driver’s seat. Our teachers and other educators deserve our admiration. But we’ve all heard a teacher lament “teaching to the test” or that money that doesn’t seem to reach the classroom.

A recent column about school choice (“How school choice works in Kansas,” Nov. 29 Eagle) seems to confuse what public education is intended to be with what it currently is. Schools — public, private, and home — are tremendous parts of our community. They make our society vibrant as a by-product of preparing children to succeed.

Dr. Sharon Iorio’s concern about expanded tax credit programs undermining public education gets it backward. The free association of people choosing a private school is equally important to “the bond that holds together our society…” as is a choice to send a child to a public school. The point is that tax credit programs, which are different from vouchers, put parents back in the primary role of educating their children. Kansas’ tax credit scholarships help low-income students attending the lowest-performing schools in our state. It is almost paradoxical, but there is evidence from around the country that achievement increases in public schools when school choice is an option.

America and Kansas have always been a patchwork of communities and cultures. This is what makes a road trip so great. We get to experience the different flavors of American life, many of them from our immigrant history. Expanding private school choice enhances and protects this diversity by allowing parents to decide where their children are educated. Local educators and parents will decide what education looks like in a community. This is in contrast to a one-size-fits-all approach taken when standards are dictated, tests are mandated and policies are implemented from afar.

One approach captures the diversity of our communities and helps improve achievement for all students. The other homogenizes a rich community life and too often leaves student achievement stagnant.

—

Following, some comments from Eagle readers. These comments show how much there is to learn about the actual Tax Credit for Low Income Students Scholarship Program.

Who qualifies for scholarships?

What people think: “The Kochs, err, KPI, wants private vouchers because it gives money to the wealthy to help pay for their expensive private schools.”

“The tax credit idea mostly benefits religious schools.”

“It’s a regressive tax meant for the 1%.”

First, the guidelines from KSDE state: “An educational scholarship shall not exceed $8,000 per eligible student.” Expensive private schools cost more than this, but there are many private schools that do not. Also, $8,000 is less than the state spends on each student.

Further, the scholarship program is limited to students who are “eligible for free lunch and attends a Title I Focus School or Title I Priority School.” This means a student from a low-income family.

Still further, students over the age of six must have attended a public school in the year prior to receiving a scholarship. Students currently enrolled in private schools of any type, including church schools, are not eligible for a scholarship.

Parents already have choice

What people think: “You have always had, in fact anyone, freedom to choose where to send their child to school. Be it private or public.”

This is cruel. The people who need school choice the most — poor children in inner-city schools — simply can’t afford tuition at even the most inexpensive private schools. Thinking like this ensures a permanent underclass cut off from private schools or even good public schools.

Who gets the tax credits?

What people think: “Tax credit is only if you make enough to apply for it and I have yet to see any of these minoritys and poor demanding school choice.”

“When one can get 100% of their tax credit refunded and another family only gets a portion of their tuition refunded due to a low tax rate your playing a KPI pretend game without the facts.”

These writers believe that the parents of scholarship students receive tax credits. Anyone who contributes to a scholarship-granting organization may receive a tax credit. Since scholarships are limited to students from low-income families, it’s not likely these families are able to make a contribution and receive a tax credit. Also, the writer who mentioned tax rates is confusing tax deductions with tax credits.

Education only for those who can afford one

What people think: “Right now people have the ability to get a free education. Under the Koch’s dream land, education would be reserved for those who could afford it.”

Somehow, there are people who think that the goal of companies like Koch Industries and others is to have a poorly-educated population. But companies spend much time and effort recruiting educated and qualified employees to work in scientific laboratories, deal with complicated financial and accounting matters, drive innovation through information technology and other means, deliver health care, and perform numerous other tasks that benefit from a competent education.

Then, don’t these companies want customers to buy their stuff? People with better educations earn more, buy more, and invest more. Companies want more of these people, not fewer.

Without taxes and public schools, there will be no learning

What people think: You don’t like paying taxes? You don’t like living where people can read and write? Go live in the woods.”

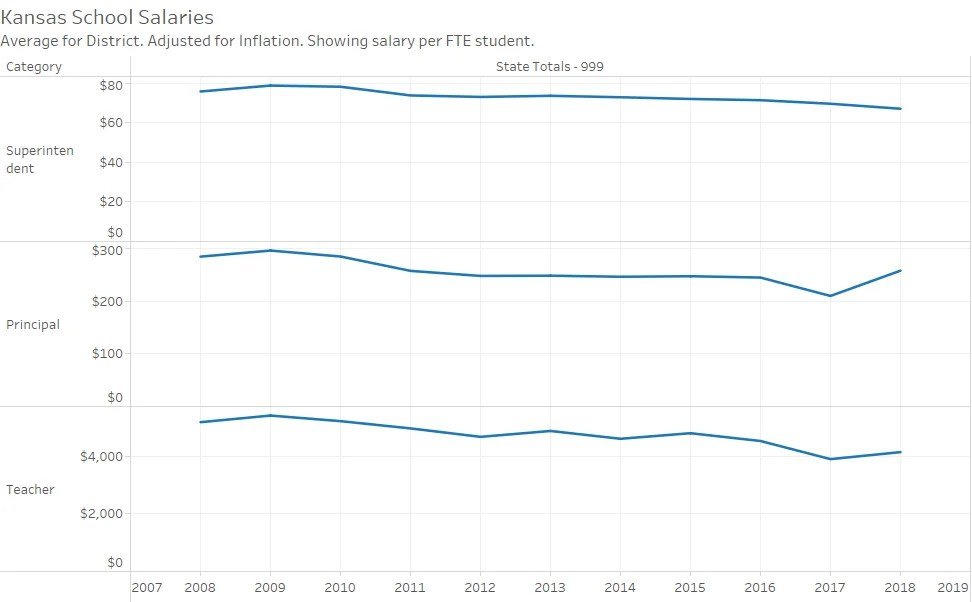

In both the Wichita Public School System and the State of Kansas, the proportion of students testing at Level 1 rose. That’s bad. The proportion of students testing at Level 3 or better declined. That’s bad, too.

The writer seems to think that public schools are teaching students to read and write. Despite a large influx of spending this year, test scores have fallen. A population of people can’t read and write is becoming larger.

Kansas and Wichita school performance reports. Click for larger.

—

Notes