Yesterday’s meeting of the Wichita City Council revealed a council — except for one member — totally captured by special interests, to the point where the council, aided by city staff, used a narrow legal interpretation in order to circumvent a statutorily required public hearing process.

The issue was a downtown hotel to be developed by a team lead by David Burk of Marketplace Properties. The subsidies Burk wants, specifically tax increment financing (TIF), require a public hearing to be held. The city scheduled the hearing for September 13th.

That schedule, however, didn’t suit Burk. In order to provide him a certain comfort level, the council agreed to issue a letter of intent stating that the council intends to do the things that the public hearing is supposed to provide an opportunity for deliberation.

I, along with others, contend that this action reduces the September 13th public hearing to a meaningless exercise. This action is not good government, and it’s not open and transparent government, despite the claims of Mayor Carl Brewer. It goes against our country’s principle of the rule of law, part of which holds that our laws are more important than any single person.

Several times council members — and once city attorney Gary Rebenstorf — explained that the letter of intent is non-binding on either party. But: No matter what information is presented at the September public hearing, no matter how strong public opinion might be against the incentives involved, is there any real likelihood that the council would not proceed with this plan and its incentives, having already passed a letter of intent to do so? I think there is very little possibility of that.

Persuasive arguments will be made that since the city issued a letter of intent, and since the developers may have already taken action based on that letter, it follows that the city is obligated to pass the plan. Otherwise, who would ever vest any meaning in a future letter of intent from this city?

During the discussion, no one was able to explain adequately why a letter of intent — if it is non-binding and therefore does not commit the city — was asked for by the developers. Despite the lawyerly explanation of Rebenstorf and council members — including the mayor — the letter does have meaning. Practically, it has such a powerful meaning that it makes the holding of the public hearing on September 13th a mere charade, a meaningless exercise in futility.

It’s not just me and a handful of others who contend this. The Wichita Eagle’s Rhonda Holman, who is usually in favor of all forms of public spending on downtown, wrote: “Even though the letter of intent will be nonbinding, it risks making the Sept. 13 public hearing on tax-increment financing seem like a pointless afterthought.”

In his remarks, City Manager Bob Layton explained that the meeting was the first time for council members to “formally vet this project and all of the incentives.”

He added: “If the council were to say, for instance, there were two or three pieces of that that you had discomfort with, that would then put everyone on notice that the deal may not go forward.” He said this is the purpose of today’s action, and he added that the action is non-binding.

I would suggest that since the council, with the exception of Council Member Michael O’Donnell (district 4, south and southwest Wichita), found no problems with issuing the letter of intent, it has no problems with the deal, and this is what makes the September public hearing, as Holman said, a “pointless afterthought.”

Astonishingly, the manger said while this is “not intended to be the normal process,” he said that he “kind of like it” as it gave an initial opportunity to gauge the sentiment of council members.

I’m glad the manager didn’t mention the sentiment of the public, as with little notice as to the content of the deal and its incentives, citizens had no meaningful opportunity to prepare.

An example of the contorted logic council members use to justify their action: Council Member Jeff Longwell (district 5, west and northwest Wichita) explained that issuing letters of intent is a common practice in real estate deals. He confused, however, agreements made between private parties and those where government is a party. Private parties can voluntarily enter into whatever agreements they want. But agreements with government are governed by laws. Yesterday, the city council announced its intent to do something for which it is required to hold a public hearing. That didn’t violate the letter of the law, but it certainly goes against its spirit and meaning. Longwell said he has no problem with that.

Their bureaucratic enablers helped out, too. Wichita Downtown Development Corporation President Jeff Fluhr, in his testimony, said we are working towards becoming a “city of distinction.” That we are, indeed — a city distinguished by lack of respect for the rule of law and its disregard for citizens in favor of special interests.

A few observations from the meeting follow.

Public investment

In response to a question from the mayor, Allen Bell, Wichita’s Director of Urban Development, said that the ratio of private dollars to public dollars for this project is about 2.2 to 1. Whether these numbers are correct is doubtful. It will take an analysis of the deal to determine the true numbers, and the details have been available for only a short time. But if correct, this ratio falls well short of the stated goals. Two years ago, when agitation for a new round of downtown planing started, boosters spoke of a ratio of 15 to 1. Eventually planners promised a ratio of 5 to 1 private to public investment for downtown. This project, while of course is just a single project and not the entirety of downtown development, doesn’t reach half that goal.

Order of events and media coverage

During the meeting, Council Member Pete Meitzner (district 2, east Wichita) conceded that “the order of events is confusing.”

Before that, Council Member Janet Miller (district 6, north central Wichita) claimed that there had been much media coverage of the proposed hotel, and that the public was actually getting two opportunities to talk about this project. She said that the media had published information about today’s meeting and the public hearing on September 13th.

Miller is gravely mistaken. Until a Wichita Eagle article on Saturday, I saw no mention of the letter of intent, and no detail of the form of subsidies to be considered for this project. The city’s list of legal notices contains no mention of the action that was taken at this meeting.

Questions not answered

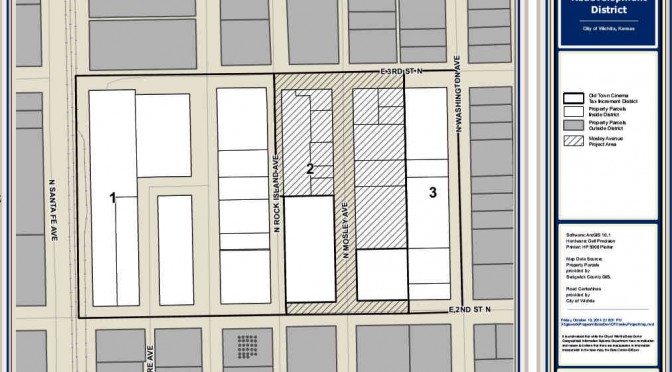

During my remarks to the council, I related how last year the Wichita Eagle alleged that David Burk, the managing member of this project — and I quote here: “Downtown Wichita’s leading developer, David Burk, represented himself as an agent of the city — without the city’s knowledge or consent — to cut his taxes on publicly owned property he leases in the Old Town Cinema Plaza, according to court records and the city attorney.”

This Eagle article and a companion article went on to quote these people as having trouble with and being concerned, to varying degrees, with Burk’s acts: City Attorney Gary Rebenstorf; City Council member Jeff Longwell; City Council Member Lavonta Williams, now serving as vice mayor; then-Vice Mayor Jim Skelton, now on the Sedgwick County Commission; and City Manager Robert Layton.

In particular, the manager said, according to the Eagle, that anyone has the right to appeal their taxes, but he added that ‘no doubt that defeats the purpose of the TIF.’”

The manager’s quote is most directly damaging. Despite the fact that nearly all the property taxes Burk pays directly enriches himself and only him, he still doesn’t want to pay them. And according to the Wichita Eagle — not me — he engaged in deception in order to reduce them.

None of the four people in the council chambers — Rebenstorf, Longwell, Williams, and Layton — explained their apparent change of mind with regard to Burk’s acts.

Burk, who addressed the council immediately after I asked if he cared to explain his actions, decided to avoid the issue. In his shoes, I probably would have done the same, as there is no justification for the acts the Eagle accused him of doing. He, and his political and bureaucratic enablers in Wichita city hall, have to hope this issue fades.

Campaign contributions

Council member O’Donnell asked about a parking garage to be built at a cost of $6 million to the city: Will the city be putting this project out to competitive bid? Bell replied no, that is the developer’s request. City attorney Rebenstorf added that there is a charter ordinance that exempts these types of projects from bidding requirements.

O’Donnell said that awarding the construction contract to a company that has made campaign contributions to all council members (except him) “seems a little questionable.”

The company in question is Key Construction. Its principals regularly appear on campaign finance reports, making the maximum allowed contribution to a wide variety of candidates. Similarly, Burke and his wife also frequently make the maximum contribution to city hall candidates.

O’Donnell is correct to publicize these contributions. They emit a foul odor. In our political system, many people make contributions to candidates whose ideology they agree with, be it conservative, liberal, or something else.

But Burk and others routinely make the maximum contribution to all — or nearly all — candidates, even those with widely varying political stances. How can someone explain Burk’s (and his wife’s) contributions to liberals like Miller and Williams, and also to conservatives like Longwell, Meitzner, and former council member Sue Schlapp?

The answer is that Schlapp and Longwell, despite their proclamations of fiscal conservatism, have shown themselves to be willing to vote for any form of developer welfare Burk and others have asked for. They create tangled webs of tortured logic to explain their votes. Meitzner, along with his fellow new council member James Clendenin (district 3, south and southeast Wichita), seems to be following the same path.

Several council members and the mayor took exception to O’Donnell’s raising of this matter. Clendenin, for his part, objected and said that the public has had over 30 days to consider and take exception with this project. This contention, like Miller’s, isn’t supported by any facts that I am aware of. It appears that the first mention of any of the details of the plan and the subsidies is contained in a MAPC agenda that appears to have been created on July 29. Besides not being 30 days in advance, the MAPC agenda is an obscure place to release what Clendenin believes is adequate public notice.

Regarding the issue of campaign contributions, the mayor — without mentioning his name — strongly criticized O’Donnell for bringing up this matter. Many people watching this meeting felt that the extreme reaction of Brewer and others to O’Donnell’s observation reveals a certain uneasiness regarding these contributions. I don’t believe the mayor and council members are taking illegal bribes, although when any city is enriching people with millions of dollars of developer welfare there is always that threat, and in some cities and states such practices are commonplace.

The fact remains, however, that there is a small group of campaign contributors who — over and over — ask for and receive largess from city hall.

The mayor’s criticisms

In his comments, Mayor Brewer accused opponents of providing only partial facts about matters, because the full facts did not support their case. He was referring to my remarks that a lawsuit brought against the city by a party who felt the city had reneged on a letter of intent was litigated all the way to the Kansas Supreme Court. In my remarks I didn’t mention who won that case — the city did — and the mayor believes this is an example of slanting the facts.

The mayor went on to make accusations of “grandstanding” from some of the public and “some council members” because there are cameras in the council chambers. He mentioned that news media are present at every meeting and that council meetings are broadcast on television.

The mayor should take notice, however, that most people who care about public affairs and policy are severely disappointed with news media coverage of city hall events. The resources of news gathering agencies, especially newspapers, are severely depleted as compared to the past. In my coverage of a talk given by former Wichita Eagle editor Davis Merritt, I wrote this: “A question that I asked is whether the declining resources of the Wichita Eagle might create the danger that local government officials feel they can act under less scrutiny, or is this already happening? Merritt replied that this has been going on for some time. ‘The watchdog job of journalism is incredibly important and is terribly threatened.’ When all resources go to cover what must be covered — police, accidents, etc. — there isn’t anything left over to cover what should be covered. There are many important stories that aren’t being covered because the ‘boots aren’t on the street anymore,’ he said.” See Former Wichita Eagle editor addresses journalism, democracy, May 11, 2009.

In addition, Bill Wilson, the reporter the Wichita Eagle sent to cover the meeting, has a documented bias against the concept of free markets, and against those who believe in them.

The mayor, when delivering his criticism, does not use the names of those he criticizes. It would be useful if he did, but it would mean he has to take greater accountability for his remarks.

Following are links to excerpts of testimony from the meeting — perhaps examples of the “grandstanding” the mayor complained about: John Todd, Shirley Koehn, and Bob Weeks.