Wichita leaders are proud of our region’s economic growth. Here are the numbers.

Greater Wichita Partnership is our region’s primary agency responsible for economic development. On its website, it tells us, “We are an organization built upon teamwork and the idea that, when everyone is advancing in the same direction, we can create a powerful force to effect change — and, thanks to our numerous investors and partners, we are.” One of the things GWP says we are doing is “Growing primary jobs.” 1

Recently Greater Wichita Partnership president Jeff Fluhr told a group of young people this:

From the innovation campus at Wichita State University and development along the Arkansas River in downtown, including a new baseball stadium, to the conversations happening now about a new convention center and performing arts facility, Fluhr said the momentum is pushing to keep Wichita on par with the development of other communities around the country.

That development, which has in recent years expanded to incorporate the entire region, is a critical component to attracting and retaining talent — the exact kind of talent in the ICT Millennial Summit crowd. 2

In January Wichita Mayor Jeff Longwell said, “It’s hard to find a time when we’ve had more momentum.” 3

In announcing his candidacy for Sedgwick County Commission, Wichita city council member Wichita City Council Member Pete Meitzner (district 2, east Wichita) said, “We have enjoyed great progress and growth during my two terms as a City Council member and I plan to do my part to assure Sedgwick County is part of this continued success.” 4

Given all this, it ought to be easy to find economic data supporting momentum, progress, and growth. Let’s look at some indicators.

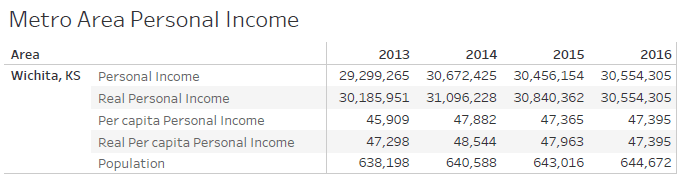

Personal income. For the Wichita metropolitan statistical area, personal income in 2016 rose slightly from the 2015 level, but is still below the 2014 level. In real (inflation-adjusted) dollars, personal income fell in 2016. 5

Population. In 1990 Wichita was the 80th largest metropolitan area. In 2016 its ranking had fallen to 87.

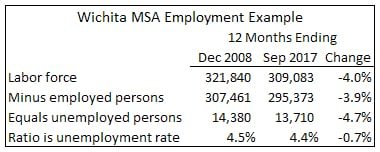

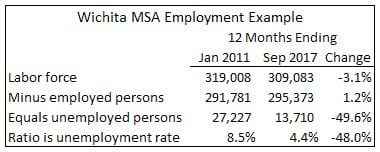

Employment. While officials promote the low Wichita-area unemployment rate, there is an alternative interpretation: The September 2017 unemployment rate declined to just about half the January 2011 rate. The number of employed persons rose by 1.2 percent, but the labor force fell by 3.1 percent. If we consider only the unemployment rate, it looks like the Wichita area is prospering. But the unemployment rate hides bad news: The number of jobs increased only slightly, and the labor force fell by a lot. While it’s good that there are more people working, the decline in the labor force is a problem. (More about employment below.) 7

Growth in output. The worst news, however, is that the Wichita-area economy shrank from 2015 to 2016. In real (inflation-adjusted) dollars, the Wichita metropolitan area gross domestic product fell by 1.4 percent. For all metropolitan areas, GDP grew by 1.7 percent. Since 2001, GDP for all metropolitan areas grew by 29.3 percent, while Wichita had 12.3 percent growth. 8

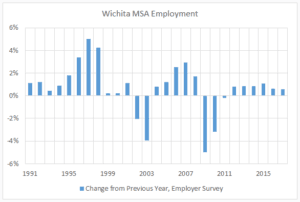

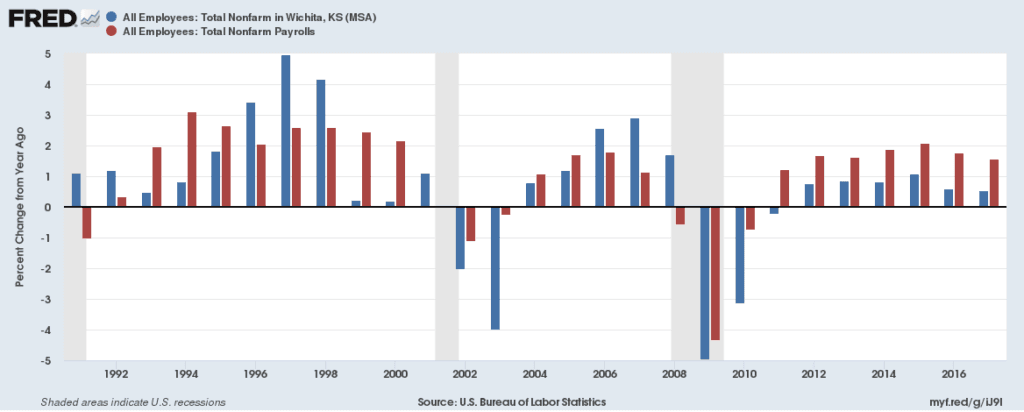

While GDP figures aren’t available, jobs numbers are. For the year 2016, total nonfarm employment in the Wichita metropolitan area grew by 0.62 percent. For 2017, the growth rate was 0.56 percent — a slowdown in the rate of job growth.

These job growth figures are far below the rate for the nation, which were 1.79 and 1.58 percent respectively.

Furthermore, Wichita’s job growth rate in 2016 was lower than 2015’s rate of 1.07 percent. This is momentum in the wrong direction. Nearby charts illustrate. 9

What to do?

You can’t change what you don’t acknowledge.

— Phillip C. McGraw

The failure of the Wichita-area economy to thrive is a tragedy. This is compounded by Wichita leaders failing — at least publicly — to acknowledge this. While we expect people like the mayor, council members, and the chamber of commerce to be cheerleaders for our city, we must wonder: Do these people know the economic statistics, or do they choose to ignore or disbelieve them?

From private conversations with some of these leaders and others, I think it’s a mix of both. Some are simply uninformed, while others are deliberately distorting the truth about the Wichita economy for political or personal gain. The people who are uninformed or misinformed can be educated, but the liars are beyond rehabilitation and should be replaced.

—

Notes

- Greater Wichita Partnership. Available at http://www.greaterwichitapartnership.org/about_us/about_us. ↩

- Daniel McCoy. ICT Millennial Summit: Wichita is having a moment. Wichita Business Journal, November 30, 3017. Available at https://www.bizjournals.com/wichita/news/2017/11/30/ict-millennial-summit-wichita-is-having-a-moment.html. ↩

- Heck, Josh. Emerging Leaders panel offers insight into eco-devo strategies. Available at https://www.bizjournals.com/wichita/news/2018/01/11/emerging-leaders-panel-offers-insight-into-eco.html. ↩

- Bill Wilson. Wichita council member unveils bid for county commission. Wichita Business Journal, November 30, 3017. Available at https://www.bizjournals.com/wichita/news/2018/02/13/wichita-council-member-unveils-bid-for-county.html. ↩

- Weeks, Bob. Wichita personal income up, a little. Available at https://wichitaliberty.org/wichita-government/wichita-personal-income-up-2016/. ↩

- Weeks, Bob. Downtown Wichita business trends. Available at https://wichitaliberty.org/wichita-government/downtown-wichita-business-trends/. ↩

- Weeks, Bob. Wichita employment up. Available at https://wichitaliberty.org/wichita-government/wichita-employment-up/. ↩

- Weeks, Bob. Wichita economy shrinks. Available at https://wichitaliberty.org/economics/wichita-economy-shrinks/. ↩

- In some presentations these figures may differ slightly due to data revisions and methods of aggregation. These differences are small and not material. ↩