Tag: Wichita city council

-

Large County Employment, Second Quarter 2023

Employment in large counties, including Sedgwick County and others of interest.

-

Wichita Mayoral Debate, October 11, 2023

This is a transcript of a debate between Wichita mayoral candidates Brandon Whipple and Lily Wu on October 11, 2023 .

-

Wichita Mayoral Debate, September 25, 2023

This is a transcript of a debate between Wichita mayoral candidates Brandon Whipple and Lily Wu.

-

Wichita Mayoral Forum

An AI-generated transcript for an event for candidates for Wichita mayor held on July 20, 2023.

-

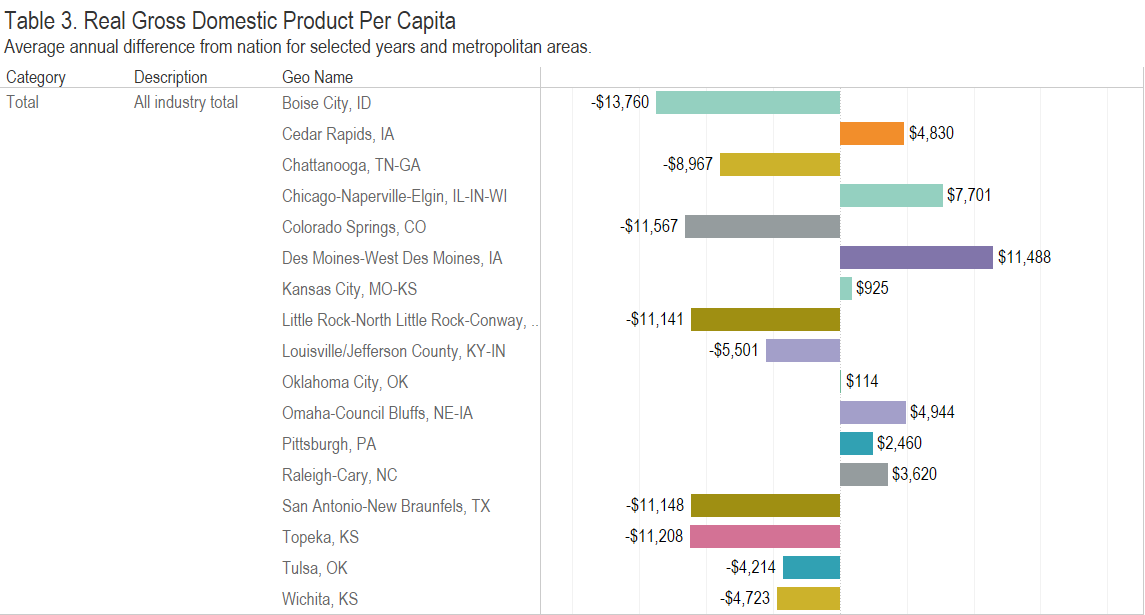

Gross Domestic Product in Metropolitan Areas

Examining the economy of metropolitan areas in an interactive visualization. Wichita examples included.

-

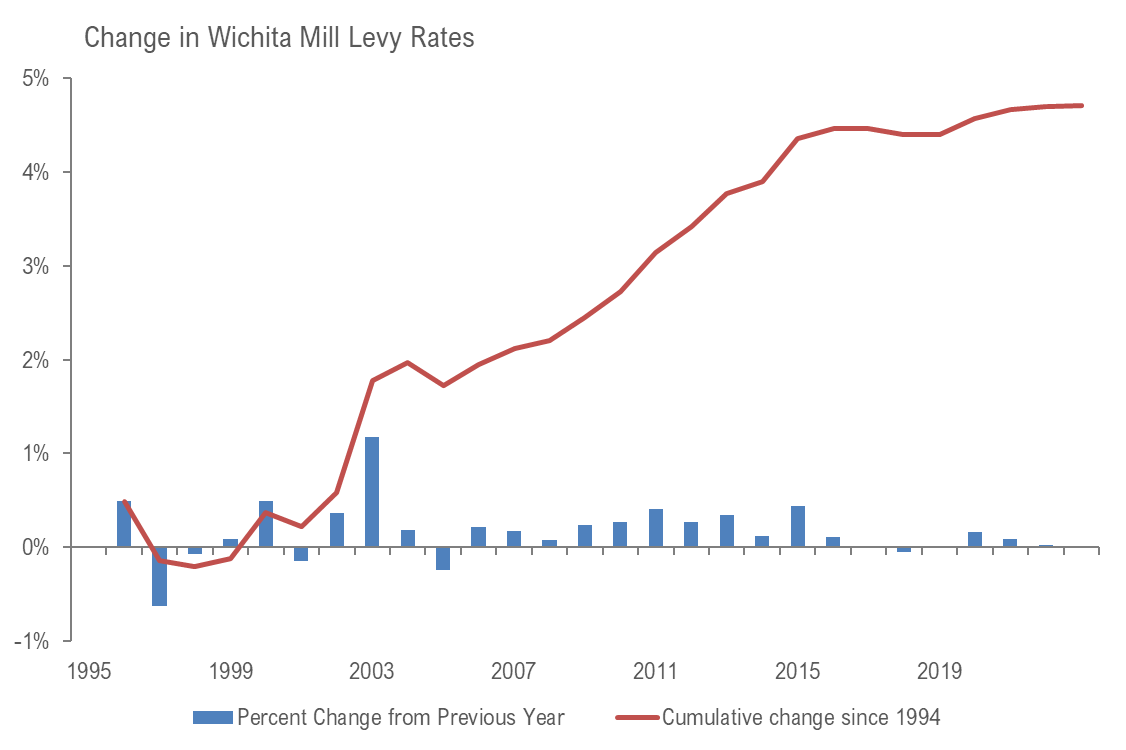

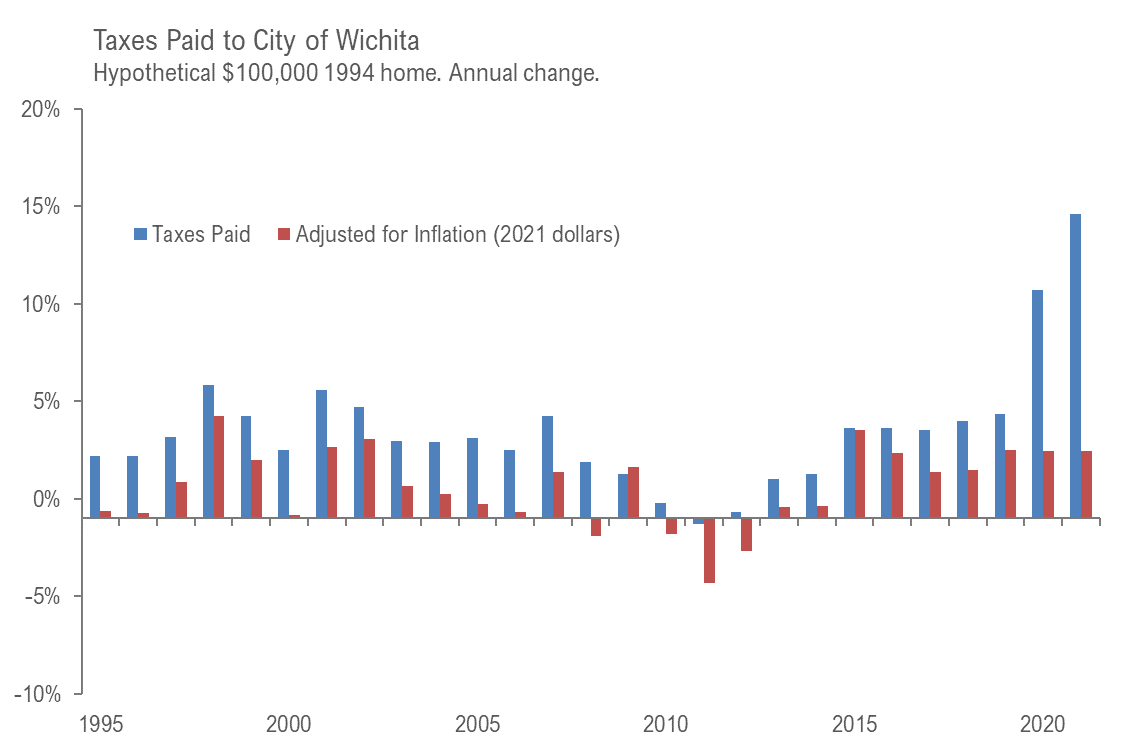

Wichita property tax rate: Up, just a little

The City of Wichita property tax mill levy rose very slightly for 2022.

-

Century II Roof Needs Repair

Wichita has delayed maintaining Century II’s roof, and it needs repair.

-

Wichita property tax rate: Up, just a little

The City of Wichita property tax mill levy rose slightly for 2021.

-

Claycomb connection to real estate developer criticized

A Wichita developer makes generous campaign contributions to a city council candidate, raising questions about both parties.