We should be wary of government planning in general. But when those who have been managing and planning the foundering Wichita-area economy want to step up their management of resources, we risk compounding our problems.

As announced by the City of Wichita, “In response to recent recommendations from Project Wichita and the Century II Citizens Advisory Committee, community organizations and their leadership are stepping forward to take the next step to create a comprehensive master plan and vision that connects projects and both banks of the Arkansas River.”

The city says these organizations will be involved:

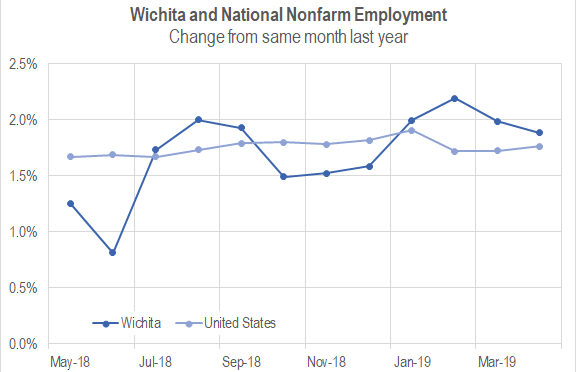

We should note that these organizations have been responsible for developing the Wichita-area economy for many years. Despite recent developments like Cargill and Spirit Aerosystems, the Wichita economy has performed below the nation. While improving, our economic growth is perhaps half the national rate, and just two years ago Wichita lost jobs and population, and economic output fell.

Thus, the question is this: Why these organizations?

Then, recent behavior by the city, specifically surrounding the new ballpark, has resulted in a loss of credibility. Few seem happy with the city’s conduct. To this day, we still do not know the identities of the partners except for one.

In the future, can we trust the city and its partners are telling us the truth, and the whole truth?

Then, there are the problems with government planning. Randal O’Toole is an expert on the problems with government planning. His book The Best-Laid Plans: How Government Planning Harms Your Quality of Life, Your Pocketbook, and Your Future

Planning seems like a good thing. But O’Toole tells us the problem with government plans: “Everybody plans. But private plans are flexible, and we happily change them when new information arises. In contrast, special interest groups ensure that the government plans benefiting them do not change — no matter how costly.”

He continues: “Like any other organization, government agencies need to plan their budgets and short-term projects. But they fail when they write comprehensive plans (which try to account for all side effects), long-range plans (two to 50 years or more), or plans that attempt to control other people’s land and resources. Many plans try to do all three.”

Other problems with government planning as identified by O’Toole (and many others):

- Planners have no better insight into the future than anyone else

- Planners will not pay the costs they impose on other people

- Unlike planners, markets can cope with complexity

Some will argue that the organizations listed above are not government entities and shouldn’t exhibit the problems inherent with government planning. But their plans will undoubtedly need to be approved by, and enforced by, government.

Further, some of these organizations are funded substantially or nearly entirely by government, are in favor of more government (such as higher taxation and regulation), and campaign vigorously for candidates who support more taxes and planning.

Following, from Randal O’Toole as published in 2007.

Government Plans Don’t Work

By Randal O’Toole

Unlike planners, markets can cope with complexity and change.

After more than 30 years of reviewing government plans, including forest plans, park plans, watershed plans, wildlife plans, energy plans, urban plans, and transportation plans, I’ve concluded that government planning almost always does more harm than good.

Most government plans are so full of fabrications and unsupportable assumptions that they aren’t worth the paper they are printed on, much less the millions of dollars taxpayers spend to have them written. Federal, state, and local governments should repeal planning laws and shut down planning offices.

Everybody plans. But private plans are flexible, and we happily change them when new information arises. In contrast, special interest groups ensure that the government plans benefiting them do not change — no matter how costly.

Like any other organization, government agencies need to plan their budgets and short-term projects. But they fail when they write comprehensive plans (which try to account for all side effects), long-range plans (two to 50 years or more), or plans that attempt to control other people’s land and resources. Many plans try to do all three.

Comprehensive plans fail because forests, watersheds, and cities are simply too complicated for anyone to understand. Chaos science reveals that very tiny differences in initial conditions can lead to huge differences in outcomes — that’s why megaprojects such as Boston’s Big Dig go so far over budget.

Long-range plans fail because planners have no better insight into the future than anyone else, so their plans will be as wrong as their predictions are.

Planning of other people’s land and resources fails because planners will not pay the costs they impose on other people, so they have no incentive to find the best answers.

Most of the nation’s 32,000 professional planners graduated from schools that are closely affiliated with colleges of architecture, giving them an undue faith in design. This means many plans put enormous efforts into trying to control urban design while they neglect other tools that could solve social problems at a much lower cost.

For example, planners propose to reduce automotive air pollution by increasing population densities to reduce driving. Yet the nation’s densest urban area, Los Angeles, which is seven times as dense as the least dense areas, has only 8 percent less commuting by auto. In contrast, technological improvements over the past 40 years, which planners often ignore, have reduced the pollution caused by some cars by 99 percent.

Some of the worst plans today are so-called growth-management plans prepared by states and metropolitan areas. They try to control who gets to develop their land and exactly what those developments should look like, including their population densities and mixtures of residential, retail, commercial, and other uses. “The most effective plans are drawn with such precision that only the architectural detail is left to future designers,” says a popular planning book.

About a dozen states require or encourage urban areas to write such plans. Those states have some of the nation’s least affordable housing, while most states and regions that haven’t written such plans mostly have very affordable housing. The reason is simple: planning limits the supply of new housing, which drives up the price of all housing and leads to housing bubbles.

In states with growth-management laws, median housing prices in 2006 were typically 4 to 8 times median family incomes. In most states without such laws, median home prices are only 2 to 3 times median family incomes.

Few people realize that the recent housing bubble, which affected mainly regions with growth-management planning, was caused by planners trying to socially engineer cities. Yet it has done little to protect open space, reduce driving, or do any of the other things promised.

Politicians use government planning to allocate scarce resources on a large scale. Instead, they should make sure that markets — based on prices, incentives, and property rights — work.

Private ownership of wildlife could save endangered species such as the black-footed ferret, North America’s most-endangered mammal. Variably priced toll roads have helped reduce congestion. Pollution markets do far more to clean the air than exhortations to drive less. Giving people freedom to use their property, and ensuring only that their use does not harm others, will keep housing affordable.

Unlike planners, markets can cope with complexity. Futures markets cushion the results of unexpected changes. Markets do not preclude government ownership, but the best-managed government programs are funded out of user fees that effectively make government managers act like private owners. Rather than passing the buck by turning sticky problems over to government planners, policymakers should make sure markets give people what they want.

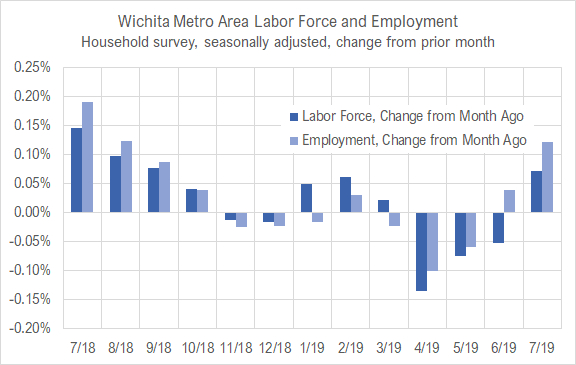

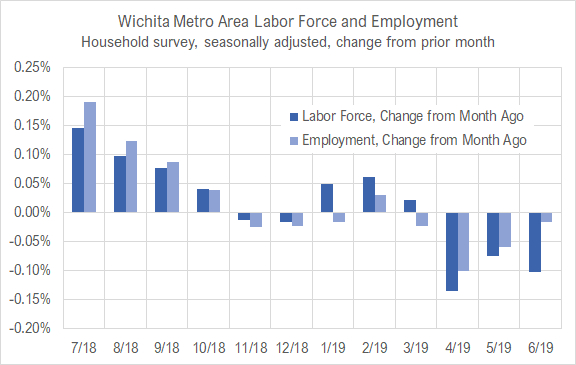

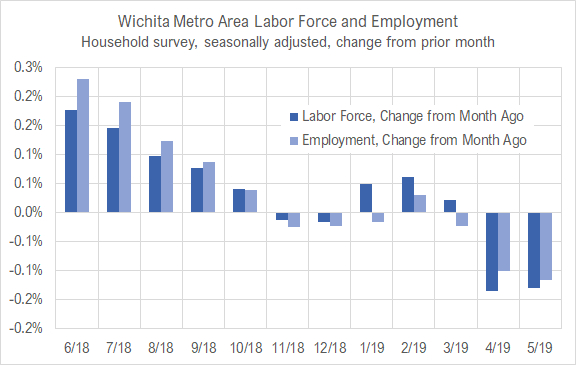

Look at the data. In this table, we see that the unemployment rate (monthly average) for 2018 is nearly unchanged from 1999. Also nearly unchanged for these 19 years are the civilian labor force and number of jobs. Both values are slightly lower now. This is not “steady job growth,” as Wichita officials proclaim. It is stagnation.

Look at the data. In this table, we see that the unemployment rate (monthly average) for 2018 is nearly unchanged from 1999. Also nearly unchanged for these 19 years are the civilian labor force and number of jobs. Both values are slightly lower now. This is not “steady job growth,” as Wichita officials proclaim. It is stagnation.