Tag: KPERS

-

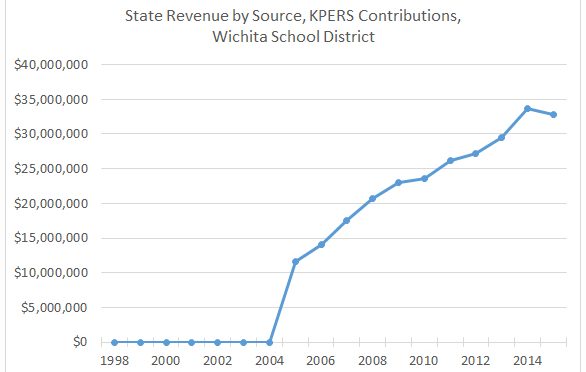

KPERS payments and Kansas schools

There is a claim that a recent change in the handling of KPERS payments falsely inflates school spending. The Kansas State Department of Education says otherwise.

-

Under Goossen, Left’s favorite expert, Kansas was admonished by Securities and Exchange Commission

The State of Kansas was ordered to take remedial action to correct material omissions in the state’s financial statements prepared under the leadership of Duane Goossen.

-

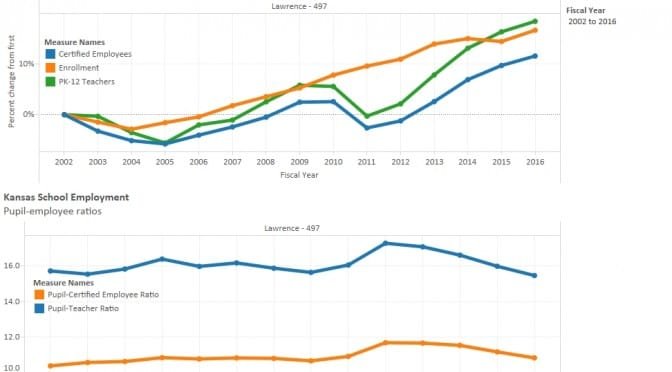

Lawrence school funding and employment

A Kansas school board president complains about funding, but the district has been able to grow employment faster than enrollment.

-

In Kansas, teachers unions should stand for retention

A bill requiring teachers union to stand for retention elections each year would be good for teachers, students, and taxpayers.

-

Kansas transportation bonds economics worse than told

The economic details of a semi-secret sale of bonds by the State of Kansas are worse than what’s been reported.

-

This is why we must eliminate defined-benefit public pensions

Actions considered by the Kansas Legislature demonstrate — again — that governments are not capable of managing defined-benefit pension plans.