The case of Beechcraft and economic development incentives holds several lessons as Wichita considers a new tax with a portion devoted to incentives.

In December 2010 Kansas Governor Mark Parkinson announced a deal whereby the state would pay millions to Hawker Beechcraft to keep the company in Kansas. The company had been considering a purported deal to move to Baton Rouge, Louisiana. (Since then the company underwent bankruptcy, emerged as Beechcraft, and has been acquired by Textron.) The money from the state was to be supplanted by grants from the City of Wichita and Sedgwick County.

At the time, the deal was lauded as a tremendous accomplishment. In his State of the City address for 2011, Wichita Mayor Carl Brewer told the city that “We responded to the realities of the new economy by protecting and stabilizing jobs in the aviation industry. … The deal with Hawker Beechcraft announced last December keeps at least 4,000 jobs and all existing product lines in Wichita until at least 2020.”

The nearby table shows data obtained from the Kansas Department of Commerce for Hawker Beechcraft. “MPI” means “Major Project Investment,” a class of payments that may be used for a broad range of expenses, including employee salaries and equipment purchases. SKILL is a program whereby the state pays for employee training. The MPI payments have been reduced below the $5 million per year target as the company has not met the commitment of maintaining at least 4,000 employees.

Besides these funds, the City of Wichita and Sedgwick County approved incentives of $2.5 million each, to be paid over five years at $500,000 per year (a total of $1,000,000 per year). The company has also routinely received property tax abatements by participating in an industrial revenue bond program.

It’s unfortunate that Beechcraft employment has fallen. The human cost has been large. But from this, we can learn.

First, we can learn it’s important to keep the claims of economic development officials and politicians in perspective. Mayor Brewer confidently claimed there would be at least 4,000 jobs at Beechcraft and the retention of existing product lines in Wichita. As we’ve seen, the promised employment level has not been maintained. Also, Beechcraft shed its line of business jets. The company did not move the production of jets to a different location; it stopped making them altogether. So “all existing product lines” did not remain in Wichita — another dashed promise.

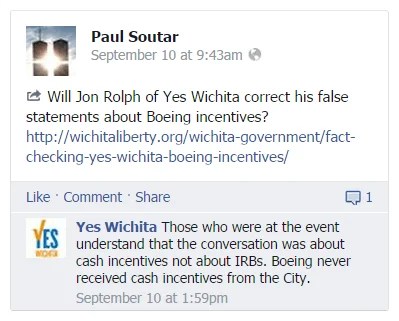

Second, Wichita officials contend that our city can’t compete with others because our budget for incentives is too small. The figure of $1.65 million per year is commonly cited. As we see, Beechcraft alone received much more than that, and in cash. Local economic development officials are likely to say that the bulk of these funds are provided by the state, not by local government. I doubt it made a difference to Beechcraft. The lesson here is that Wichita officials are not truthful when telling citizens the amounts of incentives that are available.

Third, this incident illuminates how incentives are extorted from gullible local governments. In his 2011 address, the Wichita mayor said “We said NO to the State of Louisiana that tried to lure Hawker Beechcraft.” (Capitalization in original.) But a Baton Rouge television station reported that the move to Louisiana was never a possibility, reporting: “Today, Governor Bobby Jindal said the timing was not right to make a move. He says Hawker could not guarantee the number of jobs it said it would provide.”

The Associated Press reported this regarding the possible move to Louisiana: “They [Hawker Beechcraft] weren’t confident they could meet the job commitments they would have to make to come to Baton Rouge so it just didn’t make sense at this time.”

The threat the mayor said Wichita turned back with tens of millions of dollars? It was not real. This is another lesson to learn about the practice of economic development.