Tag: Featured

-

Arguments for and against term limits

The arguments in favor of term limits are presented, along with rebuttals to common objections to term limits.

-

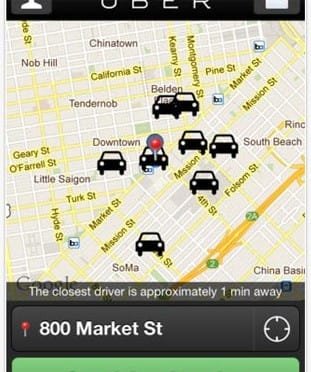

WichitaLiberty.TV: Uber not for Wichita, Wichita fails at transparency, and Wichita jobs

Uber is an innovative transportation service, but is probably illegal in Wichita. Then, the City of Wichita fails again at basic government transparency. Finally, a look at job growth in Wichita compared to other cities.

-

In Wichita, everything that can be done has been done, except this

Discussions of Wichita’s deteriorating infrastructure and economy should lead us to ask: Who has been in charge, and is this all we can do?

-

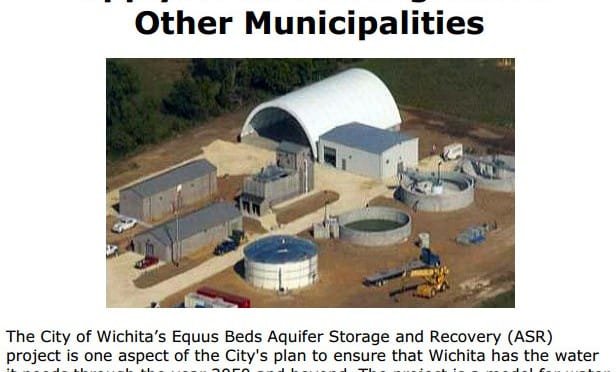

For Wichita, water supply decisions loom

Now that the Wichita City Council has all but recommended that voters raise taxes in order to spend $250 million for water supply enhancements, citizens need to consider recent history and how current decisions are made.

-

For Kansas’ Roberts, an election year conversion?

Is the conservative voting streak by Pat Roberts an election year conversion, or just a passing fad?

-

In Kansas and Wichita, there’s a reason for slow growth

If we in Kansas and Wichita wonder why our economic growth is slow and our economic development programs don’t seem to be producing results, there is data to tell us why: Our tax rates are too high.

-

Uber, not for Wichita

A novel transportation service worked well for me on a recent trip to Washington, but Wichita doesn’t seem ready to embrace such innovation.

-

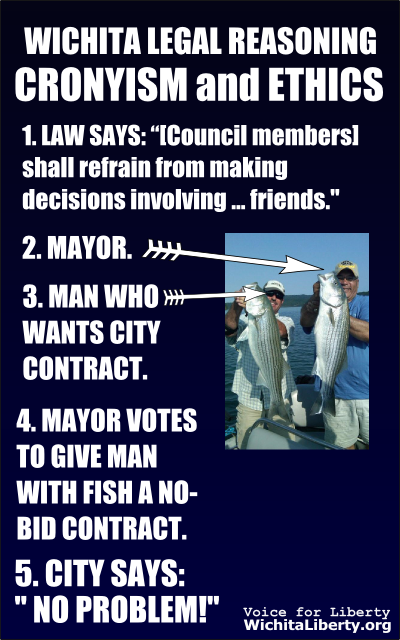

Questions for the next Wichita city attorney: Number 3

Will the next Wichita city attorney advise council members to refrain from making decisions worth millions to their friends and significant campaign contributors?

-

It was a little cloudy, so maybe that’s why

Wichita city leaders tell us that the budget and spending have been cut to the bone. Except for the waste, that is.