Tag: Community Improvement Districts

-

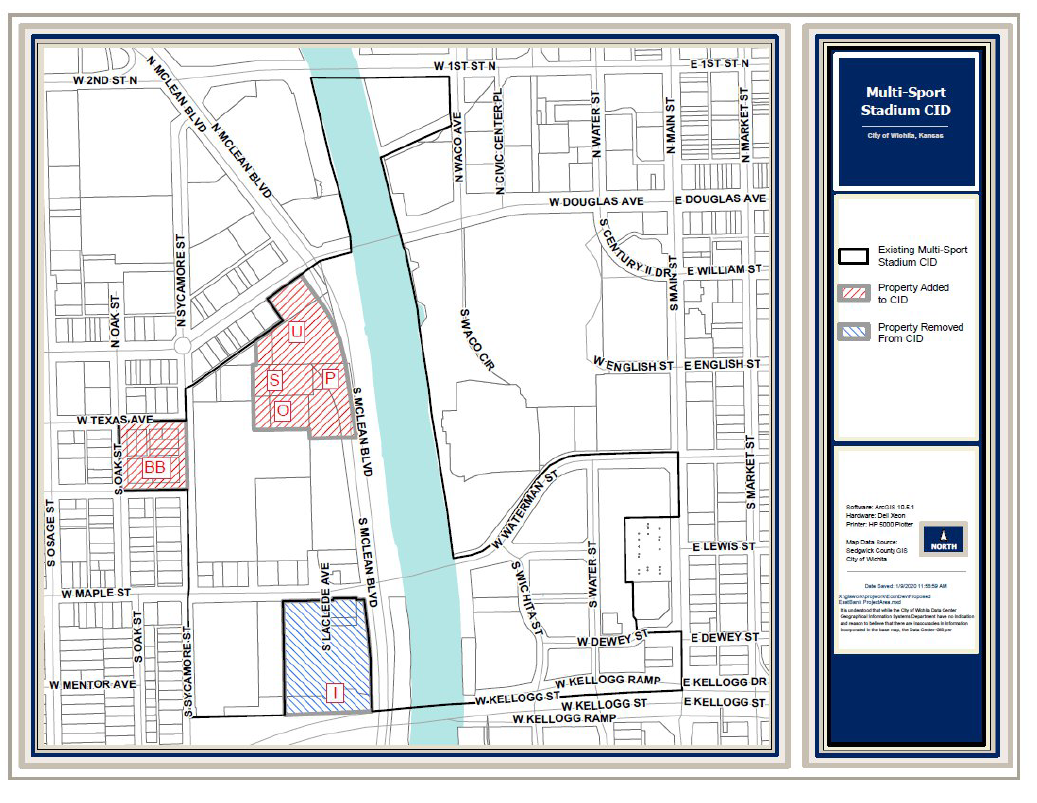

Wichita taxing district to expand

The City of Wichita plans to expand a special tax district.

-

It may become more expensive in Wichita

The City of Wichita plans to create a large district where extra sales tax will be charged.

-

From Pachyderm: Economic development incentives

A look at some of the large economic development programs in Wichita and Kansas.

-

Naftzger Park private use plans unsettled

An important detail regarding Naftzger Park in downtown Wichita is unsettled, and Wichitans have reason to be wary.

-

In Wichita, three Community Improvement Districts to be considered

In Community Improvement Districts (CID), merchants charge additional sales tax for the benefit of the property owners, instead of the general public. Wichita may have an additional three, contributing to the problem of CID sprawl.

-

Naftzger Park project details

The city has finalized a proposal for a development near Naftzger Park. It includes a few new and creative provisions.

-

CID and other incentives approved in downtown Wichita

The Wichita City Council approves economic development incentives, but citizens should not be proud of the discussion and deliberation.

-

CID and other incentives proposed in downtown Wichita

A proposal for a community improvement district in downtown Wichita includes a public hearing, but much information the public needs is missing.

-

Kansas economic development programs

Explaining common economic development programs in Kansas.

-

WichitaLiberty.TV: Lack of information sharing by government, community improvement districts, and the last episode of “Love Gov”

Do our governmental agencies really want to share data and documents with us? Community Improvement Districts and homeowners compared. And, the last episode of “Love Gov” from the Independent Institute.

-

Wichita’s demolition policy

Wichita homeowners must pay for demolition of their deteriorating homes, but the owners of a long-festering and highly visible commercial property get to use tax funds for their demolition expense.

-

Another week in Wichita, more CID sprawl

Shoppers in west Wichita should prepare to pay higher taxes, if the city approves a Community Improvement District at Kellogg and West Streets.