Thank you to Karl Peterjohn, Kansas Taxpayers Network, for this fine article containing information we don’t see in our state’s newspapers.

Why is information like this important to our liberty? It’s because much of what our state spends consists of simply taking the property of one person and giving it to someone else. Add to that the fact that much of this spending is on public schools, that our government leaders firmly refuse to allow us choice in schools (vouchers), this spending (and resultant taxation) amounts to a huge assault on liberty, our freedoms, and our wealth.

Senate spending spree blows roof off Kansas capitol

March 30, 2006 @ 11:30 AM

The government school spending spree is erupting in the Kansas senate today. The senate took up the horrific house passed HB 2986 this morning. Over three years Sen. Karin Brownlee said this bill would cost a total of $1.38 billion.

Two amendments to lower the spending increases failed. The first would have limited spending growth to $670 million failed on a 17-to-20 vote with three legislators showing their profile in courage and passing! Then the original house spending plan that would raise school spending over $1 billion over three years was taken up and failed 17-to-23.

Once again unified Democrats and their big spending GOP allies headed up by school district attorney Sen. John Vratil and Wichita school district specialist Sen. Jean Schodorf (they are vice chair and chair of the education committees, does anyone see a special interest there?) easily defeated these slightly smaller spending bills with the votes of their liberal allies.

Sen. Karin Brownlee warned the senate that the house passed H 2986 would “…spend the roof off the dome…,” if this passed. So far, the smallest spending increase amendment to this bill came from Sen. Jim Barnett who had a four-year spending hike plan. Barnett’s proposal did not receive a single Democrat vote and the most “moderate,” ie. liberal Republicans voted against it: Allen, Brungardt, Emler, Morris, Reitz, D. Schmidt, V. Schmidt, Teichman, Umbarger, Vratil, & Wysong. The three passing were McGinn and two Democrats: Haley and Lee.

Barnett warned the senate that continuing the spending spree that began in the 2005 regular legislative session and was compounded by the court mandated special session was going to lead this state into major financial mess. He was not alone in these concerns. He was joined by a majority of senate Republicans including excellent comments from senators Brownlee and Wagle.

Sen. Les Donovan joined warned the senate that there are, “… built in (spending) escalators and they are not going away,” and that the cumulative impact is to put the state in a $600 million fiscal hole two years from now.

The left wing and all too bipartisan senate leaders on both sides of the aisle Steve Morris, Tony Hensley, Derek Schmidt, and John Vratil do not care. As I write this, the debate continues and more amendments are being offered. The sausage mill continues to grind.

From this taxpayer advocate’s perspective it is hard to see who is more irresponsible: the usurping Kansas Supreme Court that created the fiscal environment with the lawsuit that continues to fester over the entire state, Governor Sebelius who proposes nothing but controls through her legislative leadership allies Morris/Hensley everything, or left-wing Republicans and Democrats in the legislature. The house plan was increased with the Loyd-McKinney amendment but a more accurate name for this spending spree bill would begin with Governor Sebelius, add the four senate leaders, and then the two house members: Loyd/McKinney. Then the seven members of the black robed legislature/Supreme Court’s names should be included too. All these folks’ fingerprints dominate this spending spree bill.

The scuttlebutt among some lobbyists is that there aren’t 21 votes in the senate to adopt any school finance bill. I don’t buy it. It looks like there are 21 votes to go on a spending spree that when fully implemented will place this state in such a deep financial hole that it will be decades before Kansans will see any sunlight. This is what Governor Sebelius’ father did when he was governor in Ohio for one term in the 1970’s and created that state’s debilitating income tax. Its deja vu all over again.

The big lie is that gambling is a fiscal solution. It is only a solution if you think that the $323 million of spending from 2005 when combined with $660 million in additional spending (and assuming that the state doesn’t increase spending anywhere else, fat chance) can be funded by the gambling proponents most optimistic guess of $200 million in new money (that a gross not net figure). I guess this is called “Government Math.” Even an increase in state revenues of a couple of hundred million this year will not balance this spending spree.

The government school establishment does not know how to spend this money fast enough. Full day kindergarten is already becoming universal statewide. Then the school districts will begin to expand their pre-kindergarten programs. They still will have truckloads of cash to spend.

The size of the spending spree is demonstrated by the 2005-06 increase that if nothing were added, would increase state spending per pupil by $725 per FTE pupil statewide. That’s almost chump change when the spending in HB 2986 is added to the total. That should add roughly $1,500 more per pupil and assumes that local and federal spending is not increased—which is highly unlikely. That would take average spending from about $10,000 per pupil per year (or $200,000 for a classroom with 20 kids in it) to $12,000 per pupil (or $240,000 per classroom) a year.

The legislature has been warned that financing HB 2986 would require draconian hikes in any one of the state’s major revenue sources: 22% hike in state personal income tax rates (taking us close to a max rate of 8 percent), more than doubling by over 21 mills in the statewide property tax, or at least a 38% hike in the state sales tax rate. What would be most likely is a combination of all three and perhaps adding some other excise tax hikes to the mix.

Kansas’ already obscenely high tax rates would be made even higher. The departure of businesses and productive people will grow. The governor has a key supporter, Phil Ruffin, who is already a billionaire according to Forbes Magazine’s billionaire issue. To help fund this spending spree with slots/casino’s at his racetracks he would be able to move a good ways up the Forbes list into the multiple billionaire category. Forbes reports that Ruffin lives in Nevada where the sales tax is a fraction of Kansas; there is no statewide property or personal income taxes.

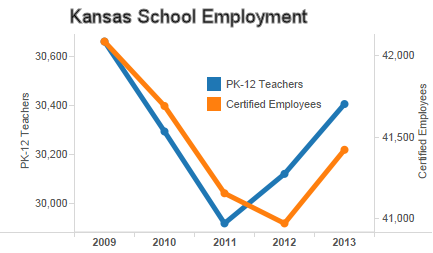

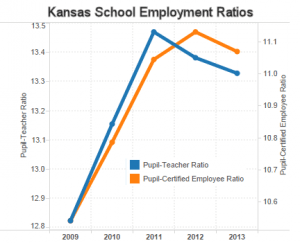

The irony is that a large chunk of this new spending will not be used to raise the salaries of Kansas’ best public school teachers. The government school spending lobbies plan is to expand the number of employees (see the Augenblick and Myer report that is the basis for the court’s school finance edicts).

This is a political play for more power. More employees means more union dues and that means more political power. Ultimately, the state grows and dependency upon government will grow. Kansas union leaders will soon be getting the same mid-six figure pay that national union heads like the National Education Association currently enjoy.

This spending hike is a negative productivity plan since it will take more people to perform the same schooling that has occurred in the past. Don’t get me wrong; school employees will certainly get paid more. Superintendents will be able to trade in their Jaguars for Rolls-Royces (this is not hyperbole, there already is a superintendent driving her Jag). If teachers get 10 percent hikes principals will get a bigger percentage as will their bosses. More staff will be needed. Kansas will follow the build the government school bureaucracy model.

If the Kansas City (MO) school lawsuit experience in the 1980’s was a tragedy that cost taxpayers a couple of billion the school spending debacle in 2006 should be called a farce. Except Kansas is larger so it will be a lot more expensive. All additional efforts to provide more performance and school accountability for state spending were removed on the house floor and the efforts to re-insert these provisions on the senate floor were terminated by the liberal senators.

Since Kansas is already spending a higher percentage of its state budget for the public school establishment, the idea that taxpayers are short-changing any public school is absurd. Over 50 percent of the state’s $5.2 billion plus Gen. Fund budget already goes for public schools. When colleges are added in the figure is now approaching 70 percent. This new spending is likely to make the former figure close to 60 percent and the latter percentage around 75 percent.

Since the efforts to stop the school finance lawsuits have largely been sidetracked in the legislature the future for Kansas enterprise is high in uncertainty, increasing risk, and more automatic tax hikes. There are enough state reserves due to the 2003 Bush tax cuts that have helped grow state revenues so that no tax hike (besides the automatic property tax appraisal/income tax inflation) will be necessary in this election year of 2006 but wait till after November.

The property appraisal notices went out this month and Kansas property owners will be paying large increases. Again. This is now an annual event. One mill of the statewide property tax has now grown to over $30 million per year. In the 1990’s this figure was in the just over half this amount.

None of the statewide property tax collections for schools show up in the state’s official revenue figures. I’ll let you do the math and multiply the $30 million by the 21.5 mill statewide mill levy and add this to a 2007 state budget that will soon be pushing $6 billion for the General Fund and blow by $12 billion for the All Funds budget (Medicaid costs are soaring at double digit rates too). In 2002 the state budget reached $10 billion for the first time.

The fiscal decline of Kansas will lead to an overall decline for this state. We are a spending model for the rest of country: watch Kansas and do the opposite. Please feel free to forward this to anyone with an interest in the fiscal health of this state.

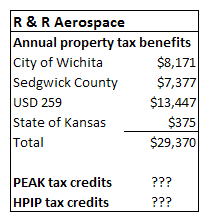

City documents give some detail regarding the amounts of property tax to be forgiven on an annual basis, for a period of up to ten years. In the past, city documents have often mentioned other incentive programs that will benefit the company, but that information is missing. Other sources mention two state programs — PEAK and HPIP — the company may benefit from, but amounts are not available.

City documents give some detail regarding the amounts of property tax to be forgiven on an annual basis, for a period of up to ten years. In the past, city documents have often mentioned other incentive programs that will benefit the company, but that information is missing. Other sources mention two state programs — PEAK and HPIP — the company may benefit from, but amounts are not available.