The flow of tax dollars Wichita city leaders have planned for Douglas Place, a proposed hotel in Wichita, creates a mechanism where taxpayer funds are routed to a politically-connected construction firm. And unlike the real world, where developers have an incentive to build economically, the city has created incentives for Douglas Place developers to spend lavishly in a parking garage, at no cost to themselves.

The original plan for Douglas Place as specified in a letter of intent that the city council voted to support, calls for a parking garage (and urban park) to cost $6,800,000. Details provided at the August 9th meeting of the city council gave the cost for the garage alone as $6,000,000. The garage would be paid for by capital improvement program (CIP) funds and tax increment financing (TIF). The CIP is Wichita’s long-term plan for building public infrastructure. TIF is different, as we’ll see in a moment.

During the meeting, it was also revealed that plans specified that Key Construction of Wichita would be the contractor for the garage. Key would not have to bid for the contract, even though the garage is being paid for with taxpayer funds.

At the meeting, Council Member Michael O’Donnell (district 4, south and southwest Wichita) expressed concern about the no-bid contract. As a result, it is likely that the contract will be put out for competitive bid. Sources say it’s possible that the garage could be built for as much as $2,000,000 less than the original plan.

However much is saved, it’s money that otherwise would have gone into the pockets of Key Construction. Because of the way the garage is being paid for, that money would not have been a cost to Douglas Place’s developers. Instead, it would have been a giant ripoff of Wichita taxpayers.

Even worse, the Douglas Place developers have no incentive to economize on the cost of the garage. In fact, they have incentives to make it cost even more.

Recall that the garage is being paid for through two means. One is CIP, which is a cost to Wichita taxpayers. It doesn’t cost the Douglas Place developers anything except for their small quotal share of Wichita’s overall tax burden. In exchange for that, they get part of a parking garage paid for.

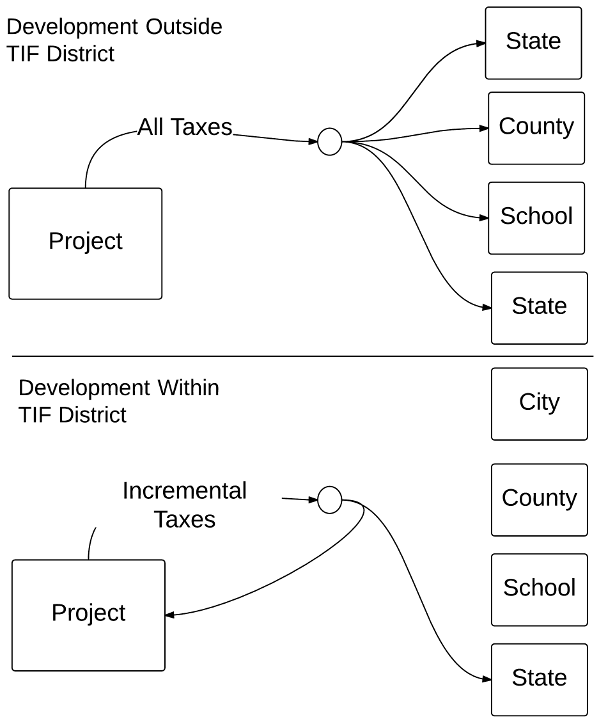

But the tax increment financing, or TIF, is different. Under TIF, the increased property taxes that Douglas Place will pay as the project is completed won’t go to fund the general operations of government. Instead, these taxes will go to pay back bonds that the city will issue to pay for part of the garage — a garage that benefits Douglas Place, and one that would not be built but for the Douglas Place plans.

That’s a pretty neat deal for the Douglas Place developers. Under such a scheme, the more the parking garage costs, more Douglas Place property taxes are funneled back to it — taxes, remember, it has to pay anyway. (Since Douglas Place won’t own the garage, it doesn’t have to pay taxes on the value of the garage, so it’s not concerned about the taxable value of the garage increasing its tax bill.)

Why would Douglas Place be interested in an expensive parking garage? Here are two reasons:

First, the more the garage costs to build, the more the hotel benefits from a fancier and nicer garage for its guests to park in. Remember, since the garage is paid for by property taxes on the hotel — taxes Douglas Place must pay in any case — there’s an incentive for the hotel to see these taxes used for its own benefit rather than used to pay for firemen, police officers, and schools.

Second, consider Key Construction, the planned builder of the garage under a no-bid contract. The more expensive the garage, the higher the profit for Key.

Now add in the fact that one of the partners in the Douglas Place project is a business entity known as Summit Holdings LLC, which is composed of David Wells, Kenneth Wells, Richard McCafferty, John Walker Jr., and Larry Gourley. All of these people are either owners of Key Construction or its executives. The more the garage costs, the higher the profit for these people. Remember, they’re not paying for the garage. City taxpayers are.

The sum of all this is a mechanism to funnel taxpayer funds, via tax increment financing, to Key Construction. The more the garage costs, the better for Douglas Place and Key Construction — and the worse for Wichita taxpayers.

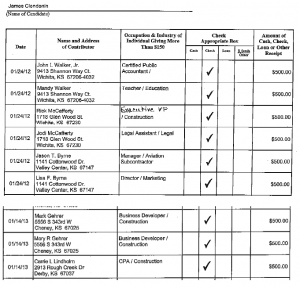

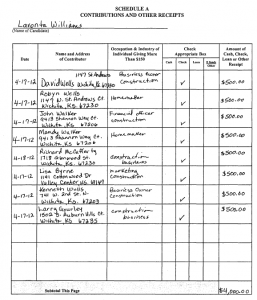

It’s no wonder Key Construction principals contributed $13,500 to Mayor Carl Brewer and four city council members during their most recent campaigns. Council Member Jeff Longwell alone received $4,000 of that sum, and he also accepted another $2,000 from managing member David Burk and his wife.

This scheme, of which few people must be aware, as it has not been reported anywhere but here, is a reason why Wichita and Kansas need pay-to-play laws. These laws impose restrictions on the activities of elected officials and the awarding of contracts.

An example is a charter provision of the city of Santa Ana, in Orange County, California, which states: “A councilmember shall not participate in, nor use his or her official position to influence, a decision of the City Council if it is reasonably foreseeable that the decision will have a material financial effect, apart from its effect on the public generally or a significant portion thereof, on a recent major campaign contributor.”

This project also shows why complicated financing schemes like tax increment financing need to be eliminated. Government intervention schemes like this turn the usual economic incentives upside down, and at taxpayer expense.

Wichita mayor Carl Brewer with major campaign donor Dave Wells of Key Construction.

Wichita mayor Carl Brewer with major campaign donor Dave Wells of Key Construction.