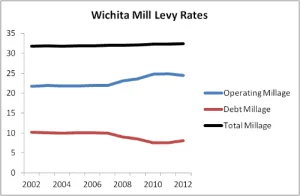

The City of Wichita is fond of saying that it hasn’t raised its mill levy in many years. But the mill levy has increased in recent years, and the use of the tax revenue has shifted.

In 2002 the City of Wichita mill levy rate was 31.845. In 2012 it was 32.471, based on the city’s Comprehensive Annual Financial Report. That’s an increase of 0.626 mills, or 1.97 percent. The Wichita City Council did not take explicit action to raise this rate. Instead, the rate is set by the county based on the city’s budgeted spending and the assessed value of taxable property subject to Wichita taxation. While the city doesn’t have control over the assessed value of property, it does have control over the amount it decides to spend.

In 2002 the City of Wichita mill levy rate was 31.845. In 2012 it was 32.471, based on the city’s Comprehensive Annual Financial Report. That’s an increase of 0.626 mills, or 1.97 percent. The Wichita City Council did not take explicit action to raise this rate. Instead, the rate is set by the county based on the city’s budgeted spending and the assessed value of taxable property subject to Wichita taxation. While the city doesn’t have control over the assessed value of property, it does have control over the amount it decides to spend.

Although the mill levy has increased slightly, property tax revenue collected has risen faster. From 2002 to 2012 property tax revenue increased from $82.948 to $118.990 million, or 43.5 percent. We didn’t experience anything near that rate of growth in population or inflation. For the same period sales tax revenue to the city rose from $40.982 million to $54.095 million, or 32.0 percent.

The allocation of city property tax revenue has shifted in a troubling way. According to the 2010 City Manager’s Policy Message, page CM-2, “One mill of property tax revenue will be shifted from the Debt Service Fund to the General Fund. In 2011 and 2012, one mill of property tax will be shifted to the General Fund to provide supplemental financing. The shift will last two years, and in 2013, one mill will be shifted back to the Debt Service Fund. The additional millage will provide a combined $5 million for economic development opportunities.”

The allocation of city property tax revenue has shifted in a troubling way. According to the 2010 City Manager’s Policy Message, page CM-2, “One mill of property tax revenue will be shifted from the Debt Service Fund to the General Fund. In 2011 and 2012, one mill of property tax will be shifted to the General Fund to provide supplemental financing. The shift will last two years, and in 2013, one mill will be shifted back to the Debt Service Fund. The additional millage will provide a combined $5 million for economic development opportunities.”

This shift has not caused the city to delay paying off debt. This city is making its scheduled payments. But we need to recognize that approximately 2.5 mills (now about 2 mills) that could have been used to retire debt has instead been shifted to support current spending. Instead of spending this money on current consumption — including economic development spending that has produced little result — we could have, for example, used that money to purchase some of our outstanding bonds.

The video below is of interest as it provides insight into the level of knowledge of some elected officials and city staff.