Tag: Wichita Eagle

-

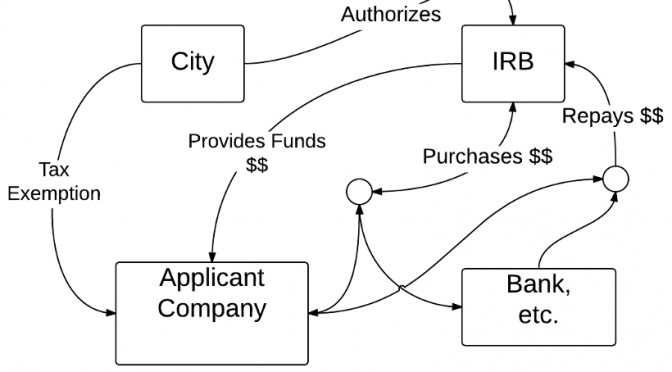

It’s not the bonds, it’s the taxes

A Wichita Eagle headline reads “Wichita aircraft supplier plans 45 new jobs with $7.5 million bond request,” but important information is buried and incomplete.

A Wichita Eagle headline reads “Wichita aircraft supplier plans 45 new jobs with $7.5 million bond request,” but important information is buried and incomplete.