A Wichita Eagle editorial argues for higher property taxes to help the city grow.

In a recent op-ed, the Wichita Eagle editorial board writes: “It’s hard to make the argument that Wichitans are overtaxed by their city government. It’s time for the community to look at how it helps the city grow. A responsible plan that asks Wichita families to chip in the cost of a family meal should be part of the conversation.” 1

First, note that some factual elements of the editorial board’s argument are incorrect, as I show in Wichita Eagle argues for higher taxes.

The argument that a tax increase is only “the cost of a family meal” is weak. (From the editorial: “A 1-mill increase would cost a property owner $11.50 annually for every $100,000 of appraised value of a home.”) In other words, it’s just a little bit. Just one dollar each month. You won’t even notice it.

This is a standard argument made by those who want higher taxes and those who oppose tax cuts. The problem is just that: Everyone makes this argument, and when added together, the nickels and dimes add up to real money.

Besides, there are families in Wichita who have trouble paying for family meals.

Then, there’s the effect on business. An ongoing study reveals that generally, property taxes on commercial and industrial property in Wichita are high. Specifically, taxes on commercial property in Wichita are among the highest in the nation. Commercial property is taxed at 2.180 times the rate as residential property. (The U.S. average is 1.683.) Because Wichita’s ratio is high, it leads to high property taxes on commercial property. 2

Raising taxes on commercial enterprise shifts economic activity from the private sector to government. Citizens may want to ask where money is spent most beneficially.

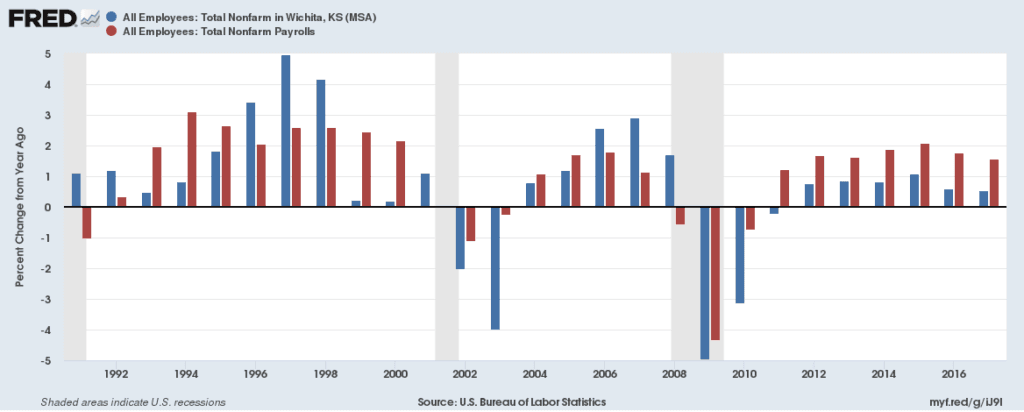

The Eagle editorial board says higher property taxes could help the city grow. There’s no doubt the city needs help growing. But given the record of our local government leaders — both elected and bureaucratic — it’s difficult to see how giving them more money to spend will help.

The Wichita Eagle editorialized “Seven years into a project that was supposed to give Wichita a grand gathering place full of shops, restaurants and night spots as well as offices and condos, some City Council members and citizens remain skeptical at best about WaterWalk’s ability to deliver on its big promises. … True, the skepticism to date is richly deserved.” 4

Oh. That editorial was written in 2009, nine years ago. Since then, there has been some improvement, like the Marriott Fairfield Inn and Suites Hotel and the fountain. But, Gander Mountain — the development’s retail anchor — closed.

The present Eagle editorial board calls for a “responsible plan.” But when we see the city spending on things like Waterwalk and then failing to uphold agreements designed to protect taxpayers — well, the city hasn’t been acting responsibly.

Contrast downtown’s Waterwalk with Waterfront, a development at 13th and Webb Road in east Wichita that started around the same time as Waterwalk. There, developers spent millions of their own money to build a beautiful parkway, sewers, traffic lights, and the like. 5

All this at Waterfront was done without help from the taxpayers, unlike downtown’s Waterwalk consuming our $41 million. Other popular developments like Bradley Fair and New Market Square were developed with little or no government help.

So: Do we trust Wichita’s political and bureaucratic leaders to develop a “responsible plan?” Give this record, do we want to shift more resources from the private sector to the government sector?

Competing tax hikes

It’s surprising that the Eagle editorial board would recommend higher property taxes right now. That’s because it’s likely we’ll be asked to approve more taxation, probably soon. There is support among the city’s elite for a renovated or new performing arts and convention center, something that probably can’t be done without more tax revenue. Project Wichita is seen by many as an effort to persuade the region for higher taxes.

Also: In 2014 the steering committee for the Wichita/Sedgwick County Community Investments Plan delivered a report to the Wichita City Council. This report told the council that the “cost to bring existing deficient infrastructure up to standards” is an additional $45 to $55 million per year over current levels of spending. 7

I’m not aware of the city directing additional spending to cure this maintenance gap. As time passes, the gap becomes larger. Although: The city decided to spend an additional $10 million on street repair. But that was a one-time infusion made available when the city sold a capital asset.

This backlog of maintenance is a manifestation of the city not being responsible with assets Wichita taxpayers paid for. And if it is true that we need to spend an additional $45 to $55 million per year, where will the city get those funds? The Eagle urges a one mill property tax increase, which it says means the “city budget would gain $3.5 million to $4 million.” To fix our maintenance backlog would require a property tax increase of over ten mills, if that is how the city decides to raise the funds.

—

Notes

- Wichita Eagle editorial board. Wichita, it’s time to consider a tax increase. It’s past time, actually. August 17, 2018. Available at https://www.kansas.com/opinion/editorials/article216790960.html. ↩

- Weeks, Bob. Wichita business property taxes still high. Available at https://wichitaliberty.org/wichita-government/wichita-business-property-taxes-still-high/. ↩

- Weeks, Bob. Wichita WaterWalk contract not followed, again. Available at https://wichitaliberty.org/wichita-government/wichita-waterwalk-contract-not-followed/. ↩

- Weeks, Bob. Wichita’s Waterwalk failure breeds skepticism. Available at https://wichitaliberty.org/wichita-government/wichitas-waterwalk-failure-breeds-skepticism/. ↩

- Weeks, Bob. Many Wichita developers pay for infrastructure. Available at https://wichitaliberty.org/wichita-government/many-wichita-developers-pay-for-infrastructure/. ↩

- Weeks, Bob. Downtown Wichita business trends. Available at https://wichitaliberty.org/wichita-government/downtown-wichita-business-trends-2016/. ↩

- Weeks, Bob. Wichita sales tax does little to close maintenance gap. Available at https://wichitaliberty.org/wichita-government/wichita-sales-tax-little-close-maintenance-gap/. ↩