Tag: Visit Wichita

-

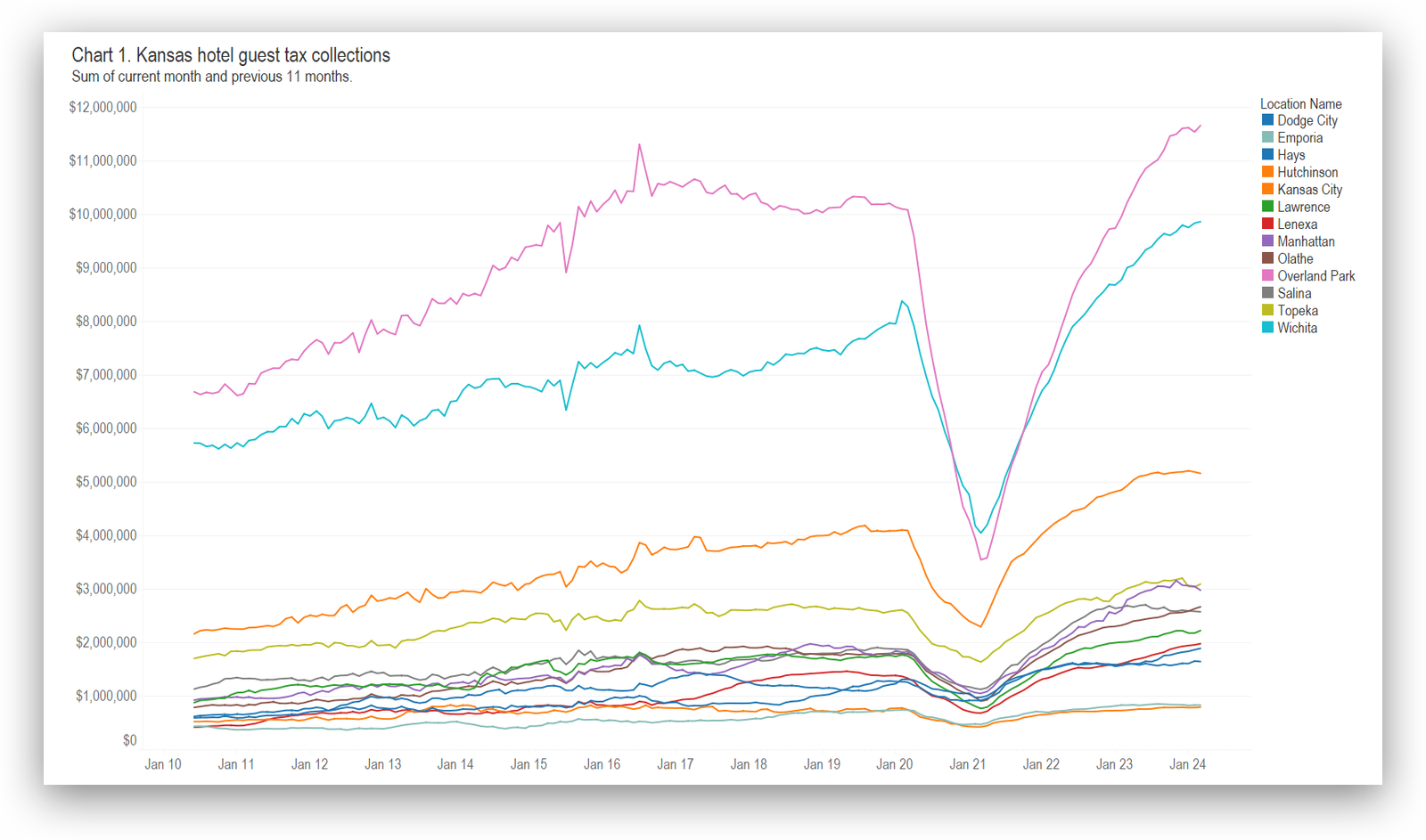

Updated: Kansas hotel guest tax collections

Kansas hotel guest tax collections presented in an interactive visualization. Updated with data through March 2024.

-

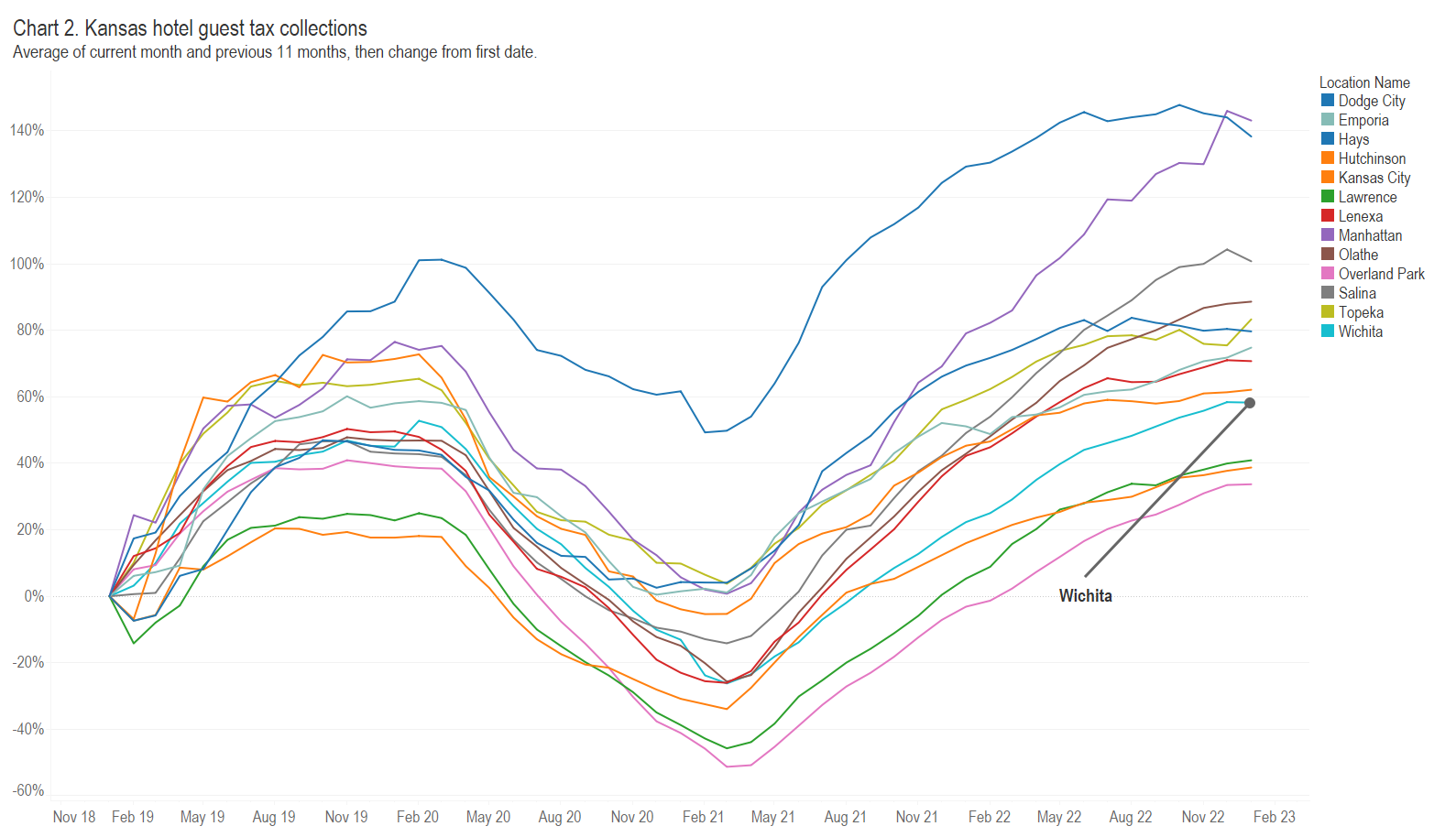

Updated: Kansas hotel guest tax collections

Kansas hotel guest tax collections presented in an interactive visualization. Updated with data through January 2023.

-

Wichita needs transparency from its agencies

When the Wichita city council delegates spending to outside agencies such as Visit Wichita, it should insist on the same transparency requirements the city itself faces.

-

Wichita tourism fee budget

The Wichita City Council will consider a budget for the city’s tourism fee paid by hotel guests.

-

Liquor tax and the NCAA basketball tournament in Wichita

Liquor enforcement tax collections provide insight into the economic impact of hosting NCAA basketball tournament games in Wichita.

-

Effect of NCAA basketball tournament on Wichita hotel tax revenues

Hotel tax collections provide an indication of the economic impact of hosting a major basketball tournament.