From Kansas Policy Institute.

Debunking CBPP on tax reform and school funding — Part 3

By Dave Trabert

We continue our debunking of the Center on Budget and Policy Priorities (CBPP) latest report entitled “Lessons for Other States from Kansas’ Massive Tax Cuts.” Part 1 dealt with state revenues and Part 2 covered state spending in general and school funding in particular. Today we debunk their claims that tax reform hasn’t boosted the economy.

We continue our debunking of the Center on Budget and Policy Priorities (CBPP) latest report entitled “Lessons for Other States from Kansas’ Massive Tax Cuts.” Part 1 dealt with state revenues and Part 2 covered state spending in general and school funding in particular. Today we debunk their claims that tax reform hasn’t boosted the economy.

CBPP claim #3 – Kansas’ tax cuts haven’t boosted its economy.

While tax reform hasn’t produced the “shot of adrenaline” predicted by Governor Brownback, the problem is one of political enthusiasm rather than economics. Most elected officials are prone to effusive optimism for their ideas, just as opponents to their ideas can often be counted upon to distort and deliberately misstate information in pursuit of their own beliefs.

The data pretty clearly shows that states with lower tax burdens have much stronger economic growth and job creation over time; we’ll review the facts in Part 4. Today’s post covers some of the reasons why the benefits of Kansas’ tax reform will unfold over several years rather than overnight and explain a number of misleading claims by the Center on Budget and Policy Priorities (CBPP).

First of all, tax reform was implemented while coming out of a recession. It’s impossible to know the extent to which this impacts employers’ decision-making on adding jobs or relocating, but having run a few businesses, I can appreciate how the initial benefits of tax reform might be used to shore up the business while continuing to work through the recession.

First of all, tax reform was implemented while coming out of a recession. It’s impossible to know the extent to which this impacts employers’ decision-making on adding jobs or relocating, but having run a few businesses, I can appreciate how the initial benefits of tax reform might be used to shore up the business while continuing to work through the recession.

Concurrent federal changes are also a factor. Pass-through income on LLCs, Subchapter S corps, partnerships and proprietorships was not subject to state income tax in 2013 but those employers were simultaneously hit with higher federal income taxes (marginal rates and on capital gains) and multiple changes related to Obamacare.

Predictability is an important element of tax policy, and some of the mixed signals coming out of Topeka over the last two years may also be prompting taxpayers to proceed cautiously. The 2012 tax reform legislation would have reduced income taxes by $4.5 billion over the first five years but changes implemented in 2013 took back about $700 million. While still a very positive net effect, the 2013 changes sent a number of mixed signals.

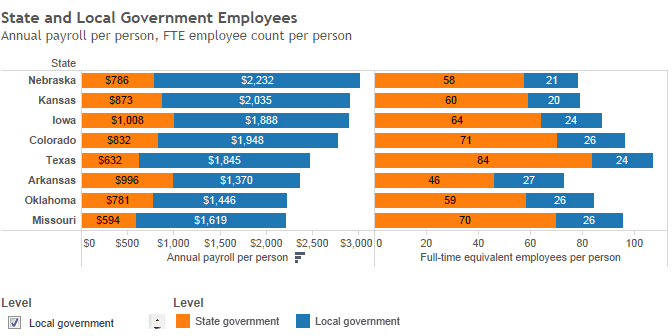

Many employers are also well aware that a majority of legislators and Governor Brownback have not yet made the necessary (and quite feasible) spending reductions that will be required to fully implement tax reform. Kansas’ General Fund budget in 2012 was 25 percent more per-resident than states with no income tax; total budgeted spending was 39 percent higher on a per-resident basis. Every state provides the same basic services – public education, highways, social services programs, etc. — but some states provide those services at a much better price and keep taxes low.

The fiscal year 2015 General Fund budget of $6.273 billion is a new record for Kansas and is 2.9 percent higher than the 2012 budget. Until government is made to operate more efficiently, taxpayers must consider the possibility of further modifications to the tax plan — and that uncertainty will continue to impact economic growth.

Relocating a business is also not something that happens quickly. For starters, leases might have several years to run before a move is feasible.

CBPP uses a combination of unsubstantiated claims, fails to put a lot of information in context and exploits the unrealistic notion that tax reform would have an immediate, explosive impact on the state’s economy. “Data from” is not how intellectually honest people substantiate a position; they show you all their data or at least tell you exactly what data they used and where to find it. Claiming that a one-year change in jobs or earnings is proof that something as complex as major tax reform failed is just a political statement; it is certainly not an intellectually honest economic analysis.

Yes, private sector job grew a little slower in 2013 than in 2012, but that was not a Kansas phenomenon. In fact, private sector job growth nationwide in 2012 was 2.2% but dipped to 2.1% in 2013.[1] This is a good example of CBPP ignoring context.

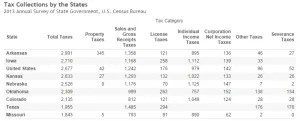

It’s also important to examine the underlying factors that contribute to a state average. The adjacent table shows that Kansas did better than all but one adjacent state in 2013. Colorado did better, but then Colorado has historically had a better tax structure than Kansas and also did a better job of controlling spending. Less favorable tax and spending policy has been introduced in Colorado over the last few years but, just as it takes time for upward momentum to build, it does as well for the full measure of bad policy to be seen.

Digging deeper, we find that the Kansas City, Kansas metro area not only outperformed the national average but also grew at five times the rate of the Kansas City, Missouri metro area. The Wichita metro lost jobs in aerospace but that is a reflection of the global economy; the balance of the Wichita metro was almost at the national average.

CBPP dismisses the increase in new business filings but if history is any guide, these gains are quite significant. Research conducted by the Center for Applied Economics at the University of Kansas found that, if not for jobs created by new startups in their first year of existence, Kansas would have only had two years of net job growth between 1997 and 2010.

Dr. Arthur Hall, who conducted the research at KU, says “Economic development is a numbers game. The more that an economic environment motivates entrepreneurs to try new business ideas, the more likely a gazelle will be born.” Dr. Hall cites Garmin Industries as an example of what he calls a “gazelle” — a company founded by two people in Lenexa, Kansas in 1989 that is now a multi-billion dollar company.

Hall’s views are similar to those of Carl Schramm, former CEO of the Ewing Marion Kauffman Foundation, a leading entrepreneurial think tank in Kansas City. In 2010, Schramm told Forbes Magazine “The single most important contributor to a nation’s economic growth is the number of startups that grow to a billion dollars in revenue within 20 years.”[3]

The initial economic signs are encouraging but the true economic impact of tax reform won’t be known for several years. Snap judgments based on partial one-year data are the hallmark of politicians and special interest groups looking for justification to support their beliefs — whether in support of or opposition to tax reform.

—

[1] Bureau of Labor Statistics, average annual private sector employment not seasonally adjusted.

[2] The Kansas City, Kansas metro is comprised of Franklin, Johnson, Leavenworth, Linn, Miami and Wyandotte counties. The Kansas City, Missouri metro is comprised of Bates, Caldwell, Cass, Clay, Clinton, Jackson, Lafayette, Platte and Ray counties.

[3] “What Grows an Economy,” Forbes Magazine.

Judging the effectiveness of economic development incentives requires looking for the unseen effects as well as what is easily seen. It’s easy to see the groundbreaking and ribbon cutting ceremonies that commemorate government intervention — politicians and bureaucrats are drawn to them, and will spend taxpayer funds to make sure you’re aware. It’s more difficult to see that the harm that government intervention causes.

Judging the effectiveness of economic development incentives requires looking for the unseen effects as well as what is easily seen. It’s easy to see the groundbreaking and ribbon cutting ceremonies that commemorate government intervention — politicians and bureaucrats are drawn to them, and will spend taxpayer funds to make sure you’re aware. It’s more difficult to see that the harm that government intervention causes.

First of all, tax reform was implemented while coming out of a recession. It’s impossible to know the extent to which this impacts employers’ decision-making on adding jobs or relocating, but having run a few businesses, I can appreciate how the initial benefits of tax reform might be used to shore up the business while continuing to work through the recession.

First of all, tax reform was implemented while coming out of a recession. It’s impossible to know the extent to which this impacts employers’ decision-making on adding jobs or relocating, but having run a few businesses, I can appreciate how the initial benefits of tax reform might be used to shore up the business while continuing to work through the recession.