Tag: Kansas Public Employees Retirement System

-

WichitaLiberty.TV: Blight, guns, testimony, and KPERS

Co-host Karl Peterjohn joins Bob Weeks to discuss the fight on blight and property rights, guns on campus, availability of testimony in the Kansas Legislature, and KPERS, our state’s retirement system.

-

Again, KPERS shows why public pension reform is essential

Proposals in the Kansas budget for fiscal year 2018 are more evidence of why defined-benefit pension plans are incompatible with the public sector.

-

No one is stealing* from KPERS

No one is stealing from KPERS, the Kansas Public Employees Retirement System. But there are related problems.

-

State pension cronyism

A new report details the way state pension funds harm workers and taxpayers through cronyism.

-

Decoding Duane Goossen

The writing of Duane Goossen, a former Kansas budget director, requires decoding and explanation. This time, his vehicle is “Rise Up, Kansas.”

-

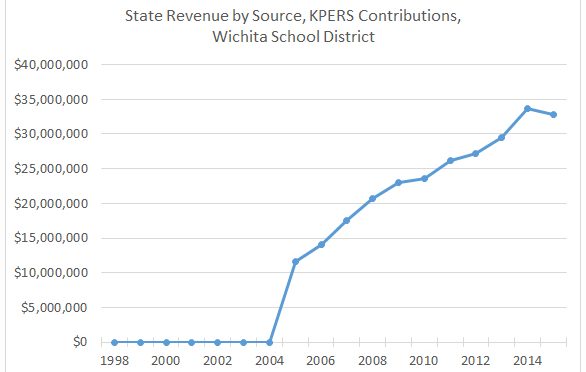

VIDEO: KPERS payments and Kansas schools

There is a claim that a recent change in the handling of KPERS payments falsely inflates school spending. The Kansas State Department of Education says otherwise.

-

KPERS payments and Kansas schools

There is a claim that a recent change in the handling of KPERS payments falsely inflates school spending. The Kansas State Department of Education says otherwise.

-

Under Goossen, Left’s favorite expert, Kansas was admonished by Securities and Exchange Commission

The State of Kansas was ordered to take remedial action to correct material omissions in the state’s financial statements prepared under the leadership of Duane Goossen.

-

This is why we must eliminate defined-benefit public pensions

Actions considered by the Kansas Legislature demonstrate — again — that governments are not capable of managing defined-benefit pension plans.