It’s interesting to look at campaign finance reports. Following, a few highlights on a report from the David Dennis campaign. He’s a candidate for Sedgwick County Commission in the August Republican Party primary election. The report was filed July 25, 2016, covering the period from January 1, 2016 through July 21, 2016. These reports are available online at the Sedgwick County Election Office website.

Keith Stevens, $200

A longtime Democrat community activist, always on the side of higher taxes and more government spending.

Suzanne F. Ahlstrand, $250

Gary & Cathy Schmitt, $100

Jon E. Rosell, $100

Charlie Chandler, Maria Chandler, $1,000 total

Al and Judy Higdon, $500

James & Vera Bothner, $250

Lyndon O. & Marty Wells, $500

All are, or have been, affiliated with the Wichita Metro Chamber of Commerce in various roles, including paid staff and leadership. At one time local chambers of commerce were dedicated to pro-growth economic policies and free markets. But no longer. The Wichita Chamber regularly advocates for more taxes (the 2014 Wichita sales tax campaign was run by the Wichita Chamber), more spending, more cronyism, and less economic freedom. It campaigns against fiscally conservative candidates when the alternative is a candidate in favor of more taxes. The Chamber says it does all this in the name of providing jobs in Wichita. If you’re wondering who ground down the Wichita economy over the past few decades, look no further than the Wichita Chamber of Commerce and its affiliates who have run Wichita’s economic development bureaucracy.

Harvey Sorensen, $500

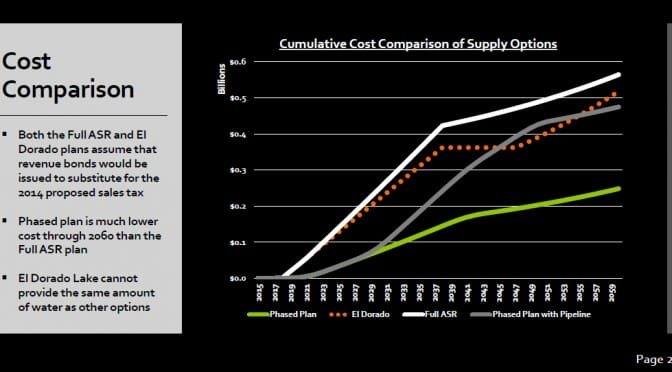

Sorensen was one of the drivers behind the 2014 one cent per dollar Wichita city sales tax proposal, serving as co-chair of Yes Wichita, the primary group campaigning for the tax. In a public forum Sorensen said, “Koch Industries is going to spend a million dollars to try to kill the future of our community.”1 Wichita voters rejected that sales tax, with 62 percent of voters voting “No.”2 Since the election, we’ve learned that we can satisfy our water future needs by spending much less than Sorensen recommended, at least $100 million less.3 Part of the Wichita Metro Chamber of Commerce cabal, Sorensen has played both sides of the street, having donated $500 to Jeff Longwell and the same amount to his opponent Sam Williams in the 2015 Wichita mayoral election. We might be led to wonder if Sorenson makes contributions based on sincerely held beliefs regarding public policy, or simply for access to officeholders.

Jon, Lauren, David, and Barbara Rolph, $2,000 total

Jon Rolph was another co-chair of Yes Wichita, the primary group campaigning for the 2014 Wichita city sales tax. Since then he’s floated the idea of trying again for a city sales tax.

Plumbers & Pipefitters Local Union No. 441 Political Action Committee, $500

Labor unions rarely — very rarely — make campaign contributions to Republicans. Except for David Dennis.

Bryan K & Sheila R Frye, $50

Bryan Frye is a newly-elected Wichita City Council member who has quickly found a home among the other big-taxing, big-spending council members. He’d very much like a county commissioner who is compliant with more taxes and more spending — like David Dennis.

Lynn W. & Kristine L. Rogers, $50

Lynn Rogers is a Republican-turned-Democrat. As a member of the Wichita public schools board, he is an advocate for more school spending, less school accountability, and no school choice.

Alan J. & Sharon K. Fearey, $100

A Democrat, Sharon Fearey served two terms on the Wichita City Council. She was always an advocate for more taxes and spending, even scolding the Wichita Eagle when it thwarted her spending plans.

Foley Equipment, $500

Ann Konecny, $500

Foley was an advocate for the 2014 Wichita city sales tax, contributing $5,000 to the campaign. The next year, Foley asked for an exemption from property taxes and the sales tax that it campaigned for.4 Foley wanted poor people in Wichita to pay more sales tax on groceries, but didn’t want to pay that same sales tax itself.

BF Wichita, L.L.C., $500

A company affiliated with George Laham. He’s a partner in the taxpayer-subsidized River Vista Apartment project on the west bank of the Arkansas River north of Douglas Avenue. Rumor is that the apartment project will be abandoned in favor of selling the land as the site for an office building.

Automation Plus, $500

Sheryl Wohlford, Vice President, is a longtime progressive activist, a member of Wichita Downtown Vision Team. In short, someone who knows how to spend your money better than you.

Steven E. Cox, Janis E. Cox, $1,000 total

Owners of Cox Machine, this company regularly applies for and receives taxpayer-funded incentives, including the forgiveness of paying sales tax. Yet, this company contributed $2,000 to the campaign for the 2014 Wichita city sales tax.

Leon or Karen Lungwitz, $500

Owner of company where Wichita mayor Jeff Longwell once worked.

Slawson Commercial Properties, LLC, $500

Socora Homes, Inc., $500

New Market 1, LLC, $500

Buildings 22-23-24, LLC, $500

All are Slawson companies, advocates of and beneficiaries of taxpayer-funded subsidies.

Carl & Cathy Brewer, $200

The Democrat former mayor of Wichita. Enough said about that.

Tom Winters, $250

Winters is emblematic of the big-taxing, big-spending Republican officeholder who believes he knows how to spend your money better than you. Karl Peterjohn defeated Winters in the August 2008 primary election.

Timothy R. Austin, $150

We might label Austin as “engineer for the cronies” based on his frequent appearances before governmental bodies advocating for taxpayer-funded subsidy for his clients.

—

Notes

- Ryan, Kelsey. Comment on Koch involvement in sales tax heats up debate. Wichita Eagle, October 29, 2014. Available at www.kansas.com/news/local/article3456024.html. ↩

- Sedgwick County Election Office. November 4th, 2014 General Election Official Results — Sedgwick County. Available at www.sedgwickcounty.org/elections/election_results/Gen14/index.html. ↩

- Weeks, Bob. In Wichita, the phased approach to water supply can save a bundle. wichitaliberty.org/wichita-government/wichita-phased-approach-water-supply-can-save-bundle/. ↩

- Weeks, Bob. In Wichita, campaigning for a tax, then asking for exemption from paying. Available at wichitaliberty.org/wichita-government/campaigning-for-tax-then-asking-for-exemption-from-paying/. ↩