As Wichita voters consider spending $250 million expanding a water project, we should look at the project’s history. So far, the ASR program has not performed near expectations, even after revising goals downward.

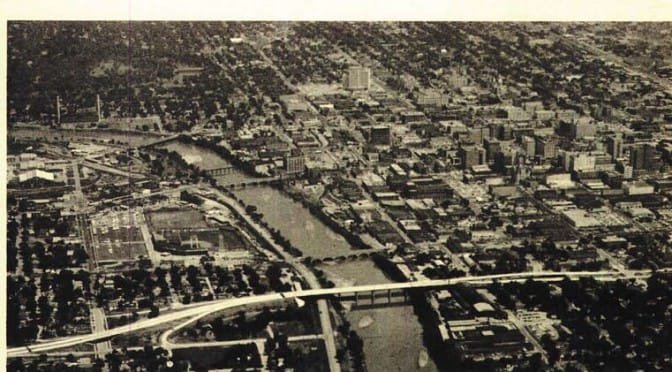

In November Wichita voters will consider approval of a one cent per dollar sales tax. Of the $400 expected to be collected over five years, $250 million is earmarked for a new water source. The city has decided that the new water supply will be implemented through expansion of the Aquifer Storage and Recovery program or ASR. This is a program whereby water is taken from the Little Arkansas River, treated, and injected in the Equus Beds aquifer. That water is then available in the future as is other Equus Beds water.

The city believes that ASR is a proven technology that will provide water and drought protection for many years and recommends that voters approve $250 million for its expansion, although there is possibility that the cost may be $200 million.

According to city documents, the original capacity of the ASR phase II project to process water and pump it into the ground (the “recharge” process) was given as “Expected volume: 30 MGD for 120 days.” That translates to 3,600,000,000 (3.6 billion or 3,600 million) gallons per year. ASR phase II was completed in 2011.

At a city council workshop in April 2014, Director of Public Works and Utilities Alan King briefed the council on the history of ASR, mentioning the original belief that ASR would recharge 11,000 acre feet of water per year. But he gave a new estimate for production, telling the council that “What we’re finding is, we’re thinking we’re going to actually get 5,800 acre feet. Somewhere close to half of the original estimates.” The new estimate translates to 1,889,935,800 (1.9 billion or 1,900 million) gallons per year.

Based on experience, the city has produced a revised estimate of ASR production capability. What has been the actual experience of ASR? The U.S. Geological Survey has ASR figures available here. I’ve gathered the data and performed an analysis.

Annual production

In 2013 ASR recharged 366 million gallons, or 19 percent of the newly revised estimate of production capacity. In 2014 through September, ASR recharged 275 million gallons, or 14 percent of capacity. Extrapolating this nine months of production to a full year results in 367 million gallons produced for 2014, or 19 percent of capacity, the same value as in 2013. This may or may not be valid, but it gives an idea of how 2014 is proceeding.

So for the two most recent years, the ASR system has not operated near its designed capacity, even after revising that capacity downwards by half.

To place these production figures in context, the city uses 56 million gallons per day, on average. So the annual production of the ASR project is about 6.5 days of water usage.

Monthly production

For a 30-day month, if the plant could be run at full design capacity each day, the production would be 900,000,000 (900 million) gallons. The best month ever for actual production was 192 million gallons, with the second best at 120 million gallons.

If we take the 12 best months for production, including before ASR Phase II started operations, the amount of water recharged is 924 million gallons. That’s 49 percent of the revised expected annual production of 1.9 billion gallons.

The cumulative deficit

The city and the “Yes Wichita” campaign say the ASR project is proven and is working. The available data, however, does not support this claim.