Tag: Featured

-

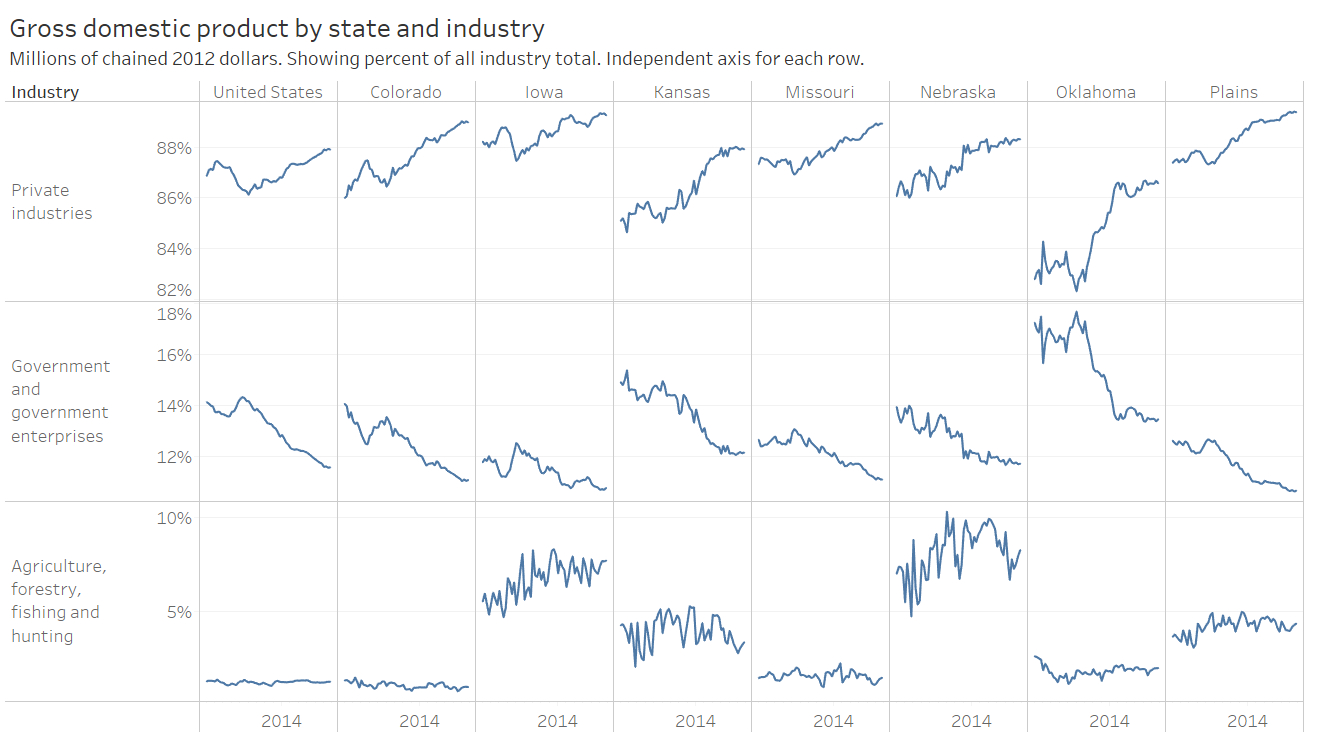

Updated: Economic indicators in the states

Economic indicators in the states, an interactive visualization.

-

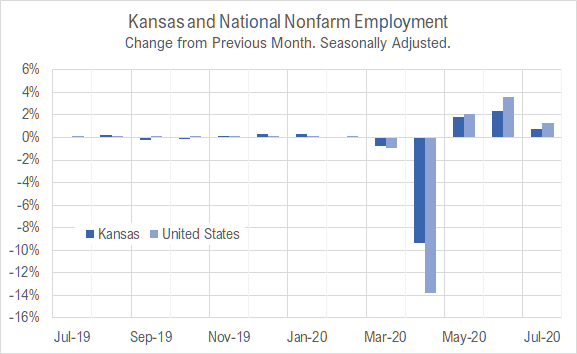

Kansas jobs, July 2020

The employment situation in Kansas continued to improve in July 2020 as the response to the pandemic continued to affect the economy.

-

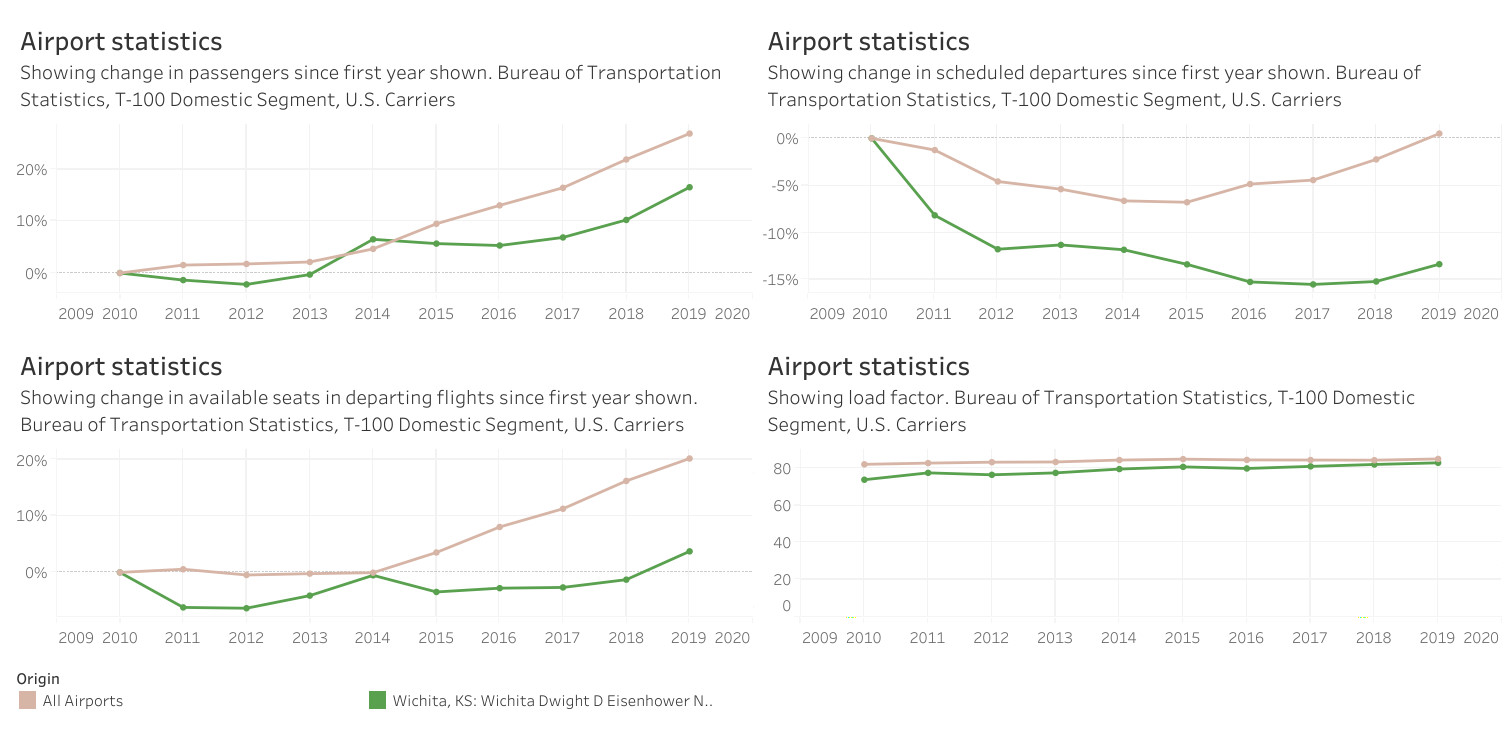

Airport traffic statistics, 2019

Airport traffic data presented in an interactive visualization, updated through 2019.

-

Wichita property tax on commercial property: High

An ongoing study reports that property taxes on commercial and industrial property in Wichita are high. In particular, taxes on commercial property in Wichita are among the highest in the nation.

-

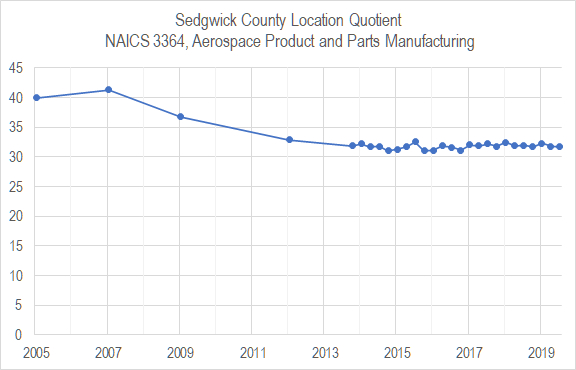

Wichita aerospace manufacturing concentration

Wichita leaders want to diversify the area economy. Has there been progress?

-

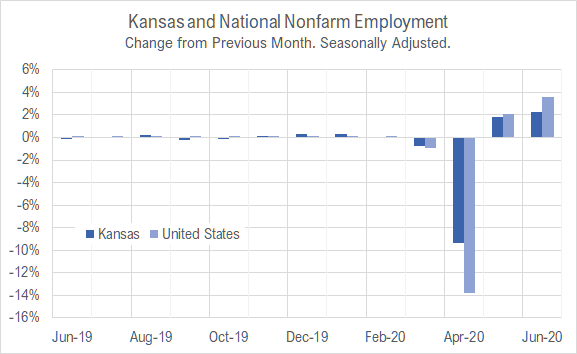

Kansas jobs, June 2020

The employment situation in Kansas continued to improve in June 2020 as the response to the pandemic continued to affect the economy.

-

Kansas GDP

In the first quarter of 2020, the Kansas economy contracted at the annual rate of 3.1 percent, compared to 2.1 percent growth in the previous quarter. While GDP fell in all states, Kansas performed relatively well, with only four states contracting less.

-

Metropolitan employment and labor force

A visualization of employment, labor force, and the unemployment rate for metropolitan areas, now with data through May 2020.

-

Wichita jobs and employment, May 2020

For the Wichita metropolitan area in May 2020, the number of unemployed persons is up, the unemployment rate is up, and the number of people working is down, all by large amounts, when compared to the same month one year ago, but improving from April.

-

Kansas jobs, May 2020

After falling sharply in April, employment in Kansas rose in May 2020 as the response to the pandemic continued to affect the economy.

-

Quarterly Real GDP in Kansas

Examining changes in GDP and industry contribution in Kansas.

-

Wichita jobs and employment, April 2020

For the Wichita metropolitan area in April 2020, the number of unemployed persons is up, the unemployment rate is up, and the number of people working is down, all by large amounts, when compared to the same month one year ago. Seasonal data shows the same trend.