Here is a sampling of stories from Voice for Liberty in 2014.

January

A transparency agenda for Wichita

Kansas has a weak open records law, and Wichita doesn’t want to follow the law, as weak as it is. But with a simple change of attitude towards open government and citizens’ right to know, Wichita could live up to the goals its leaders have set.

New York Times on Kansas schools, again

The New York Times — again — intervenes in Kansas schools. As it did last October, the newspaper makes serious errors in its facts and recommendations.

Visit Wichita, and pay a tourism fee

The Wichita City Council will consider adding a 2.75 percent tax to hotel bills, calling it a “City Tourism Fee.” Welcome to Wichita!

Wichita’s growth in gross domestic product

Compared to peer areas, Wichita’s record of growth in gross domestic product is similar to that of job creation: Wichita performs poorly.

The death penalty in Kansas, a conservative view

What should the attitude of conservatives be regarding the death penalty? Ben Jones of Conservatives Concerned about the Death Penalty spoke on the topic “Capital Punishment in Kansas from a conservative perspective: Is it a failed policy?”

Kansas school test scores, the subgroups

To understand Kansas school test scores, look at subgroups. Sometimes Kansas ranks very well among the states. In other instances, Kansas ranks much lower, even below the national average. It’s important for Kansans — be they citizens, schoolchildren, parents, education professionals, or (especially) politicians of any party — to understand these scores.

The state of Wichita, 2014

Wichita Mayor Carl Brewer delivered the annual State of the City address. He said a few things that deserve discussion.

February

In Wichita, why do some pay taxes, and others don’t?

A request by a luxury development in downtown Wichita raises issues, for example, why do we have to pay taxes?

Wichita considers policy to rein in council’s bad behavior

he Wichita City Council considers a policy designed to squelch the council’s ability to issue no-bid contracts for city projects. This policy is necessary to counter the past bad behavior of Wichita Mayor Carl Brewer and several council members, as well as their inability to police themselves regarding matters of ethical behavior by government officials.

Our Kansas grassroots teachers union

Letters to the editor in your hometown newspaper may have the air of being written by a concerned parent of Kansas schoolchildren, but they might not be what they seem.

Wichita’s legislative agenda favors government, not citizens

This week the Wichita City Council will consider its legislative agenda. This document contains many items that are contrary to economic freedom, capitalism, limited government, and individual liberty. Yet, Wichitans pay taxes to have someone in Topeka promote this agenda.

Wichita planning documents hold sobering numbers

The documents hold information that ought to make Wichitans think, and think hard. The amounts of money involved are large, and portions represent deferred maintenance. That is, the city has not been taking care of the assets that taxpayers have paid for.

In Wichita, citizens want more transparency in city government

In a videographed meeting that is part of a comprehensive planning process, Wichitans openly question the process, repeatedly asking for an end to cronyism and secrecy at city hall.

March

Special interests struggle to keep special tax treatment

When a legislature is willing to grant special tax treatment, it sets up a battle to keep — or obtain — that status. Once a special class acquires preferential treatment, others will seek it too.

In Wichita, West Bank apartments seem to violate ordinance

Last year the Wichita City Council selected a development team to build apartments on the West Bank of the Arkansas River, between Douglas Avenue and Second Street. But city leaders may have overlooked a Wichita City Charter Ordinance that sets aside this land to be “open space, committed to use for the purpose of public recreation and enjoyment.”

In Wichita, pushing back at union protests

A Wichita automobile dealer is pushing back at a labor union that’s accusing the dealer of unfair labor practices.

Wichita City Council to consider entrenching power of special interest groups

The Wichita City Council will consider a resolution in support of the status quo for city elections. Which is to say, the council will likely express its support for special interest groups whose goals are in conflict with the wellbeing of the public.

State employment visualizations

There’s been dueling claims and controversy over employment figures in Kansas and our state’s performance relative to others. I present the actual data in interactive visualizations that you can use to make up your own mind.

State and local government employment levels vary

The states vary widely in levels of state government and local government employees, calculated on a per-person basis. Only ten states have total government employee payroll costs greater than Kansas, on a per-person basis.

April

Wichita not good for small business

When it comes to having good conditions to support small businesses, well, Wichita isn’t exactly at the top of the list, according to a new ranking from The Business Journals.

Cronyism is welfare for rich and powerful, writes Charles G. Koch

“The central belief and fatal conceit of the current administration is that you are incapable of running your own life, but those in power are capable of running it for you. This is the essence of big government and collectivism,” writes Charles G. Koch in the Wall Street Journal.

Rich States, Poor States for 2014 released

In the 2014 edition of Rich States, Poor States, Utah continues its streak at the top of Economic Outlook Ranking, meaning that the state is poised for growth and prosperity. Kansas continues with middle-of-the-pack performance rankings, and fell in the forward-looking forecast.

Wichita develops plans to make up for past planning mistakes

On several issues, including street maintenance, water supply, and economic development, Wichita government and civic leaders have let our city fall behind. Now they ask for your support for future plans to correct these mistakes in past plans.

May

Poll: Wichitans don’t want sales tax increase

According to a newly released poll from Kansas Policy Institute, Wichitans may want more jobs and a secure water source but they certainly don’t support a sales tax increase as the means to get either. Reporting on this poll is available in these articles: In Wichita, opinion of city spending consistent across party and ideology, Few Wichitans support taxation for economic development subsidies, Wichitans willing to fund basics, and To fund government, Wichitans prefer alternatives to raising taxes.

Contrary to officials, Wichita has many incentive programs

Wichita government leaders complain that Wichita can’t compete in economic development with other cities and states because the budget for incentives is too small. But when making this argument, these officials don’t include all incentives that are available.

In Wichita, the streetside seating is illuminated very well

Wichita city leaders tell us that the budget and spending have been cut to the bone. Except for the waste, that is.

Wichita seeks to form entertainment district

A proposed entertainment district in Old Town Wichita benefits a concentrated area but spreads costs across everyone while creating potential for abuse.

In Wichita, capitalism doesn’t work, until it works

Attitudes of Wichita government leaders towards capitalism reveal a lack of understanding. Is only a government-owned hotel able to make capital improvements?

Wichita, again, fails at government transparency

At a time when Wichita city hall needs to cultivate the trust of citizens, another incident illustrates the entrenched attitude of the city towards its citizens. Despite the proclamations of the mayor and manager, the city needs a change of attitude towards government transparency and citizens’ right to know.

Wichita per capita income not moving in a good direction

Despite its problematic nature, per capita income in Wichita is used as a benchmark for the economy. It’s not moving in the right direction. As Wichita plans its future, leaders need to recognize and understand its recent history.

Uber, not for Wichita

A novel transportation service worked well for me on a recent trip to Washington, but Wichita doesn’t seem ready to embrace such innovation.

For Kansas’ Roberts, an election year conversion?

A group of like-minded Republican senators has apparently lost a member. Is the conservative voting streak by Pat Roberts an election year conversion, or just a passing fad?

June

Wichita property taxes compared

An ongoing study reveals that generally, property taxes on commercial and industrial property in Wichita are high. In particular, taxes on commercial property in Wichita are among the highest in the nation.

Government employee costs in the states

The states vary widely in levels of state government and local government employees and payroll costs, calculated on a per-person basis. Kansas ranks high in these costs, nationally and among nearby states.

With new tax exemptions, what is the message Wichita sends to existing landlords?

As the City of Wichita prepares to grant special tax status to another new industrial building, existing landlords must be wondering why they struggle to stay in business when city hall sets up subsidized competitors with new buildings and a large cost advantage.

Wichita city council schools citizens on civic involvement

Proceedings of a recent Wichita City Council meeting are instructive of the factors citizens should consider if they want to interact with the council and city government at a public hearing.

Forget the vampires. Let’s tackle the real monsters.

Public service announcements on Facebook and Wichita City Channel 7 urge Wichitans to take steps to stop “vampire” power waste. But before hectoring people to introduce inconvenience to their lives in order to save small amounts of electricity, the city should tackle the real monsters of its own creation.

July

Wichita property taxes rise again

The City of Wichita is fond of saying that it hasn’t raised its mill levy in many years. But the mill levy has risen in recent years.

For Wichita leaders, novel alternatives on water not welcome

A forum on water issues featured a presentation by Wichita city officials and was attended by other city officials, but the city missed a learning opportunity.

For Wichita’s new water supply, debt is suddenly bad

Wichita city leaders are telling us we need to spend a lot of money for a new water source. For some reason, debt has now become a dirty word.

Pat Roberts, senator for corporate welfare

Two years ago United States Senator Pat Roberts voted in committee with liberals like John Kerry, Chuck Schumer, and Debbie Stabenow to pass a bill loaded with wasteful corporate welfare.

August

Charles Koch: How to really turn the economy around

Writing in USA Today, Charles Koch offers insight into why our economy is sluggish, and how to make a positive change.

Wichita airport statistics updated

As the Wichita City Council prepares to authorize funding for Southwest Airlines, it’s worth taking a look at updated statistics regarding the airport.

Wichita sales tax hike would hit low income families hardest

Analysis of household expenditure data shows that a proposed sales tax in Wichita affects low income families in greatest proportion, confirming the regressive nature of sales taxes.

Welcome back, Gidget

Gidget stepped away for a few months, but happily she is back writing about Kansas politics at Kansas GOP Insider (wannabe).

September

Wichita planning results in delay, waste

Wichita plans an ambitious road project that turns out to be too expensive, resulting in continued delays for Wichita drivers and purchases of land that may not be needed.

‘Transforming Wichita’ a reminder of the value of government promises

When Wichita voters weigh the plausibility of the city’s plans for spending proposed new sales tax revenue, they should remember this is not the first time the city has promised results and accountability.

Fact-checking Yes Wichita: NetApp incentives

In making the case that economic development incentives are necessary and successful in creating jobs, a Wichita campaign overlooks the really big picture.

Arrival of Uber a pivotal moment for Wichita

Now that Uber has started service in Wichita, the city faces a decision. Will Wichita move into the future by embracing Uber, or remain stuck in the past?

Fact-checking Yes Wichita: Boeing incentives

The claim that the “city never gave Boeing incentives” will come as news to the Wichita city officials who dished out over $600 million in subsidies and incentives to the company.

Beechcraft incentives a teachable moment for Wichita

The case of Beechcraft and economic development incentives holds several lessons as Wichita considers a new tax with a portion devoted to incentives.

For Kansas budget, balance is attainable

A policy brief from a Kansas think tank illustrates that balancing the Kansas budget while maintaining services and lower tax rates is not only possible, but realistic.

To Wichita, a promise to wisely invest if sales tax passes

Claims of a reformed economic development process if Wichita voters approve a sales tax must be evaluated in light of past practice and the sameness of the people in charge. If these leaders are truly interested in reforming Wichita’s economic development machinery and processes, they could have started years ago using the generous incentives we already have.

For Wichita Chamber’s expert, no negatives to economic development incentives

An expert in economic development sponsored by the Wichita Metro Chamber of Commerce tells Wichita there are no studies showing that incentives don’t work.

Water, economic development discussed in Wichita

Dr. Art Hall, Executive Director of the Center for Applied Economics at the University of Kansas School of Business, presented his “Thoughts on Water and Economic Development” at the Wichita Pachyderm Club Friday, September 19, 2014

Stuck in the box in Wichita, part one

To pay for a new water supply, Wichita gives voters two choices and portrays one as bad. But the purportedly bad choice is the same choice the city made over the last decade to pay for the last big water project. We need out-of-the-box thinking here.

October

Kansas economy has been underperforming

Those who call for a return to the economic policies of past Kansas gubernatorial administrations may not be aware of the performance of the Kansas economy during those times.

Union Station TIF provides lessons for Wichita voters

A proposed downtown Wichita development deserves more scrutiny than it has received, as it provides a window into the city’s economic development practice that voters should peek through as they consider voting for the Wichita sales tax.

A simple step towards government transparency in Wichita

Kansas law requires publication of certain notices in newspapers, but cities like Wichita could also make them available in other ways that are easier to use.

While Wichita asks for new taxes, it continues to spend and borrow

The City of Wichita says it doesn’t have enough revenue for things like street maintenance and transit, but continues to borrow for spending on new projects.

Wichita debt levels seen to rise

As part of the campaign for a proposed Wichita sales tax, the city says that debt is bad. But actions the city has taken have caused debt levels to rise, and projections are for further increases.

For Wichita, another economic development plan

The Wichita City Council will consider a proposal from a consultant to “facilitate a community conversation for the creation of a new economic development diversification plan for the greater Wichita region.” Haven’t we been down this road before?

In Wichita, pro-sales tax campaign group uses sales tax-exempt building as headquarters

While “Yes Wichita” campaigns for higher sales taxes, it operates from a building that received a special exemption from paying sales tax.

For Wichita Chamber of Commerce chair, it’s sales tax for you, but not for me

A Wichita company CEO applied for a sales tax exemption. Now as chair of the Wichita Metro Chamber of Commerce, he wants you to pay more sales tax, even on the food you buy in grocery stores.

Should Wichita expand a water system that is still in commissioning stage?

Should we be concerned about rushing a decision to expand a water production system that has not yet proven itself?

Wichita sends educational mailer to non-Wichitans, using Wichita taxes

Why is the City of Wichita spending taxpayer money mailing to voters who don’t live in the city and can’t vote on the issue?

Wichita to consider tax exemptions

A Wichita company asks for property and sales tax exemptions on the same day Wichita voters decide whether to increase the sales tax, including the tax on groceries.

November

In election coverage, The Wichita Eagle has fallen short

Citizens want to trust their hometown newspaper as a reliable source of information. The Wichita Eagle has not only fallen short of this goal, it seems to have abandoned it.

Kansas school spending visualization updated

There’s new data available from Kansas State Department of Education on school spending. I’ve gathered the data, adjusted it for the consumer price index, and now present it in this interactive visualization.

In Kansas, school employment rises again

For the fourth consecutive year, the number of teachers in Kansas public schools has risen faster than enrollment, leading to declining pupil-teacher ratios.

Richard Ranzau, slayer of cronyism

In Sedgwick County, an unlikely hero emerges in the battle for capitalism over cronyism.

Kansans still uninformed on school spending

As in the past, a survey finds Kansans are uninformed or misinformed on the level of school spending, and also on the direction of its change.

In Kansas, voters want government to concentrate on efficiency and core services before asking for taxes

A survey of Kansas voters finds that Kansas believe government is not operating efficiently. They also believe government should pursue efficiency savings, focus on core functions, and spend unnecessary cash reserves before cutting services or raising taxes.

Kansas cities should not unilaterally grant tax breaks

When Kansas cities grant economic development incentives, they may also unilaterally take action that affects overlapping jurisdictions such as counties, school districts, and the state itself. The legislature should end this.

City of Wichita State Legislative Agenda: Cultural Arts Districts

Wichita government spending on economic development leads to imagined problems that require government intervention and more taxpayer contribution to resolve. The cycle of organic rebirth of cities is then replaced with bureaucratic management.

December

City of Wichita State Legislative Agenda: Airfares

The City of Wichita’s legislative agenda regarding the Affordable Airfares subsidy program seems to be based on data not supported by facts.

Options for funding Wichita’s future water supply

Now that the proposed Wichita sales tax has failed, how should Wichita pay for a future water supply?

KU records request seen as political attack

A request for correspondence belonging to a Kansas University faculty member is a blatant attempt to squelch academic freedom and free speech.

Why is this man smiling?

In Wichita, the chair of the Wichita Metro Chamber of Commerce crafts a sweetheart deal for his company to the detriment of Wichita taxpayers.

Wichita Metro Chamber of Commerce: What is the attitude towards taxes?

Does the Wichita Metro Chamber of Commerce support free markets, capitalism, and economic freedom, or something else?

Will the next Wichita mayor advocate enforcing our ethics laws?

Wichita has laws that seem clear. But the city attorney said they don’t mean what they seem to say. Will our next mayor stand up for ethics?

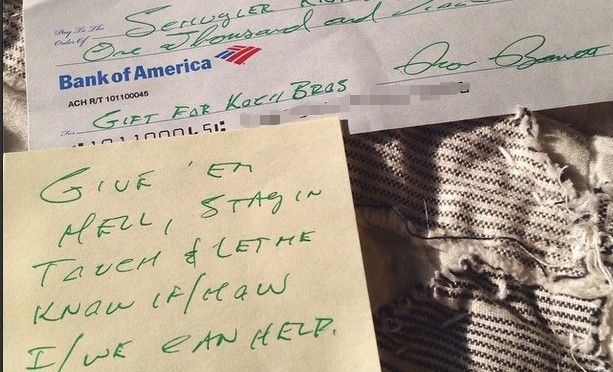

Campaign contribution stacking in Wichita

Those seeking favors from Wichita City Hall use campaign contribution stacking to bypass contribution limits. This has paid off handsomely for them, and has harmed everyone else.

Economic development in Wichita: Looking beyond the immediate

Decisions on economic development initiatives in Wichita are made based on “stage one” thinking, failing to look beyond what is immediate and obvious.

Economic development in Sedgwick County

The issue of awarding an economic development incentive reveals much as to why the Wichita-area economy has not grown.

Very often, local chambers of commerce support

Very often, local chambers of commerce support