Tag: Economic freedom

-

Wichita Chamber speaks on county spending and taxes

The Wichita Metro Chamber of Commerce urges spending over fiscally sound policies and tax restraint in Sedgwick County.

-

Government creates obstacles to progress

“Overcoming obstacles can be a difficult challenge even on a level playing field. We need to change the rigged system that favors the politically connected over the hardworking, honest citizen,” writes Charles Koch in a recent edition of Perspectives.

-

A big-picture look at the EDA

While praising the U.S. Economic Development Administration for a small grant to a local institution, the Wichita Eagle editorial board overlooks the big picture.

-

‘Love Gov’ humorous and revealing of government’s nature

A series of short videos from the Independent Institute entertains and teaches lessons at the same time.

-

Economic freedom leads to better lives for all

Economic freedom, in countries where it is allowed to thrive, leads to better lives for people as measured in a variety of ways. This is true for everyone, especially for poor people.

-

Are you in the top 1%?

Most Americans would be surprised to learn that they are, in fact, in the top one percent of income — when the entire world is considered. It is economic freedom in America that has been responsible for this high standard of living. But America’s ranking among the countries in economic freedom has declined, and may…

-

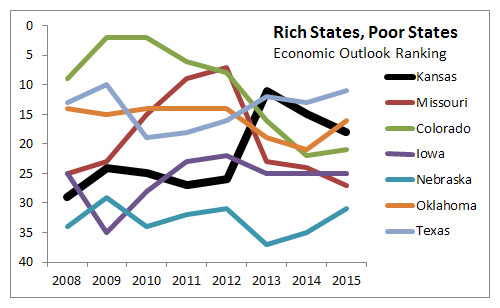

Rich States, Poor States, 2105 edition

In Rich States, Poor States, Kansas continues with middle-of-the-pack performance, and fell in the forward-looking forecast for the second year in a row.

-

Downtown Wichita deal shows some of the problems with the Wichita economy

In this script from a recent episode of WichitaLiberty.TV: A look at the Wichita city council’s action regarding a downtown Wichita development project and how it is harmful to Wichita taxpayers and the economy.

-

Huelskamp, Pompeo at top of Club for Growth scorecard

Kansans Tim Huelskamp and Mike Pompeo are among the eight U.S. House Members who scored 100 percent for 2014 on Club for Growth’s scorecard.

-

As lawmakers, Kansas judges should be selected democratically

While many believe that judges should not “legislate from the bench,” the reality is that lawmaking is a judicial function. In a democracy, lawmakers should be elected under the principle of “one person, one vote.” But Kansas, which uses the Missouri Plan for judicial selection to its highest court, violates this principle.

-

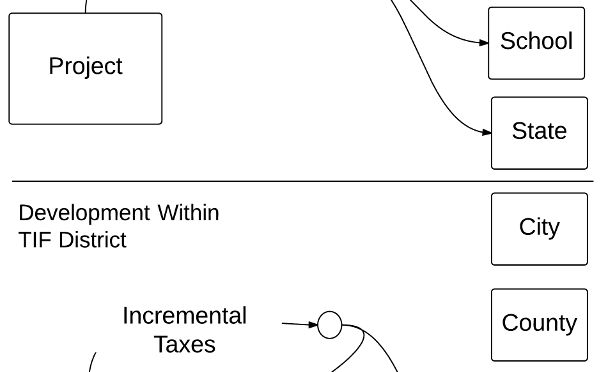

Wichita TIF projects: some background

Tax increment financing disrupts the usual flow of tax dollars, routing funds away from cash-strapped cities, counties, and schools back to the TIF-financed development. TIF creates distortions in the way cities develop, and researchers find that the use of TIF means lower economic growth.