Is there a relationship between marginal tax rates and tax dollars collected?

The top marginal tax rate — that’s the rate that applies to high income earners on most of their income — was above 90 percent during most of the 1950s. From 2003 to 2012 it was 35 percent, and is now 39.6 percent. Some see that as a lost opportunity. If we could return to the tax rates of the 1950s, they say, we could generate much more revenue for government.

The top marginal tax rate is the rate that applies to income. It’s not the same as what is actually paid. This fact is unknown or ignored by those who clamor for higher taxes on the rich.

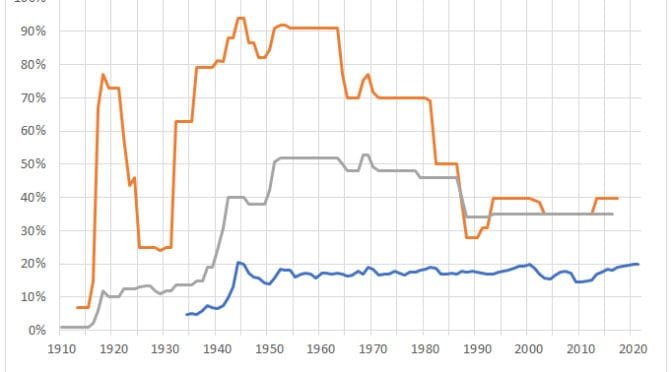

The top marginal tax rate has varied widely. But since World War II, the taxes actually collected, expressed as a percentage of gross domestic product, has been fairly constant. In 1952 the top tax rate was 92.0 percent, and income taxes paid as a percent of GDP was 18.5 percent. In 2007, for example, the top rate was 35.0 percent, and income taxes paid as a percent of GDP was 17.9 percent.

Try as we might, raising tax rates won’t generate higher revenues (as a percentage of gross domestic product), due to Hauser’s law.

W. Kurt Hauser explains in The Wall Street Journal: “Even amoebas learn by trial and error, but some economists and politicians do not. The Obama administration’s budget projections claim that raising taxes on the top 2% of taxpayers, those individuals earning more than $200,000 and couples earning $250,000 or more, will increase revenues to the U.S. Treasury. The empirical evidence suggests otherwise. None of the personal income tax or capital gains tax increases enacted in the post-World War II period has raised the projected tax revenues. Over the past six decades, tax revenues as a percentage of GDP have averaged just under 19% regardless of the top marginal personal income tax rate. The top marginal rate has been as high as 92% (1952-53) and as low as 28% (1988-90). This observation was first reported in an op-ed I wrote for this newspaper in March 1993. A wit later dubbed this ‘Hauser’s Law.’”

For many people, there is a direct relationship between tax rates and the amount of tax paid. For workers who earn a paycheck, there’s not much they can do to change the timing of their income, find tax shelters, or shift income to capital gains. When income tax rates rise, they have to pay more.

But people with high incomes can use these and other strategies to reduce the taxes they pay. In fact, there is an entire industry of accountants and lawyers to help people reduce their tax. Often — particularly in the past when top marginal rates were very high — investments and transactions were made solely for the purpose of avoiding taxes, not for productive economic benefit.

People react to changes in tax law. As tax rates rise, people seek to reduce their taxable income, and make investments in unproductive tax shelters. There is less incentive to work and invest. These are some of the reasons why tax hikes usually don’t generate the promised revenue.

But: High tax rates make the middle class feel better about paying their own taxes. With top tax rates of 90 percent, they may believe that the rich are paying a lot of tax. The middle class may take comfort in the fact that someone else is worse off. But that is based on the misconception that high tax rates mean rich people actually pay correspondingly higher tax.

Data is from The Tax Policy Center (TPC), a joint venture of the Urban Institute and Brookings Institution.