Category: Kansas state government

-

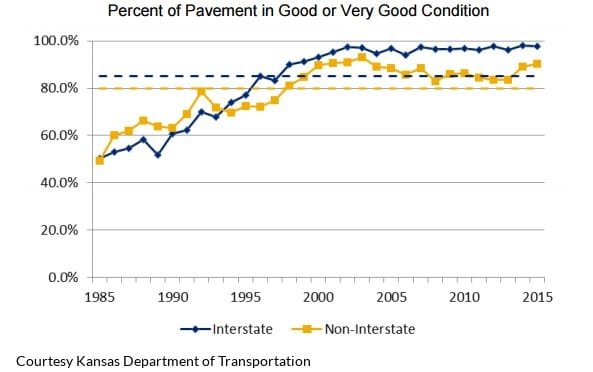

Kansas highway conditions

Has continually “robbing the bank of KDOT” harmed Kansas highways?

-

Kansas efficiency study released

An interim version of a report presents possibilities of saving the state $2 billion over five years.

-

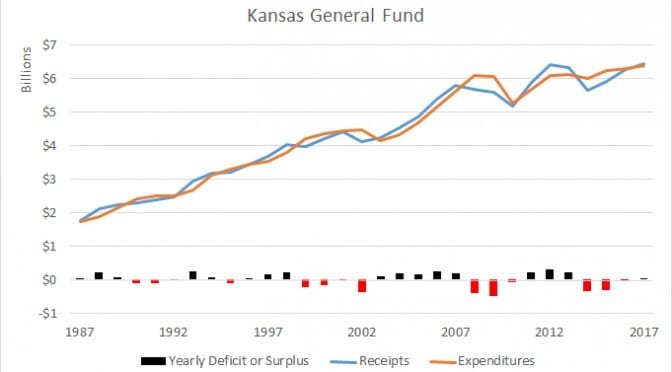

Kansas General Fund

Nominal dollar values. Click charts for larger versions.

-

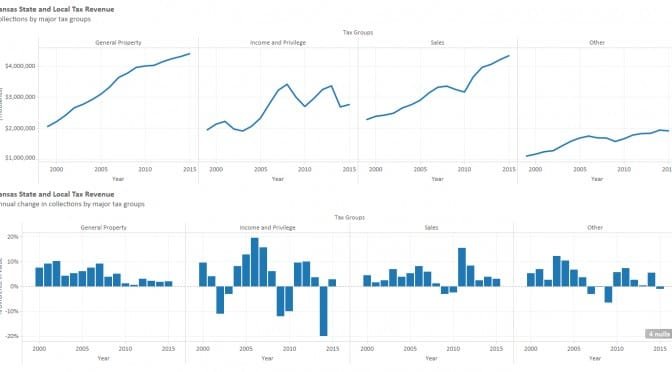

Kansas state and local tax revenue

Kansas state and local tax revenue

-

Kansas legislative resources

Citizens who want to be informed of the happenings of the Kansas Legislature have these resources available.

-

Availability of testimony in the Kansas Legislature

Despite having a website with the capability, only about one-third of standing committees in the Kansas Legislature are providing written testimony online.

-

Kansas General Fund

Click here for an updated version of this article.

-

A simple step for transparency in Kansas government

There exists a simple and inexpensive way for the Kansas Legislature to make its proceedings more readily available.

-

Kansas Senate President Susan Wagle

Kansas Senate President Susan Wagle spoke to members and guests of the Wichita Pachyderm Club on Friday December 18, 2015.

-

Kansas Legislature and Elections: 2016 Preview

Natalie Bright and Marlee Carpenter of Bright and Carpenter Consulting briefed the Wichita Pachyderm Club on the results of the 2015 session of the Kansas Legislature, and what to look for in next year’s session and elections.

-

CBPP pushes political viewpoint as economic analysis

The Center on Budget & Policy Priorities (CBPP) is at it again, pushing their political viewpoint disguised as economic analysis, writes Dave Trabert of Kansas Policy Institute.

-

Mike O’Neal, President of Kansas Chamber of Commerce

Mike O’Neal, President of Kansas Chamber of Commerce, spoke at the Wichita Pachyderm Club on October 9, 2015. His topic was “The Kansas Budget and Taxes: The 2015 Legislative Session and Looking Ahead to the 2016 Legislative Session.” This is an audio presentation.