The role of government in economic development should be limited to that of providing the framework necessary for equally protecting the rights and property of all citizens, through the rule of law, and not by acting as a participant in any activity that places it in a position of granting a competitive advantage to one group of citizens to the exclusion of all others. When government becomes an active participant in economic activity, it abdicates its proper role of providing the legal framework and physical security that is essential for natural coercive-free trade to flourish.

— John Todd

This week the Wichita City Council will consider another economic development incentive in the form of property tax abatements, this time to a company described as a “frequent flyer” in this regard. The council ought to take a few moments to explain to citizens why this action is necessary, if in fact it is.

The company requesting the tax breaks is Hijos, LLC/JR Custom Metal Products, Inc. This company has received several incentives like the one it is requesting this week. The incentive being considered is under the Economic Development Tax Exemption (“EDX”) program, which allows the city to forgive the payment of property taxes. In many instances, the issuance of Industrial Revenue Bonds is required by law in order to achieve tax forbearance. The EDX program does away with the often meaningless issuance of bonds, and lets the city do, in a streamlined fashion, what the applicant company wants: Permission to skip the payment of property taxes.

Based on a formula the city has established to guide the awarding of economic development strategies, this company qualifies to have 46 percent of the property taxes forgiven. Not 45 percent, and not 47 percent. Precisely 46 percent. This reminds me of the old saw that economists use a decimal point to remind us they have a sense of humor.

There are a number of questions that the city council ought to answer and explain to citizens before it grants this special treatment.

1. Since the incentive being considered is in the form of reduced property taxes, does this mean that property taxes in Wichita are a barrier to investment? A related question is whether the tax breaks are required to make the project economically feasible, or does the company simply want to avoid its share of the tax burden?

2. What distinguishes this company and these jobs from others that will be created this month in Wichita? Why do these jobs require a subsidy, and so many others do not?

3. When granting tax breaks like this, how does the city council explain that the tax burden is not being applied fairly and evenly to everyone? Related: If the theory of taxation is ________ (fill in the blank with your favorite theory), how does this tax exemption coexist with that theory?

4. Has the city checked with the overlapping jurisdictions that will be affected by the tax abatements? These would be Sedgwick County, the Wichita school district, and the State of Kansas. When Wichita grants a tax break, it also abates these taxes, without advice or consent. Notice is required, however.

5. If we really believe in this benefit to the city (and similar benefits to the county, school district, and state) as proclaimed by the cost-benefit studies, why doesn’t the city make more investments like this? Surely there are other worthy companies could expand if not for the burden of property taxes. And that’s what this contemplated action means, if we are to believe it is anything but cronyism and business welfare: Property taxes in Wichita are what prevented this company from expanding. Erase 46 percent of the company’s property tax burden, and it is able to make new capital investment and jobs.

If it really is so easy to promote economic growth and job creation, we should be doing things like this at every city council meeting. Several times each meeting, don’t you think?

I also wonder about companies that made expansions as did this applicant company, but did not ask the city for incentives. What is their secret?

The reality is that these economic development incentives don’t work, if we are willing to consider the effect on everyone in the region instead of just this applicant company, and also if we are willing to consider the long-term effects instead of only the immediate.

Peer-reviewed research on economic development incentives — this is the conclusion of all the studies — find business location decisions to be favorably influenced by targeted tax incentives. That’s not a surprise. But the research also finds that the benefits to the communities that offered them were less than their costs.

If peer-reviewed research is not convincing, let’s take a look at the record of Wichita.

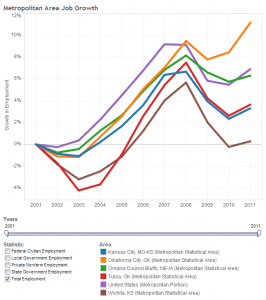

Here is a chart of job growth for Wichita, the nation, and our Visioneering peers. (Click it for a larger version, or click here for the interactive visualization, or here to watch a video.) The data shows that Wichita hasn’t been doing well.

So if we believe that an active role for government in economic development is best, we have to also recognize that our efforts aren’t working.

Leave a Reply