How does taxation differ in the states? There can be large differences.

The source of this data is the United States Census Bureau Annual Survey of State Government Tax Collections (STC). I gathered the data and performed some calculations:

- Adjusted dollar values for inflation,

- calculated per capita values for each state,

- calculated the difference between each state’s values and the national value, and

- created charts for several types of taxes.

This data is taxes captured by state governments only. Local taxes, such as a local property tax, are not in this data.

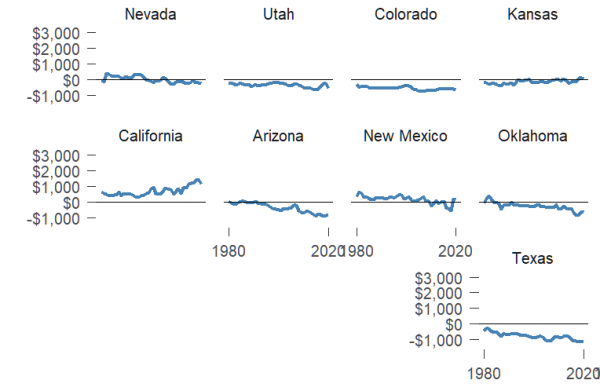

Since I show the difference between a state and the nation as a whole, it’s easy to spot high-tax states. In the nearby example from the chart for total taxes, we see that the line for Kansas is very close to zero. This means that taxes collected by the Kansas state government are nearly the same as for all states taken together, on a per-capita basis. Further, the trend in Kansas taxation follows the national trend closely.

From the same chart, we see that the line for California is above zero and rising, confirming California’s reputation as a high-tax state. This is nearly a mirror image of Texas.

Sometimes it takes a bit of local knowledge to interpret the data. For example, in the nearby example for Kansas property tax, there is a sharp jump. This is because in 2014, the state started to collect some property tax that was formerly collected by local school districts. Since the charts show only state government tax collections, we have the big jump in one year. In reality, taxation was shifted from one source to another, with little change in the total taxes paid.

Sometimes it takes a bit of local knowledge to interpret the data. For example, in the nearby example for Kansas property tax, there is a sharp jump. This is because in 2014, the state started to collect some property tax that was formerly collected by local school districts. Since the charts show only state government tax collections, we have the big jump in one year. In reality, taxation was shifted from one source to another, with little change in the total taxes paid.

It is interesting to see differences in neighboring states. Perhaps the most striking is Oregon and Washington. Oregon has no sales tax, while Washington has no income tax.

Following, a selection of charts for important tax types. Alaska and North Dakota have large differences from the other states, so I have omitted them. Also, this series does not have data for the District of Columbia.

Leave a Reply