Tag: Wichita city government

-

‘Yes Wichita’ co-chairs serve up contradicting plans for sales tax revenue

At two forums on the proposed Wichita sales tax, leaders of the “Yes Wichita” group provided contradicting visions for plans for economic development spending, and for its oversight.

-

Another Wichita sales tax forum

On Wednesday October 29 KCTU Television held a televised debate on the issue of the proposed one cent per dollar Wichita sales tax.

-

Wichita sales tax forum

The League of Women Voters — Wichita Metro held a lunchtime forum on the issue of the proposed one cent per dollar Wichita sales tax.

-

In Wichita, the public deserves and should demand answers

From Kansas Senator Michael O’Donnell, a discussion of issues surrounding the proposed Wichita one cent per dollar sales tax. O’Donnell served on the Wichita City Council for nearly two years before resigning to serve in the senate.

-

Wichita wants to expand water project, but abandons its website

As the City of Wichita recommends voters spend $250 million on the expansion of a water project, the project’s accompanying website was abandoned, and has now disappeared.

-

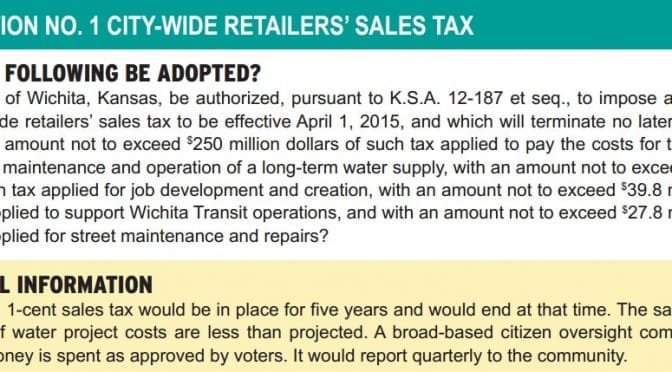

Proposed Wichita sales tax won’t satisfy needs, appetites

The proposed Wichita sales tax does little to address the city’s delinquent infrastructure maintenance gap. Despite this, there are rumors of another sales tax next year for quality of life items.

-

To pay for a new Wichita water supply, are there other choices?

To pay for a new Wichita water supply, the city gives voters two choices. Either (a) vote for a sales tax, or (b) the city will issue long-term debt and the city will have to pay an additional $221 million in interest expense. Are there alternatives?

-

What is the purpose of a new Wichita water supply?

What is Wichita gaining with a new water supply? Is a new supply needed for basic uses such as household, commercial, and industrial?

-

Has the Wichita ASR system proven its worth in production?

I expressed my concerns regarding things I had recently learned, which is that we’ve cut expectations for ASR production in half. Also, ASR is still in commissioning stage.