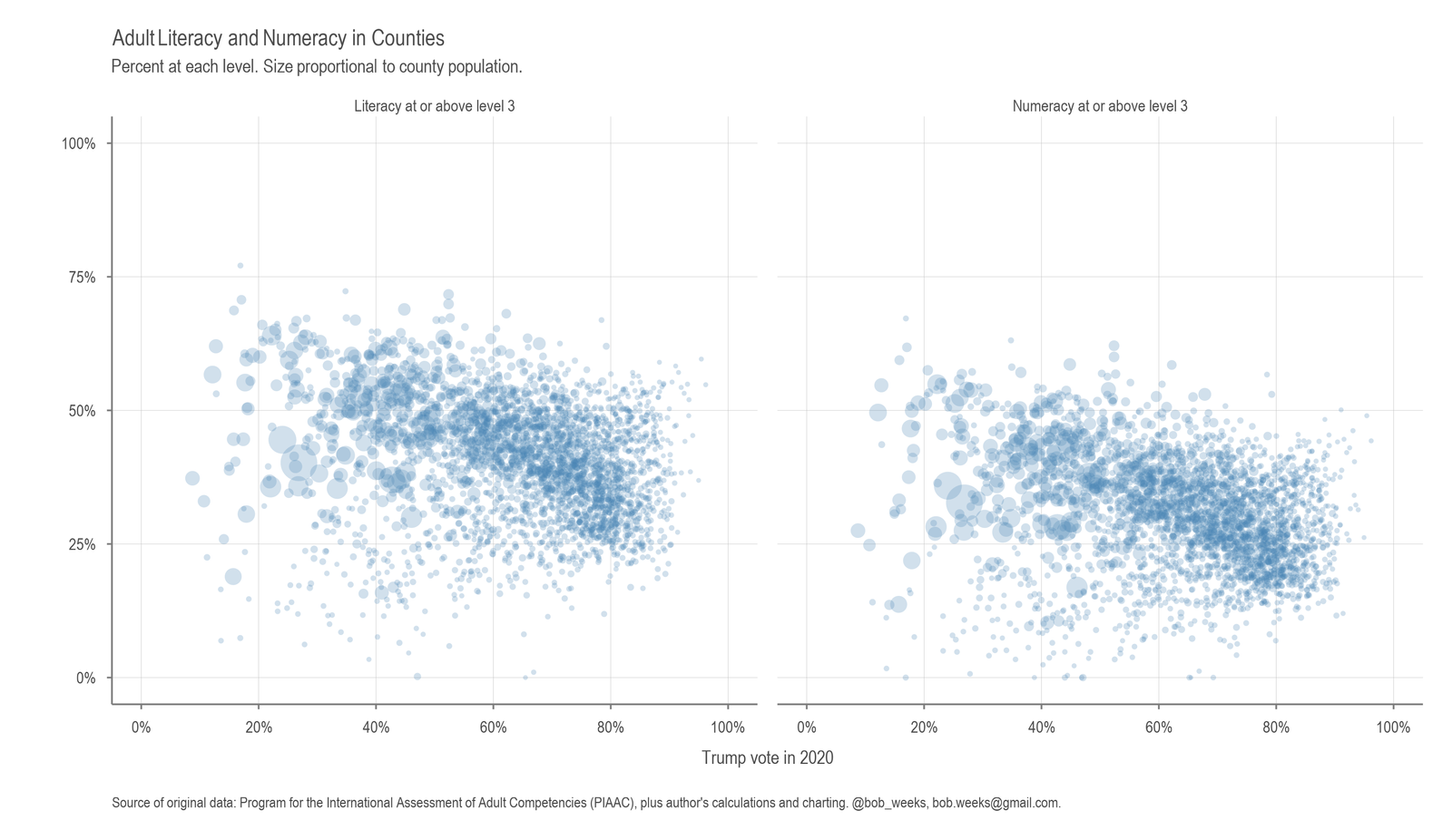

Analyzing literacy and numeracy rates in counties alongside political sentiment.

PIAAC (the Program for the International Assessment of Adult Competencies) defines different levels for adult skills in literacy and numeracy, ranging from below Level 1 up to Level 5. Level 3 is often considered a baseline or minimum desired level of proficiency for dealing with the demands of everyday life and work in a modern society. In more detail:

Level 3 in Literacy: At Level 3, tasks typically require integrating, interpreting, or synthesizing information from dense or lengthy texts. Individuals can identify important details, make some inferences, and navigate moderate complexity in reading materials.

Level 3 in Numeracy: At Level 3, tasks may require multiple steps and the interpretation of numerical information in various formats (e.g., tables, charts, or text). Individuals can handle somewhat more complex calculations, interpret data, and apply reasoning to solve problems in real-life contexts (budgeting, scheduling, analyzing simple graphs, etc.).

When a chart shows the share of adults “at or above Level 3,” it means the percentage of people who reach at least this medium-range skill level. Individuals below Level 3 may struggle more with everyday tasks — like understanding multi-paragraph instructions or making sense of typical quantitative information — whereas those at or above Level 3 can manage those tasks more successfully.

I gathered county-level data from PIAAC and plotted it along with the percent of voters in the county that chose Donald Trump in 2020. The PIAAC data is for 2017. I also asked ChatGPT to help me explain the chart. (Click chart for larger)

These two scatterplots each show U.S. counties as bubbles, where:

- Horizontal axis (x-axis): The percentage of votes cast for Donald Trump in 2020 for each county.

- Vertical axis (y-axis): The percentage of adults in the county who score “at or above level 3” in either literacy (left chart) or numeracy (right chart).

- Bubble size: Proportional to the county’s population. Larger circles represent more populous counties.

In other words, each point corresponds to a county. The position on the x-axis shows how strongly that county voted for Trump, while the position on the y-axis shows the share of adults who have at least level-3 skills in literacy or numeracy (based on data from PIAAC). Some key takeaways:

- Negative relationship: In both charts, you can see that as the percentage of Trump votes increases (moving right on the x-axis), the average proportion of adults scoring at or above level 3 in literacy/numeracy tends to go down. In other words, there’s a negative association between Trump’s vote share and higher literacy/numeracy skills in these data.

Wide spread but a clear pattern: While there is a cluster around the middle, many points in the lower-right quadrant indicate that counties with higher Trump vote shares often have a smaller share of adults at or above level 3. Meanwhile, counties with lower Trump vote shares (points farther left on the x-axis) tend to show higher percentages of adults meeting level-3 thresholds.

Bubble sizes and population: Larger circles often appear to the left (that is, in counties where Trump’s vote share was lower) and frequently have higher literacy/numeracy. These big circles represent large, more populous counties. Conversely, many smaller circles — which represent less populous counties — are distributed across the rest of the charts, including in areas where a higher share of votes went to Trump.

Overall, the charts illustrate that — within these data — counties that leaned more heavily toward Trump in the 2020 election are on average associated with somewhat lower proportions of adults at or above a level-3 threshold in literacy or numeracy, and vice versa.