Tag: United States government

-

WichitaLiberty.TV: Michael Tanner of Cato Institute on deficits, debt, and entitlements

In this episode of WichitaLiberty.TV: Michael Tanner of the Cato Institute talks about his new book “Going for Broke: Deficits, Debt, and the Entitlement Crisis.” Episode 90, broadcast August 2, 2015.

-

‘Love Gov’ humorous and revealing of government’s nature

A series of short videos from the Independent Institute entertains and teaches lessons at the same time.

-

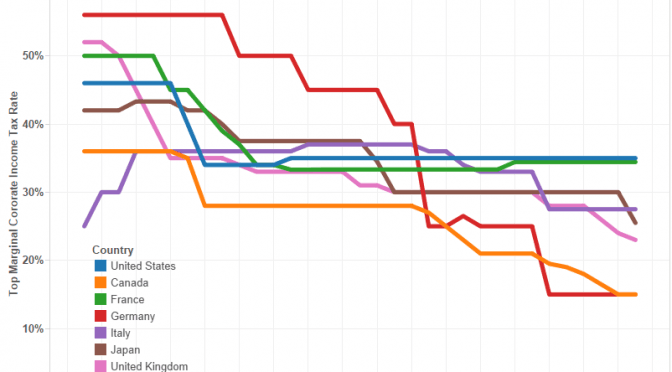

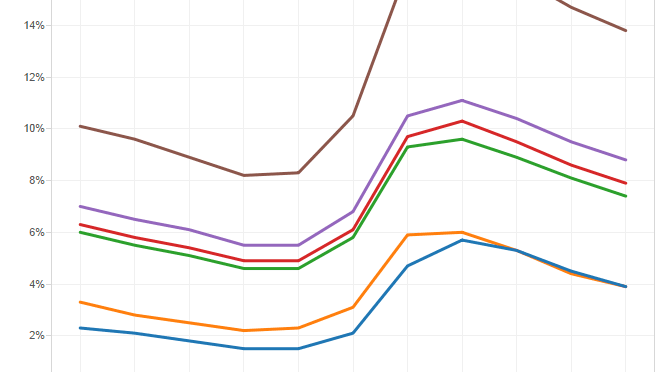

Corporate income tax rates in U.S. and other countries

Over the past two decades most large industrial countries have reduced their corporate income tax rates. Two countries, however, stand out from this trend: France and The United States.

-

WichitaLiberty.TV: United States Congressman Mike Pompeo

Congressman Mike Pompeo talks about risks to America from overseas, Benghazi, congressional scorecards, the Grant Return for Deficit Reduction Act, and labeling food with genetically engineered ingredients.

-

Corporate income tax rates in U.S. do not help our economy

Over the past two decades most large industrial countries have reduced their corporate income tax rates. Two countries, however, stand out from this trend: France and The United States.

-

Kansas was an earmark donor state

The practice of federal earmark spending was not kind to Kansas, as data shows Kansas was an earmark donor state.

-

For Kansas Senator Roberts, earmark reform not worthy of his vote

Kansas Senator Pat Roberts promotes his fiscal conservatism, but failed to vote in favor of earmark reform in a recent close vote.

-

Corporate income tax rates in U.S. are self-defeating

Over the past two decades most large industrial countries have reduced their corporate income tax rates. Two countries, however, stand out from this trend: France and The United States.

-

Voice for Liberty Radio: U.S. Rep. Mike Pompeo on Benghazi, Ukraine, and Boko Haram and the continuing threat of Islamic terrorism

United States Representative Mike Pompeo of Wichita has been appointed to the Select Committee on the Events Surrounding the 2012 Terrorist Attack in Benghazi. I spoke with him today in his Wichita office on this topic and a few others.

-

Club for Growth scorecards

I’ve gathered Congressional scorecards from Club for Growth for all years available and present them in an interactive visualization.

-

Alternative measures of unemployment

Besides the official unemployment rate that is the topic of news each month, the Bureau of Labor Statisticstracks and publishes five other series