The top takeaway of the Congressional Budget Office Monthly Budget Review for August 2020 is that the deficit for the month is smaller than last August. But there are details.

Sometimes it pays to read the fine print. Otherwise, you may receive a false impression. Here is the monthly budget review for August 2020, which is the eleventh month of fiscal year 2020:

The federal budget deficit in August 2020 was $198 billion, CBO estimates, $3 billion less than the deficit in August of last year. However, that comparison is distorted by shifts in the timing of certain payments in both years that had opposite effects on the August deficit in their respective years.

Because September 1, 2019, fell on a weekend, federal payments totaling about $52 billion were made in August rather than in September of that year (increasing the deficit in August). A similar shift, of $57 billion, occurred this year, but from August into July, reducing the August 2020 deficit. Without those timing shifts, the deficit this August would have been $106 billion (or 72 percent) larger than in the same month last year. Outlays for unemployment compensation contributed significantly to the deficit this August, accounting for about half of the increase in government spending (excluding the timing shifts). (emphasis added)

The full report is at Monthly Budget Review for August 2020.

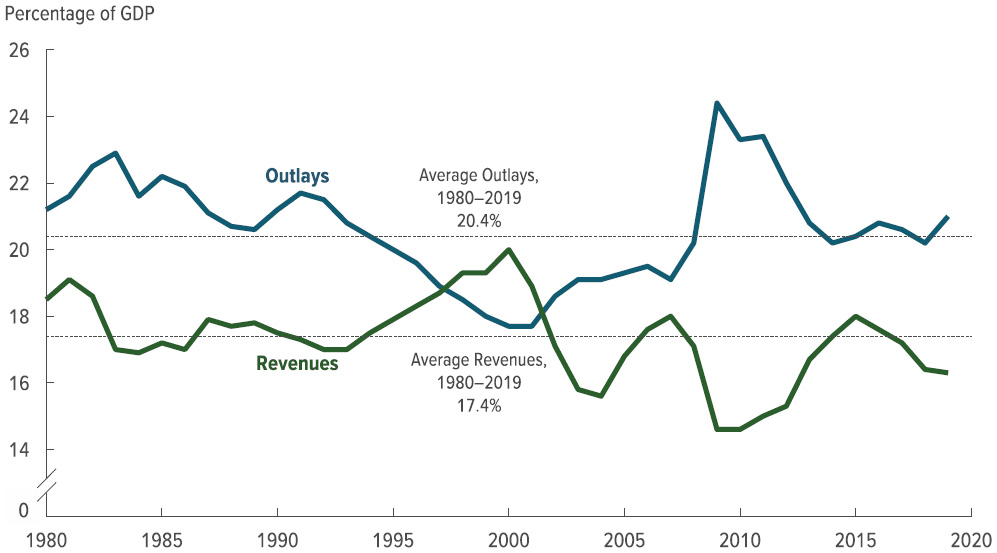

As can be seen in the nearby chart, the deficit for fiscal year 2020 was tracking closely the deficit for the prior year. Then came spending on the pandemic. (The full report has an interactive version of the chart.)

But duplicating the budgetary performance, deficit-wise, of fiscal 2019 is not a positive accomplishment. As CBO reported earlier: “In fiscal year 2019, which ended on September 30, the federal budget deficit totaled $984 billion — $205 billion more than the shortfall recorded in 2018. The deficit increased to 4.6 percent of the nation’s gross domestic product (GDP) in 2019, up from 3.8 percent in 2018 and 3.5 percent in 2017. As a result, federal debt held by the public rose to 79.2 percent of GDP, up from 77.4 percent at the end of fiscal year 2018.” (emphasis added)