For April 2023, Kansas tax revenue was 14.7 percent less than April 2022, and 2.3 percent less than estimated. Collections for fiscal year 2023 after ten months are 4.9 percent greater than the prior year. (more…)

Tag: Taxation

Say no to special tax treatment, again and again

In Kansas, a company seeks to avoid paying property and sales taxes, again. (more…)

Kansas Tax Revenue, March 2023

For March 2023, Kansas tax revenue was 11.3 percent higher than March 2022. Collections for fiscal year 2023 after nine months are 9.5 percent greater than the prior year, and 9.5 percent above estimates. (more…)

Total State Taxes

Total State Taxes

Dollars per resident, adjusted for inflation. State taxes only. (more…)

Kansas Tax Revenue, February 2023

For February 2023, Kansas tax revenue was 9.4 percent higher than February 2022. Collections for fiscal year 2023 after eight months are 9.2 percent greater than the prior year. (more…)

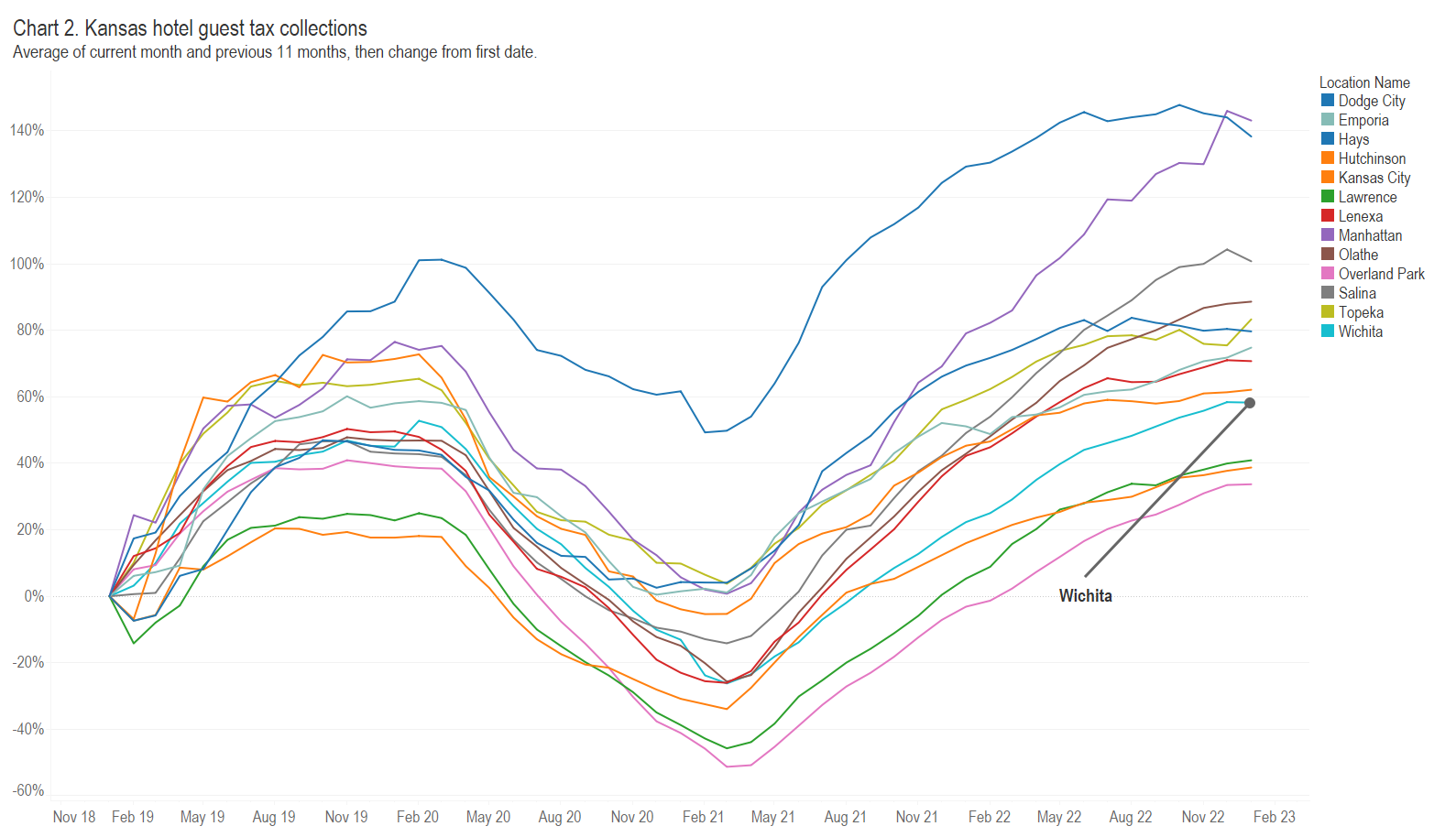

Updated: Kansas hotel guest tax collections

Kansas hotel guest tax collections presented in an interactive visualization. Updated with data through January 2023. (more…)

Kansas Tax Revenue, January 2023

For January 2023, Kansas tax revenue was 10.8 percent higher than January 2022. Collections for fiscal year 2023 after seven months are 9.2 percent greater than the prior year. (more…)

Kansas Tax Revenue, December 2022

For December 2022, Kansas tax revenue was 21.9 percent higher than December 2021. Collections for fiscal year 2023 after six months are 8.8 percent greater than the prior year. (more…)

Kansas Tax Revenue, November 2022

For November 2022, Kansas tax revenue was 2.5 percent higher than November 2021. Collections for fiscal year 2023 after five months are 5.4 percent greater than the prior year. (more…)