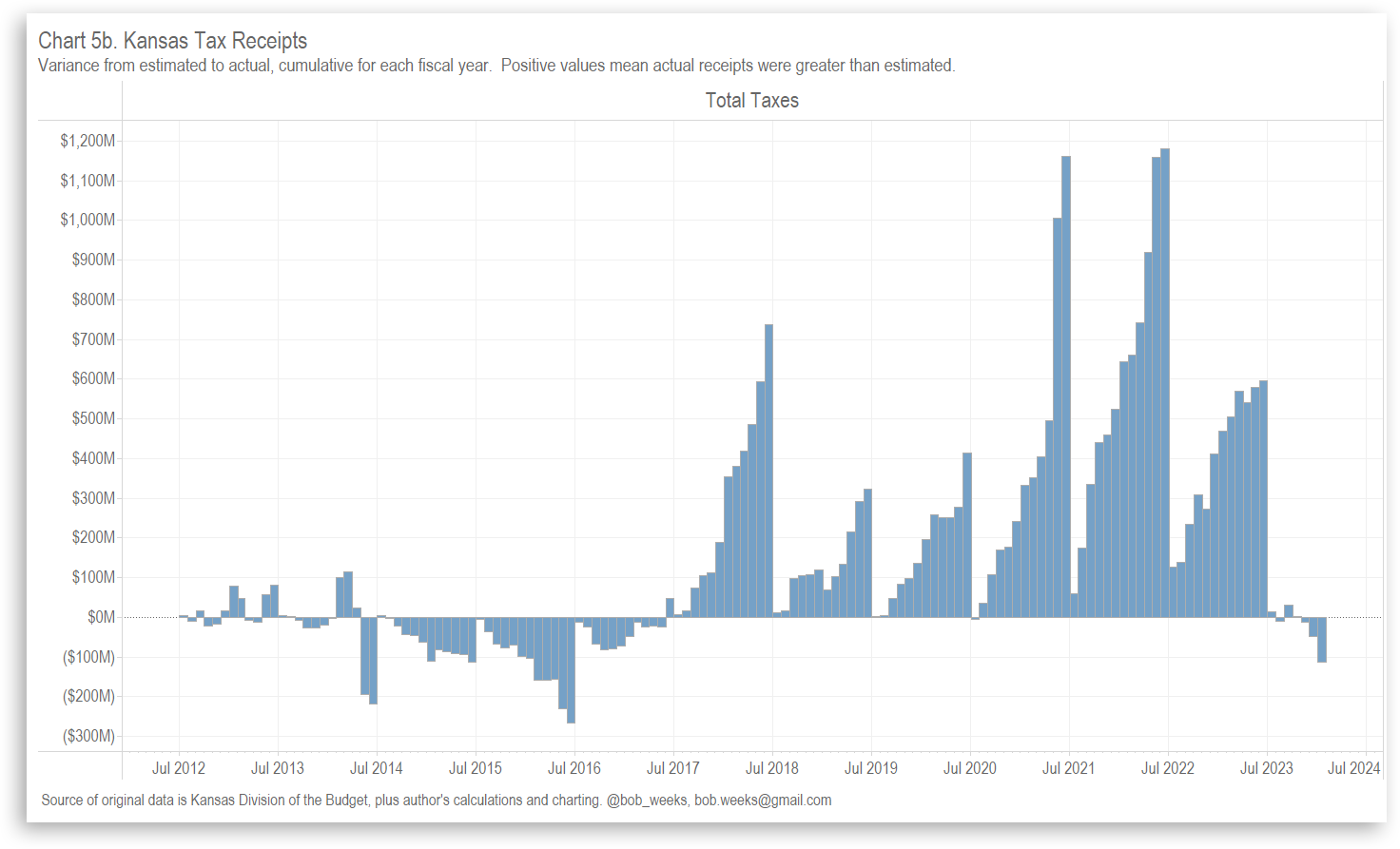

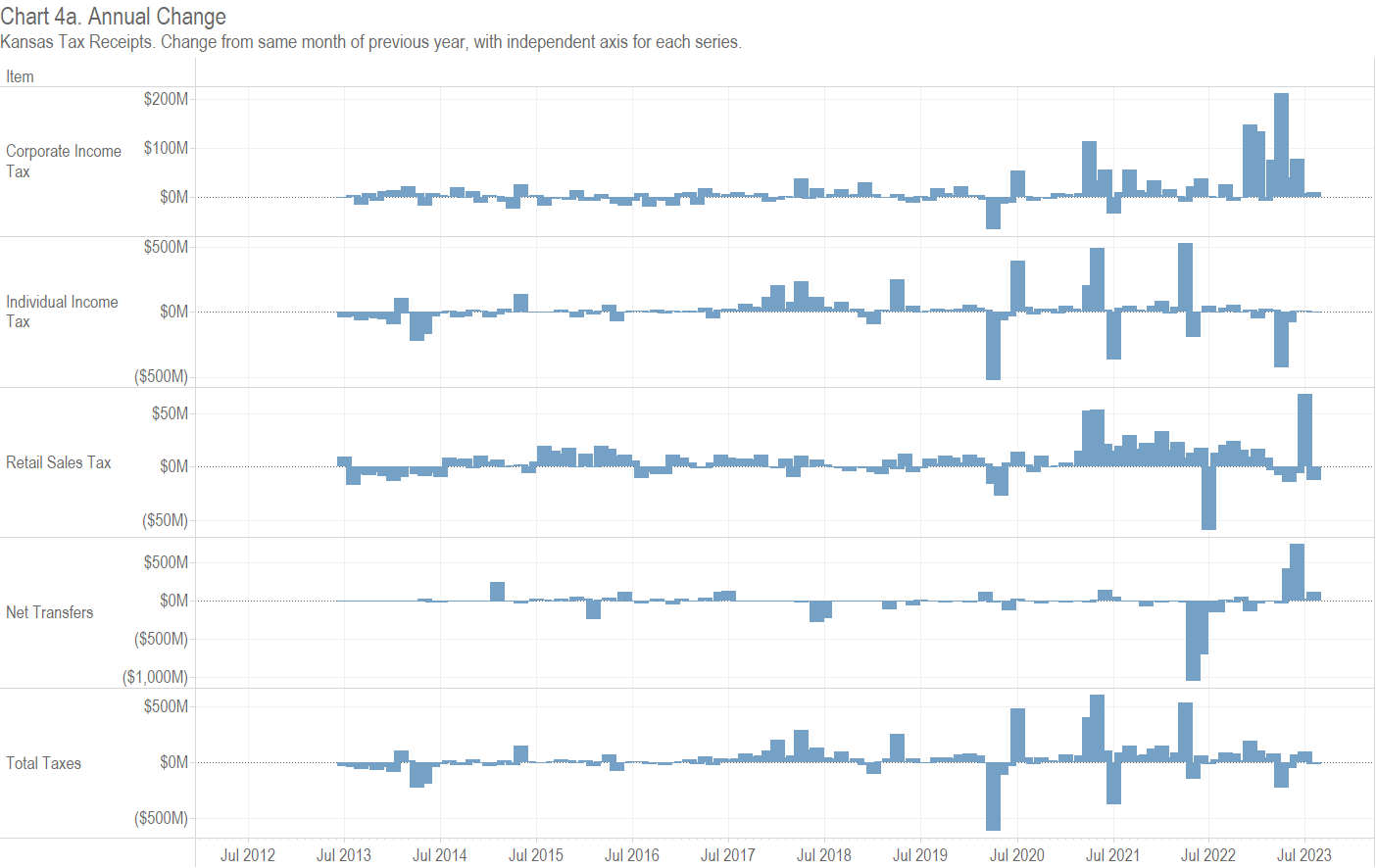

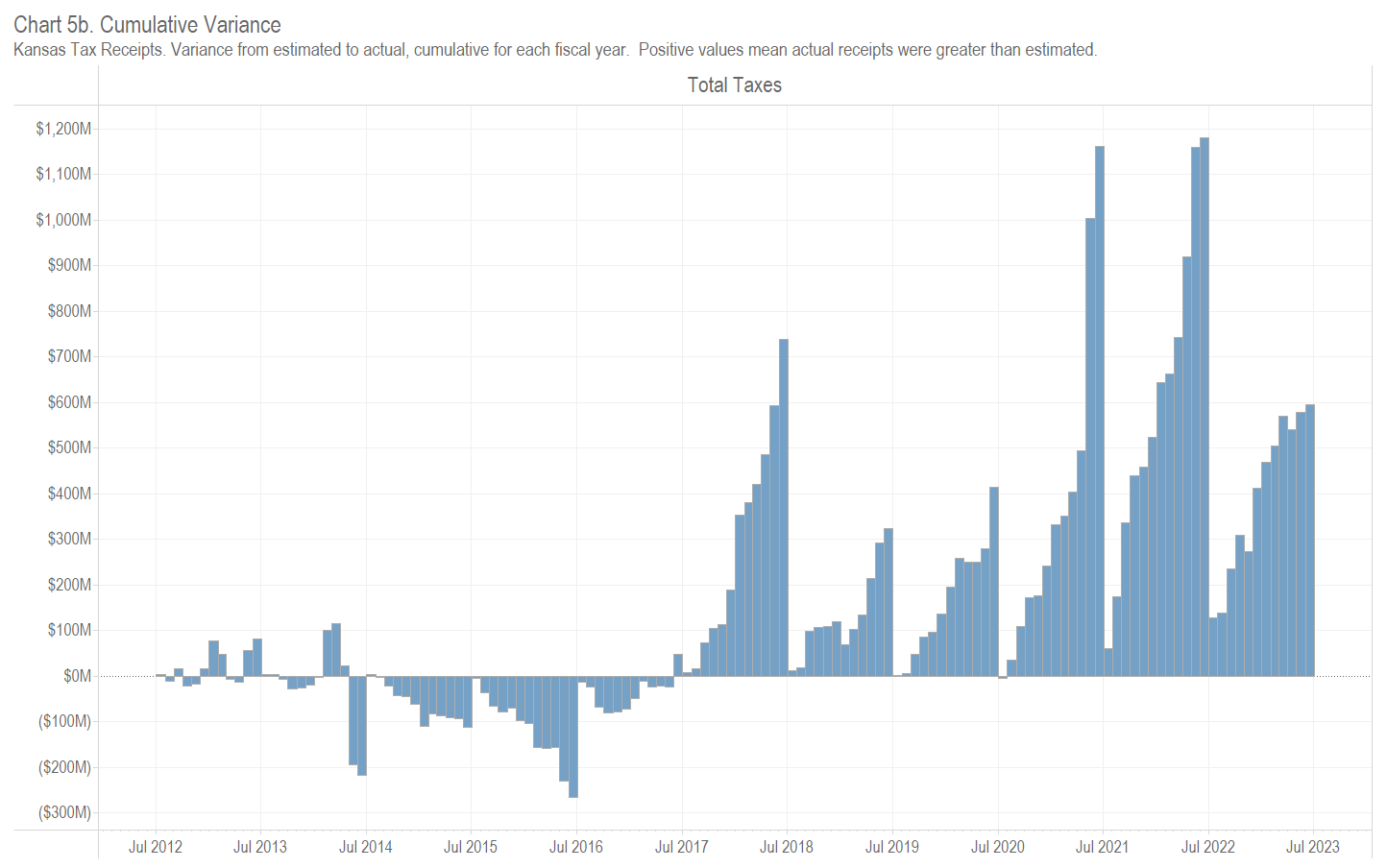

For January 2024, Kansas tax revenue was 11.3 percent lower than January 2023, and 6.5 percent lower than estimated. (more…)

Tag: Taxation

Kansas Tax Revenue, December 2023

For December 2023, Kansas tax revenue was 3.8 percent lower than December 2022, and 3.4 percent lower than estimated. (more…)

Kansas Tax Revenue, October 2023

For October 2023, Kansas tax revenue was 7.4 percent lower than October 2022, and 4.1 percent lower than estimated. (more…)

Kansas Tax Revenue, September 2023

For September 2023, Kansas tax revenue was 3.2 percent lower than September 2022, and 4.4 percent higher than estimated. (more…)

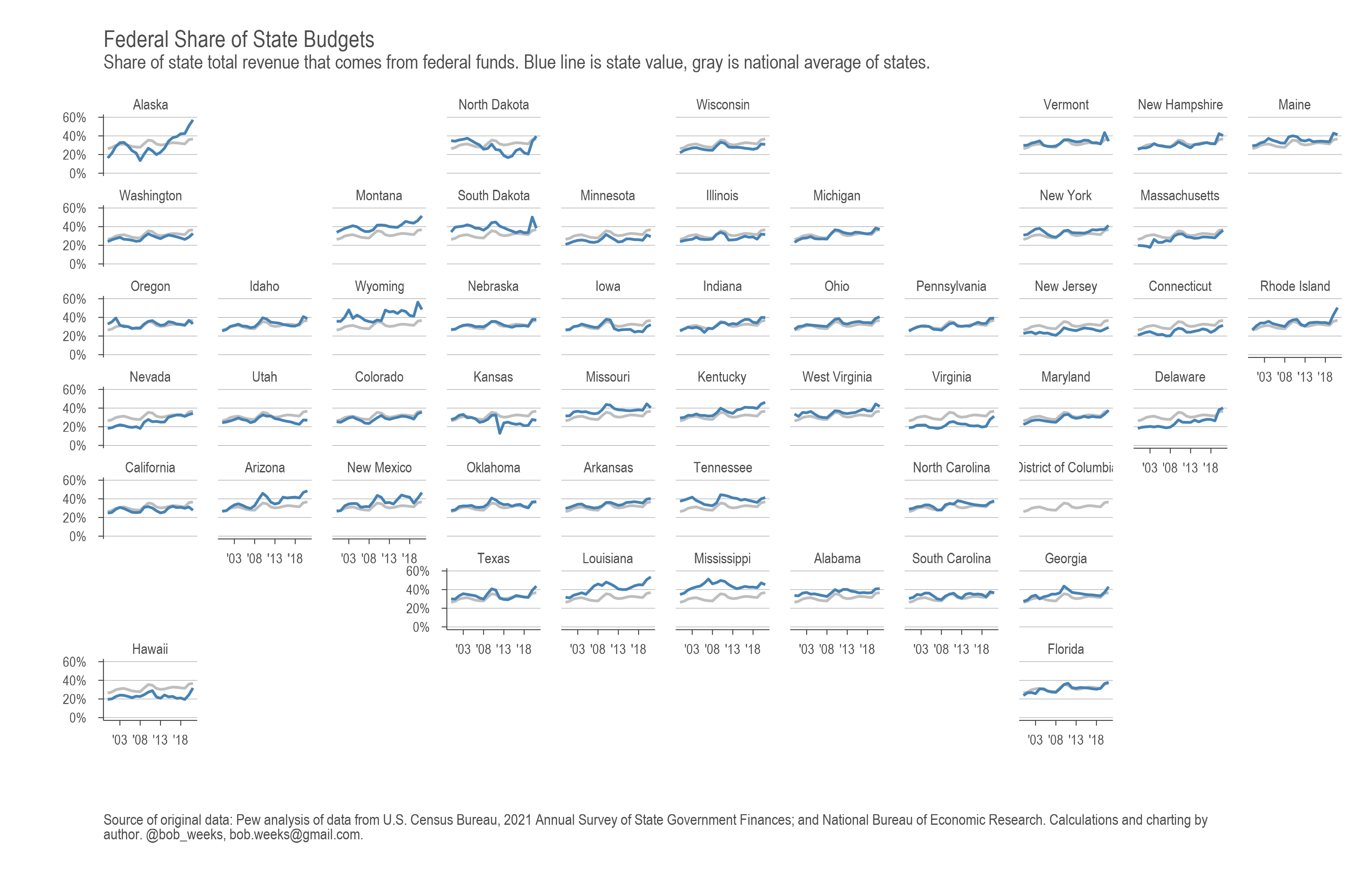

Federal Share of State Budgets

The share of state revenue from federal sources varies widely among states. (more…)

Kansas Tax Revenue, August 2023

For August 2023, Kansas tax revenue was 1.9 percent lower than August 2022, and 3.7 percent less than estimated. (more…)

Kansas Tax Revenue, July 2023

For July 2023, Kansas tax revenue was 16.2 percent higher than July 2022, and 2.1 percent more than estimated. (more…)

Kansas Tax Revenue, June 2023

For June 2023, Kansas tax revenue was 7.6 percent higher than June 2022, and 1.8 percent more than estimated. Collections for fiscal year 2023 after twelve months are 4.1 percent greater than the prior year. (more…)

Kansas Tax Revenue, May 2023

For May 2023, Kansas tax revenue was 5.8 percent less than May 2022, and 4.7 percent more than estimated. Collections for fiscal year 2023 after eleven months are 3.8 percent greater than the prior year. (more…)