Tag: Sedgwick county government

-

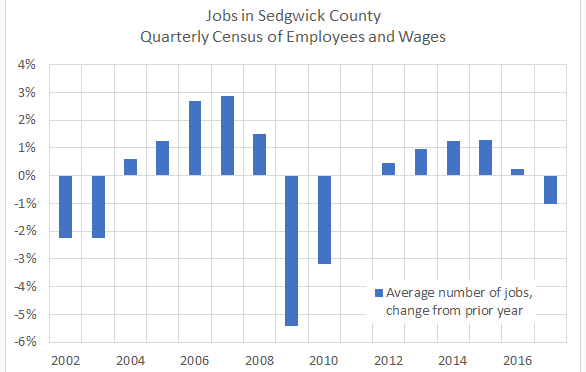

Sedgwick County jobs

Sedgwick County had fewer jobs in 2017 than in 2016.

-

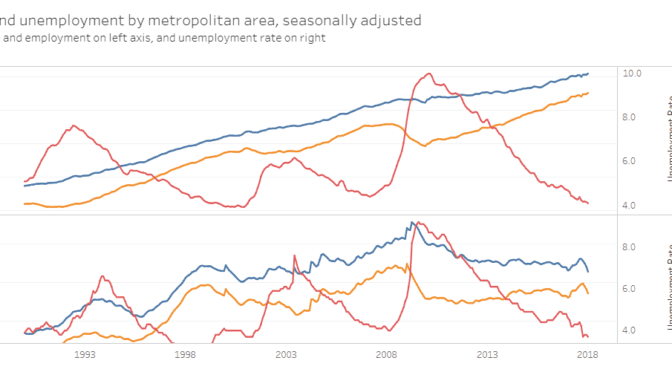

Wichita unemployment rate falls

For April 2018, the unemployment rate in the Wichita metropolitan area fell, and the number of jobs grew.

-

Wichita in ‘Best Cities for Jobs 2018’

Wichita continues to decline in economic vitality, compared to other areas.

-

Wichita metropolitan area population in context

The growth of population in Wichita compared to other areas.

-

Wichita unemployment rate falls

The unemployment rate in the Wichita metropolitan area fell. So too did the number of jobs.

-

Intrust Bank Arena loss for 2017 is $4,222,182

As in years past, a truthful accounting of the finances of Intrust Bank Arena in downtown Wichita shows a large loss.

-

Employment in metropolitan areas

An interactive visualization of labor force, employment, and unemployment rate for all metropolitan areas in the United States.

-

Sedgwick County’s David Dennis on economic development

Following the Wichita Mayor, the Chair of the Sedgwick County Commission speaks on economic development.

-

Greater Wichita Partnership asks for help

Wichita’s economic development agency asks for assistance in developing its focus and strategies.