Tag: Mark Parkinson

-

Under Goossen, Left’s favorite expert, Kansas was admonished by Securities and Exchange Commission

The State of Kansas was ordered to take remedial action to correct material omissions in the state’s financial statements prepared under the leadership of Duane Goossen.

-

Kansas school spending and achievement

From Dr. Walt Chappell, a discussion of Kansas school spending. Chappell served on the Kansas State Board of Education from 2009 to 2012.

-

Beechcraft incentives a teachable moment for Wichita

The case of Beechcraft and economic development incentives holds several lessons as Wichita considers a new tax with a portion devoted to incentives.

-

SEC orders Kansas to stop doing what it did under Sebelius and Parkinson

The Securities and Exchange Commission found that Kansas mislead bond investors. It ordered the state to implement reforms, which it has.

-

Women for Kansas voting guide should be read with caution

If voters are relying on a voter guide from Women for Kansas, they should consider the actual history of Kansas taxation and spending before voting.

-

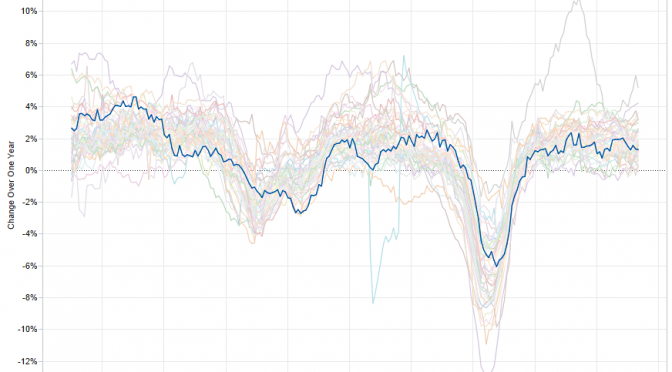

Job growth in the states and Kansas

Let’s ask critics of current Kansas economic policy if they’re satisfied with the Kansas of recent decades.

-

Two versions of the Kansas income tax cuts

There are two versions of the Kansas income tax cuts: The Media version and the reality, writes Steve Anderson of Kansas Policy Institute.

-

Shortchanging Kansas schoolchildren, indeed

This month the New York Times published an editorial that advocates for more spending on Kansas public schools. While getting some facts wrong, the piece also overlooks the ways that Kansas schoolchildren are truly being shortchanged.

-

Kansas school employment trends are not what you’d expect

Kansas school employment statistics don’t reflect the doom-and-gloom stories you may have heard from Kansas political leaders and newspaper editorialists.

-

Kansas Democrats mailing again, and wrong again

It’s campaign season, and mail pieces are flying fast, replete with more Kansas Democratic errors.

-

Kansas Democrats wrong on school spending

While the Kansas Democratic Party apologized last week for misstating candidates’ voting record on two mail pieces, the party and its candidates continue a campaign of misinformation regarding spending on Kansas public schools.

-

Dangers of texting while driving: Are laws the solution?

Texting while driving is dangerous. But the government solution — passing laws against texting while driving — haven’t worked, and some states have experienced an increase in crashes after implementing texting bans.