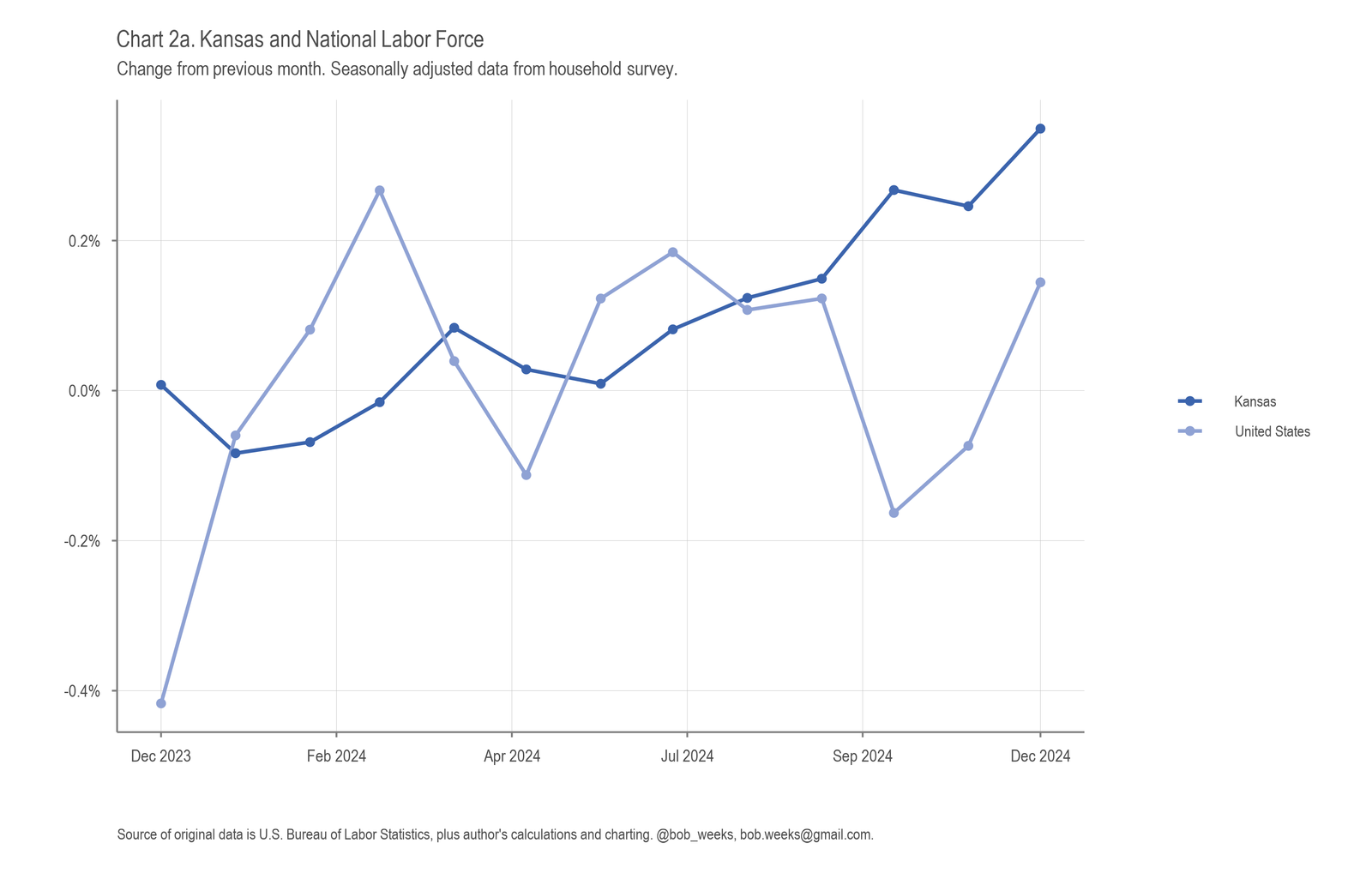

In Kansas in December 2024, the labor force rose, the number of jobs was rose, and the unemployment rate rose compared to the previous month, all by modest amounts. Over the year, Kansas is near the midpoint of states in job growth. (more…)

Tag: Kansas state government

Articles about Kansas, its government, and public policy in Kansas.

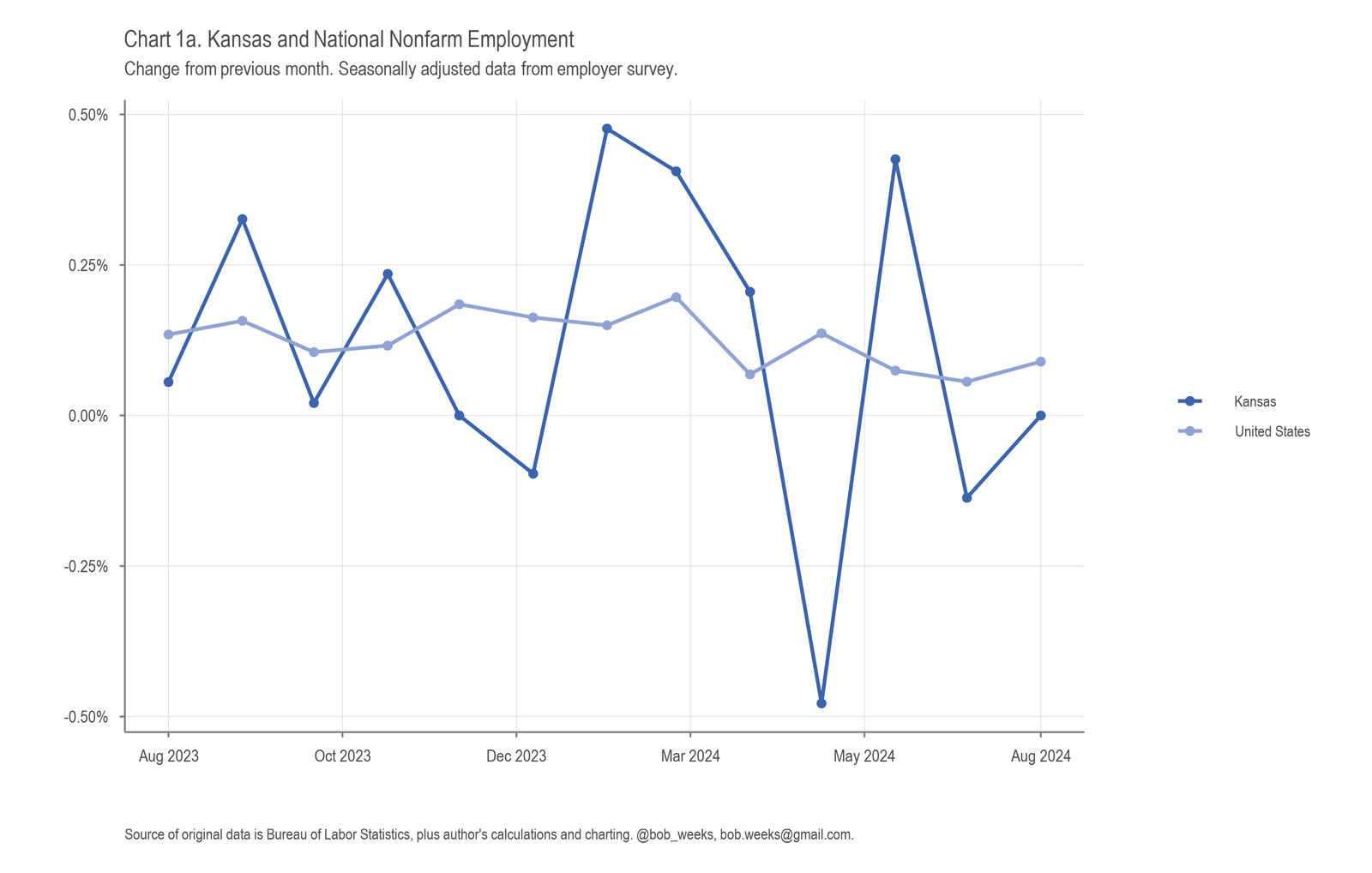

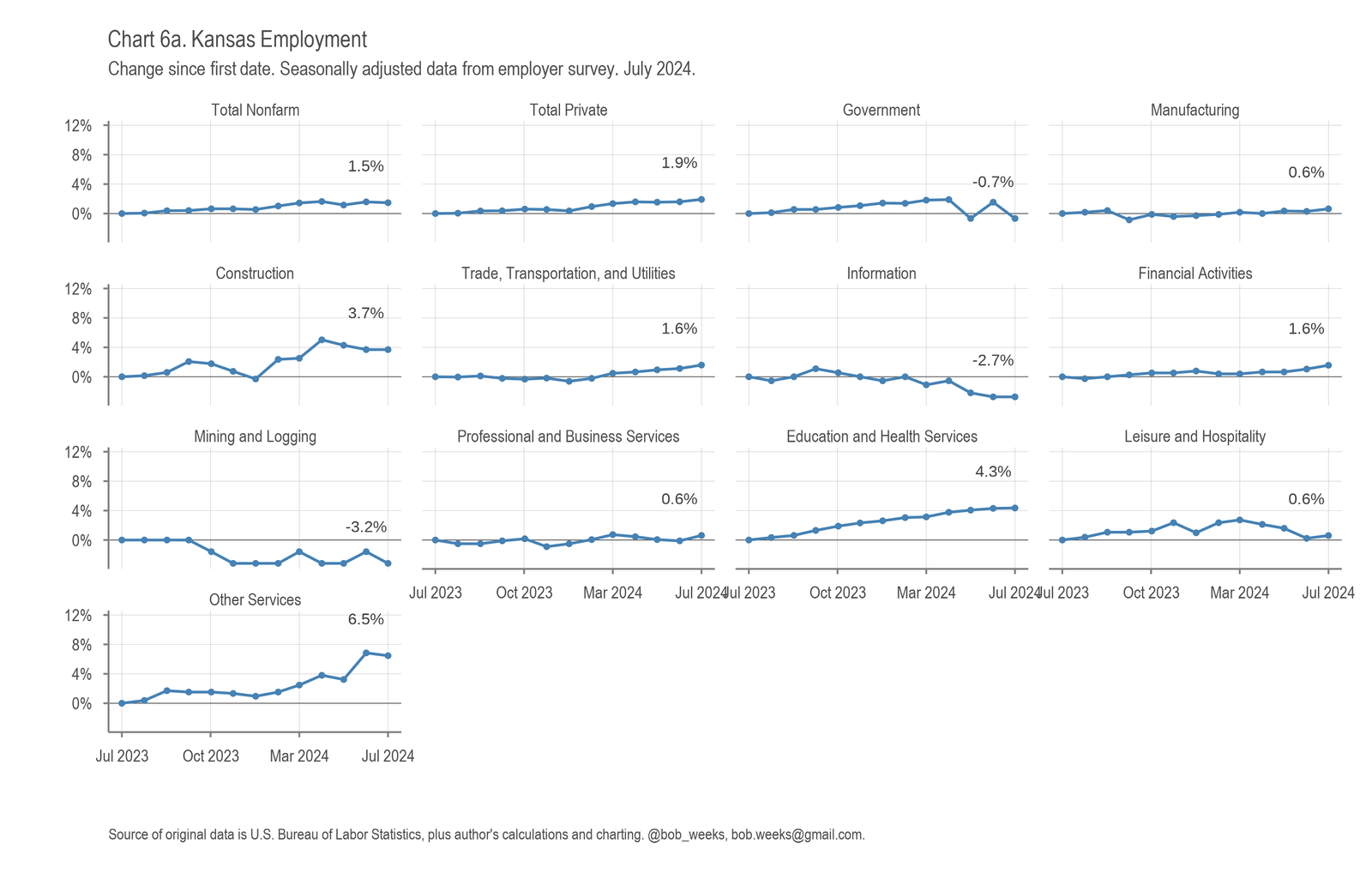

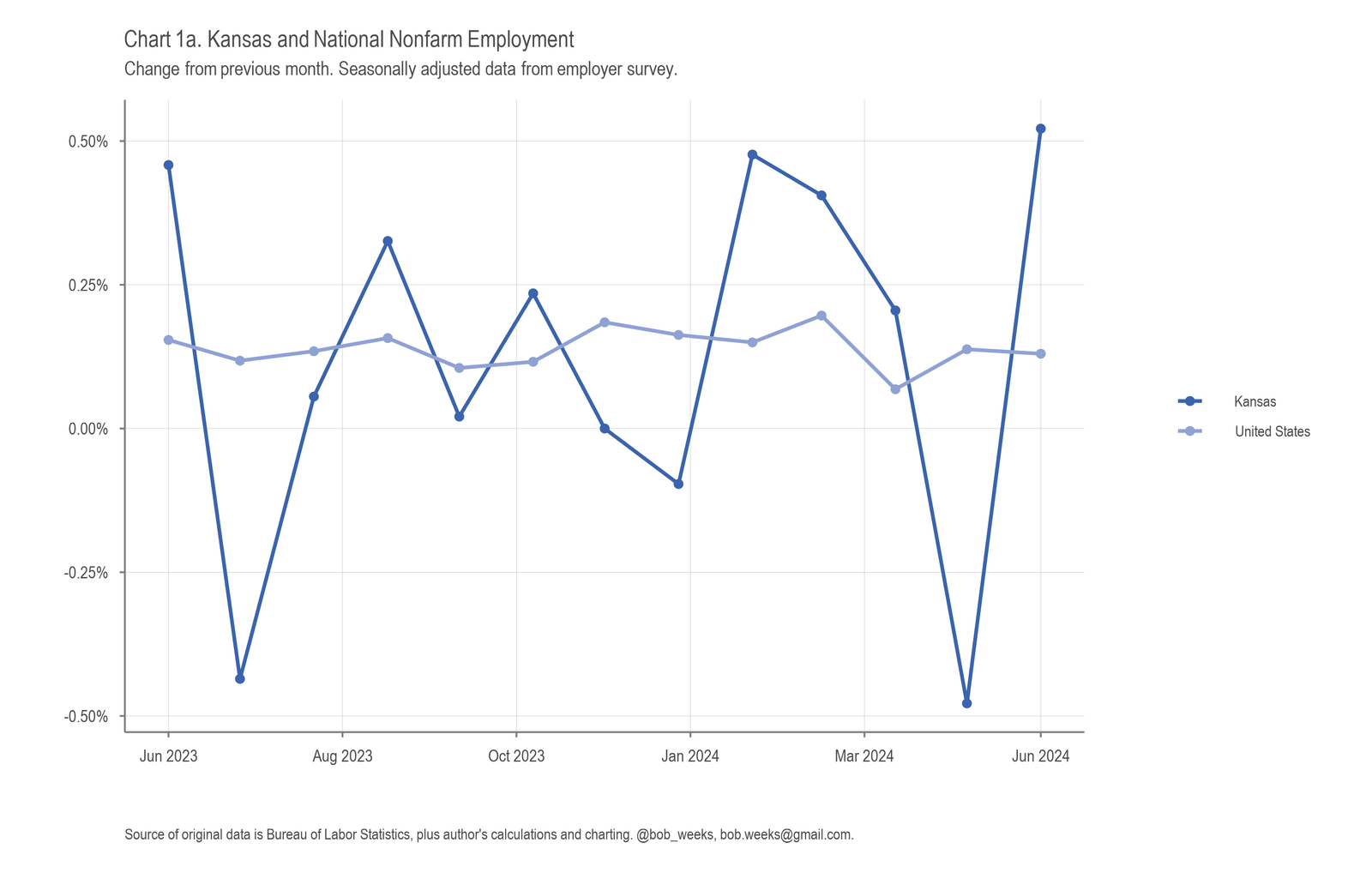

Kansas Employment Situation, August 2024

In Kansas in August 2024, the labor force rose, the number of jobs was unchanged, and the unemployment rate rose compared to the previous month. Over the year, Kansas is near the midpoint of states in job growth. (more…)

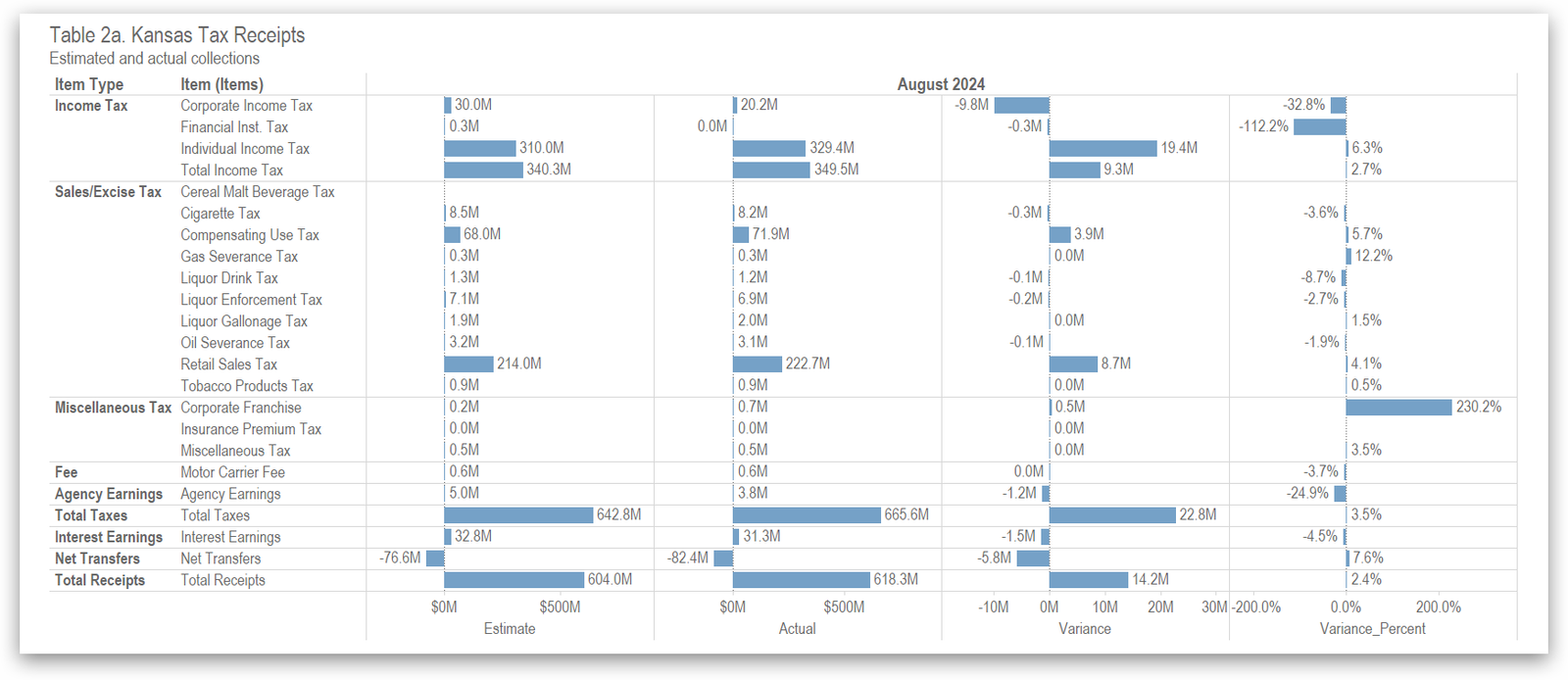

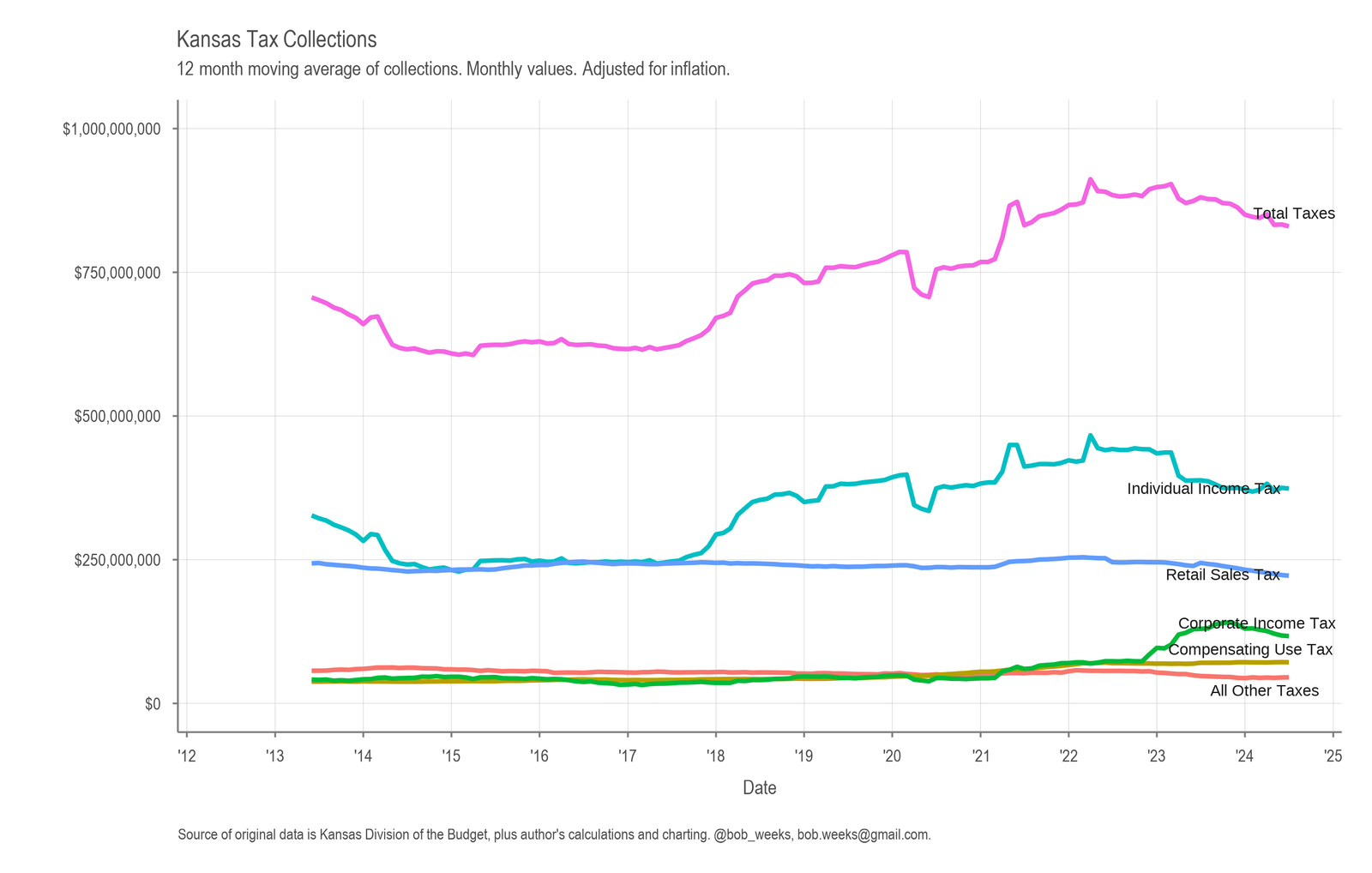

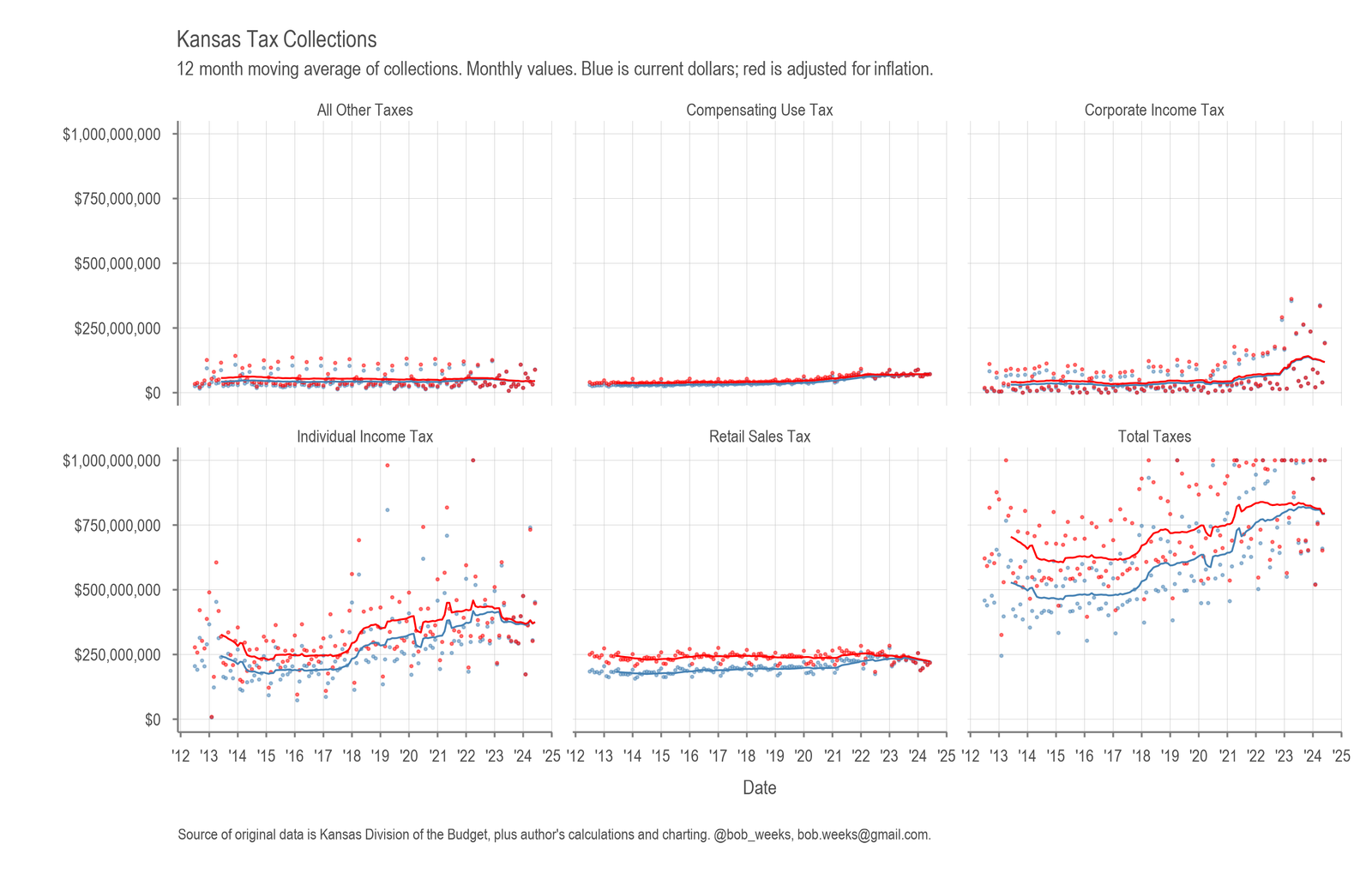

Kansas Tax Revenue, August 2024

For August 2024, Kansas tax revenue was 4.0 percent higher than August 2023, and 3.5 percent higher than estimated. (more…)

Kansas Employment Situation, July 2024

In Kansas in July 2024, the labor force rose, the number of jobs fell, and the unemployment rate rose compared to the previous month. Over the year, Kansas is near the midpoint of states in job growth. (more…)

Kansas Tax Revenue, July 2024

For July 2024, Kansas tax revenue was 3.0 percent lower than July 2023, and 1.0 percent less than estimated. (more…)

Kansas Employment Situation, June 2024

In Kansas in June 2024, the labor force was steady, the number of jobs and the number of unemployed people rose, and the unemployment rate rose compared to the previous month. Over the year, Kansas is near the midpoint of states in job growth. (more…)

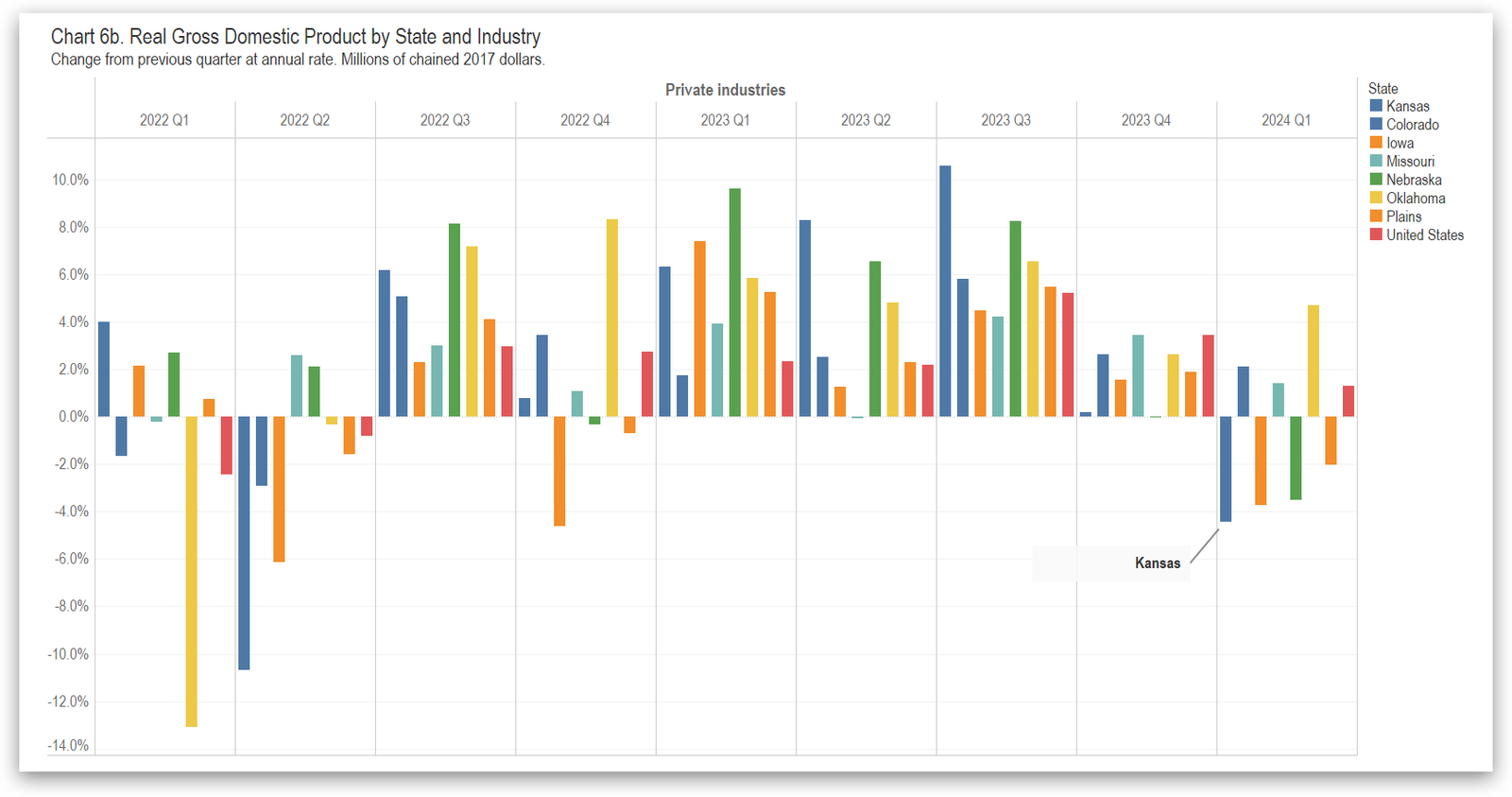

GDP in the States, First Quarter 2024

In the first quarter of 2024, the Kansas economy contracted at the annual rate of 3.9 percent. Real Gross Domestic Product increased in 39 states and the District of Columbia, ranging from 5.0 percent at an annual rate in Idaho to –4.2 percent in South Dakota. Kansas ranked forty-eighth. (more…)

Kansas Tax Revenue, June 2024

For June 2024, Kansas tax revenue was 3.9 percent higher than June 2023, and 2.4 percent higher than estimated. For the just-completed fiscal year, collections were lower by 1.5 percent than the previous year, and 2.0 percent lower than estimated. (more…)

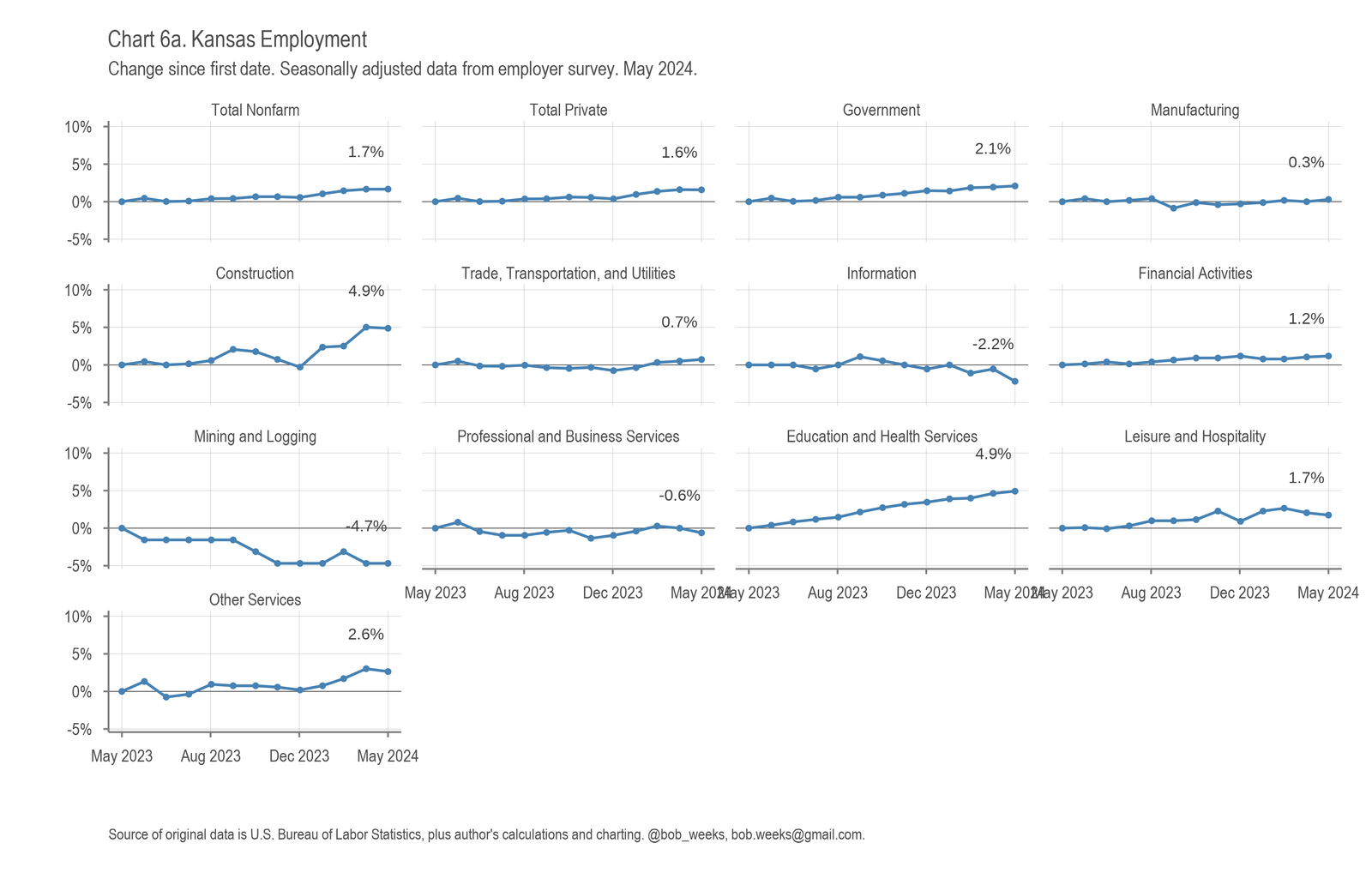

Kansas Employment Situation, May 2024

In Kansas in May 2024, the labor force, the number of jobs, and the unemployment rate changed little compared to the previous month. Over the year, Kansas is near the midpoint of states in job growth. (more…)