Tag: Kansas State Department of Education

-

Kansas school standards remain high

Kansas school assessment standards remain at a high level, compared to other states. This is a welcome change from the past.

-

What is the real problem at Wichita Southeast?

There is likely a different explanation for problems at a Wichita high schools from what we’ve been told by the school district and our newspaper.

-

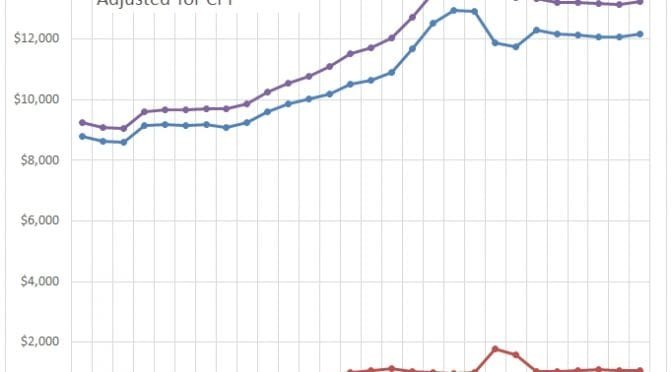

Kansas school spending

New data for spending in Kansas schools is available.

-

Kansas school fund balances

Kansas school fund balances rose this year, in both absolute dollars and dollars per pupil.

-

Deconstructing Don Hineman

Another Kansas legislator explains why raising taxes was necessary. So he says.

-

Shocking News about Kansas Education!

Listening too often to Topeka politicians and administrators can leave a normal person feeling rather jaded, even used. Or maybe it’s the reporting, sometimes I just don’t know, writes Paul Waggoner.

-

Fake government spawns fake news

Discussions of public policy need to start from a common base of facts and information. An episode shows that both our state government and news media are not helping

-

Wrong direction for Wichita public schools

A letter in the Wichita Eagle illustrates harmful attitudes and beliefs of the public school establishment.

-

Kansas state school assessments

An interactive presentation of Kansas state school assessment scores at the state, district, and building levels.

-

Public education factbook for 2017

The fifth edition of data on public schools in Kansas is available.

-

Accountability in Kansas public schools

Critics of school choice say there is no accountability outside the traditional public schools. Here are the standards Kansas used to hold its schools accountable.

-

Kansas school employment

Kansas school employment rose slightly for the current school year, and ratios of employees to pupils fell, also slightly.