Tag: Kansas legislature

-

There Are No Good Reasons to Subsidize Stadiums. Governments Keep Doing It.

Despite decades of economic evidence showing that publicly funded sports stadiums fail to deliver promised benefits, governments continue to spend billions subsidizing wealthy team owners, often at the expense of taxpayers and public trust.

-

Say no to special tax treatment, again and again

In Kansas, a company seeks to avoid paying property and sales taxes, again.

-

State of the State in Kansas, 2022

This week saw competing assessments of Kansas and different visions for the future.

-

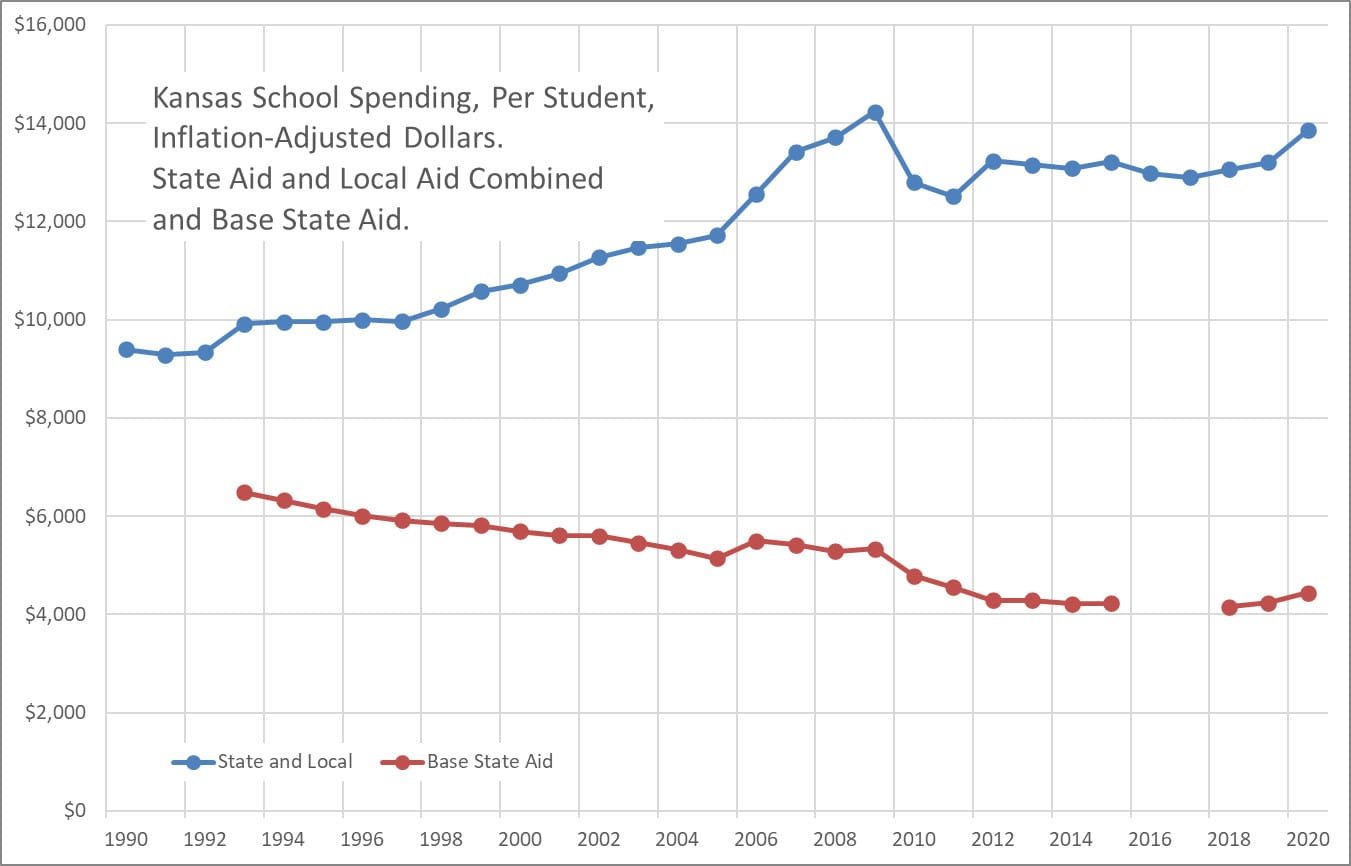

Kansas school spending

Kansas school district spending, updated through 2020 and adjusted for inflation.

-

Historic buildings bill on tap

A bill designed to protect two buildings in downtown Wichita has a legislative hearing this week.

-

Say no to special tax treatment, again

In Kansas, a company seeks to avoid paying property taxes, again.

-

Kansas school spending, through 2020

Charts of Kansas school spending presented in different forms.

-

Kansas general fund spending and receipts

The Kansas budget is volatile, with rising spending and a large deficit.

-

Regulation reform could jump-start Kansas economy after COVID

The COVID-19 outbreak has not only posed a severe public health risk, but actions to combat it now risk a global economic collapse, writes Michael Austin.

-

Wichita should post fulfilled records requests

When the City of Wichita fulfills records requests, it should make those records available to everyone.

-

Wichita legal notices an easy start on the path to transparency

Kansas law requires publication of certain notices in newspapers, but cities like Wichita could also make them available in other ways that are easier to use.

-

From Pachyderm: Leader Dan Hawkins

From the Wichita Pachyderm Club: Kansas House of Representatives Majority Leader Dan Hawkins. This audio presentation or podcast was recorded on January 17, 2020.