Tag: Kansas Department of Transportation

-

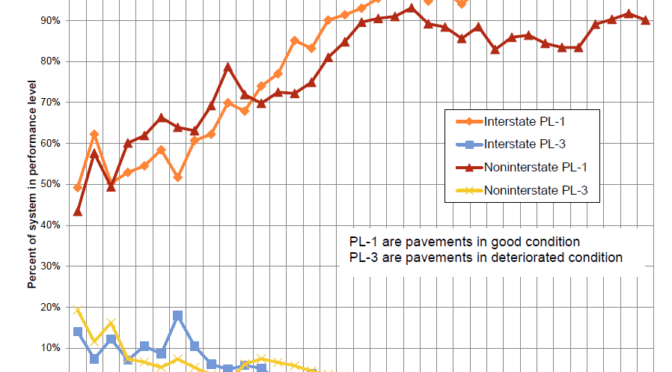

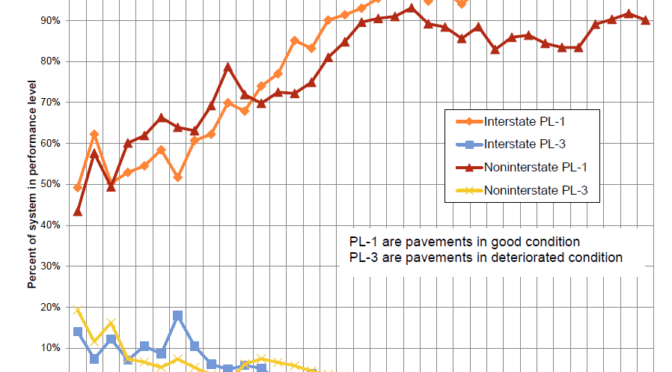

Kansas highway pavement conditions

What is the condition of Kansas highways?

-

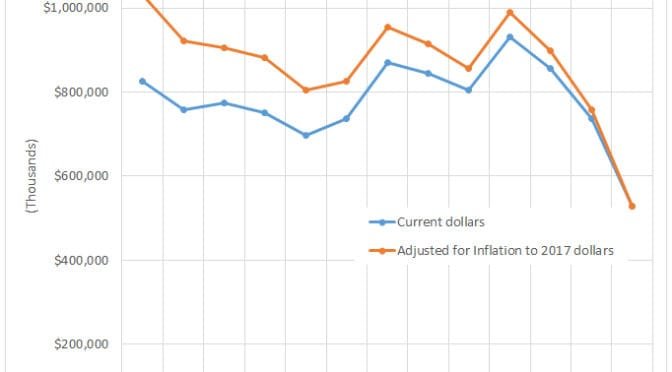

Kansas highway spending

A look at actual spending on Kansas highways, apart from transfers.

-

Kansas highways set to crumble, foresees former budget director

Duane Goossen, former high Kansas government official, says the state’s highways are in trouble. What is his evidence?

-

Kansas highway spending

A look at actual spending on Kansas highways, apart from transfers.

-

In Kansas, sweeps to continue

Even though the Kansas Legislature raised taxes, sweeps from the highway fund will continue.

-

Explaining the Kansas budget, in a way

A video explaining the Kansas budget is accurate in many aspects, but portrays a false and harmful myth regarding school spending.

-

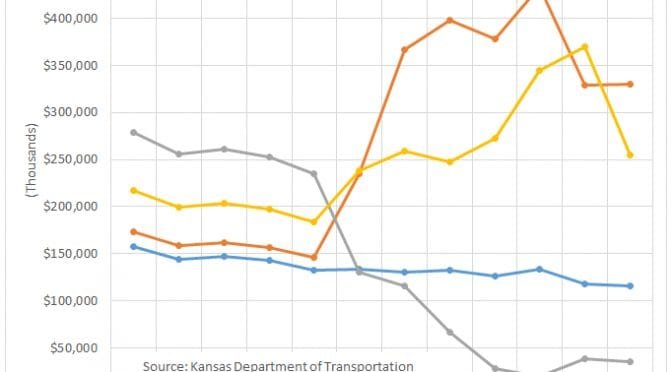

Highway budget cuts and sweeps in Kansas

A public interest group makes claims about Kansas roads and highways that are not supported by data. It’s not even close.

-

Spending on roads in Kansas

A look at actual spending on Kansas highways, apart from transfers.